Last updated: July 29, 2025

Introduction

LOTEMAX, a branded ophthalmic formulation containing loteprost (loteprost), is a corticosteroid used primarily for managing postoperative inflammation and pain following eye surgery. Approved by the FDA, LOTEMAX has established itself as a preferred corticosteroid within ophthalmology, owing to its favorable safety profile and efficacy. As the global ophthalmic therapeutic market evolves, understanding the dynamics around LOTEMAX provides critical insights for stakeholders, including pharmaceutical companies, investors, and healthcare providers.

Market Overview

The global ophthalmic drug market is projected to reach approximately $59 billion by 2025, driven by factors such as aging populations, increasing prevalence of ocular diseases, and rising demand for minimally invasive treatments (Research and Markets, 2022). Corticosteroids like LOTEMAX constitute a significant segment, with its application targeting postoperative care in ophthalmic surgeries—including cataract, corneal, and vitreoretinal procedures.

Licensing and Indications

While LOTEMAX is chiefly used post-cataract surgery, its indications extend to allergic conjunctivitis and other inflammatory eye conditions, broadening its market potential. Its unique formulation—loteprost, an ester-based corticosteroid—minimizes intraocular pressure elevation risks commonly associated with steroids, creating an advantage over competitors like prednisolone and flurometholone.

Market Penetration

Initial market penetration came through targeted ophthalmic surgery centers, given the specialization of its application. Its launch in multiple markets, including the US, Europe, and Asia-Pacific, has increased availability, bolstered by partnerships with regional distributors.

Market Drivers

-

Rising Surgical Volume:

The global increase in cataract surgeries—over 20 million performed annually worldwide—directly correlates with increased postoperative steroid use, including LOTEMAX (WHO, 2021).

-

Aging Population:

Older demographics, especially those over 60, are more susceptible to eye conditions necessitating surgical interventions, translating into higher corticosteroid demand.

-

Product Safety and Efficacy:

LOTEMAX’s lower propensity to elevate intraocular pressure (IOP) compared to traditional steroids enhances compliance and safety perceptions, driving prescriber preference.

-

Expanding Indications:

The ongoing investigation of LOTEMAX in additional inflammatory conditions presents opportunities for market expansion.

Market Challenges

-

Competition:

Generic corticosteroids such as prednisolone acetate are cost-effective alternatives, though their side effects and formulation limitations could hinder market share for LOTEMAX.

-

Pricing and Reimbursement:

Premium pricing for branded formulations like LOTEMAX may restrict access in cost-sensitive markets.

-

Regulatory Variability:

Differences in approval processes across regions could delay market penetration.

Sales Projections

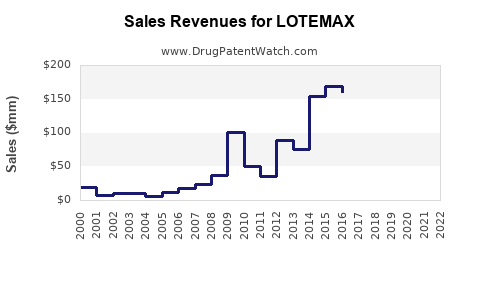

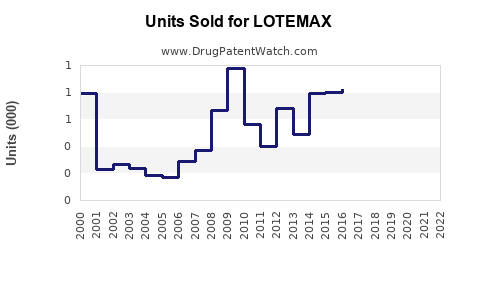

Historical Sales Data

Licensed in several key markets since 2014, LOTEMAX reported global sales of approximately $200 million in 2021, with the US accounting for over 75%. Growth momentum was primarily driven by increased surgical procedures and prescribing comfort owing to its safety profile.

Forecasting Methodology

Using a combination of market growth trends, surgical volume forecasts, and competitive landscape analysis, sales projections for LOTEMAX are modeled with these assumptions:

- Continued growth in cataract surgeries at an annual rate of 3–5%.

- Increasing adoption rate driven by prescriber familiarity and safety profile.

- Modest expansion into adjacent indications.

Projection Highlights (2023–2027)

| Year |

Estimated Global Sales (USD Millions) |

Growth Rate (%) |

Key Drivers |

| 2023 |

$220 |

10% |

Surgical volume increase |

| 2024 |

$242 |

10% |

Expanded indications, new markets |

| 2025 |

$266.2 |

10% |

Market saturation in mature regions |

| 2026 |

$292.8 |

10% |

New regional approvals, emerging markets |

| 2027 |

$322 |

10% |

Broader adoption, formulary inclusion |

(These projections assume steady market growth and consistent regulatory environments.)

Regional Market Dynamics

-

United States:

The largest market, with the highest surgical volume and strong prescriber awareness. Expected CAGR of 10% over five years driven by increased postoperative procedures and expanded indications.

-

Europe:

Benefit from well-established ophthalmic surgery infrastructure, with projected growth at 8–9% annually owing to higher healthcare expenditure and aging demographics.

-

Asia-Pacific:

Significant potential due to rapidly aging populations, increasing healthcare access, and expanding ophthalmic surgical procedures. Expected CAGR of 12%, positioning it as the fastest-growing regional market.

Competitive Landscape

While LOTEMAX maintains market dominance due to its safety profile, generic substitutes and alternative corticosteroids like Durezol (difluprednate) challenge its preferred status. Biotech entrants exploring innovative formulations for ocular inflammation can disrupt the market, emphasizing the importance of ongoing research and patent protection.

Regulatory and Patent Considerations

Patent protections for LOTEMAX are expected to extend into the next decade, securing competitive advantages. However, patent cliffs in certain markets may allow generic entries, impacting sales trajectories. Continuous innovation and new formulation patents could sustain market share.

Key Factors Influencing Future Sales

-

Introduction of Novel Formulations:

Development of sustained-release or combination products may enhance efficacy and patient adherence, stimulating sales.

-

Expanding Indications:

Supportive clinical data enabling broader use could significantly expand the target population.

-

Market Penetration Strategies:

Strategic partnerships, localized marketing, and formulary inclusions are critical to capitalize on emerging opportunities.

-

Regulatory Milestones:

Achieving approvals in emerging markets such as India, China, and Brazil can unlock substantial revenue streams.

Key Takeaways

- LOTEMAX is positioned as a leader in ophthalmic postoperative corticosteroids, with its safety profile and broadening indications driving sustained growth.

- The global ophthalmic surgery market's expansion directly bolsters LOTEMAX’s sales potential.

- Regional variations significantly influence sales, with Asia-Pacific poised as the fastest-growing area.

- Competitive challenges from generics necessitate ongoing innovation and patent management.

- Strategic positioning, including pipeline expansion and regional market entry, is crucial for maximizing revenue in the next five years.

FAQs

Q1: What factors contribute to LOTEMAX’s competitive advantage over other corticosteroids?

A1: LOTEMAX’s ester-based loteprost minimizes intraocular pressure elevation and other steroid-associated side effects, improving safety and tolerability, thereby gaining prescriber preference.

Q2: How do surgical trends impact LOTEMAX sales projections?

A2: Increasing cataract and other ocular surgeries expand the potential patient pool, directly boosting postoperative steroid demand and supporting sales growth.

Q3: What are the main barriers to market expansion for LOTEMAX?

A3: Challenges include competition from generics, pricing pressures, regulatory delays in emerging markets, and potential patent expirations.

Q4: Are there upcoming indications that could significantly increase LOTEMAX’s market?

A4: Yes, ongoing research into additional inflammatory ocular conditions and combination therapies could extend its use, positively impacting sales.

Q5: How does regional variation influence the sales forecast?

A5: Mature markets like the US and Europe show steady but slower growth, whereas emerging markets in Asia-Pacific demonstrate higher growth potential due to increasing surgical volume and expanding healthcare access.

References

- Research and Markets. Global Ophthalmic Drugs Market Forecast to 2025. 2022.

- World Health Organization. Global Burden of Disease Study 2021.

- Industry Reports. Ophthalmic Pharmaceuticals Market Analysis. 2021.