Share This Page

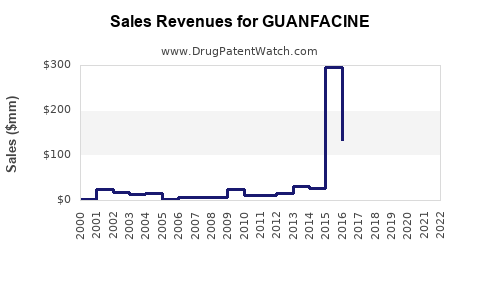

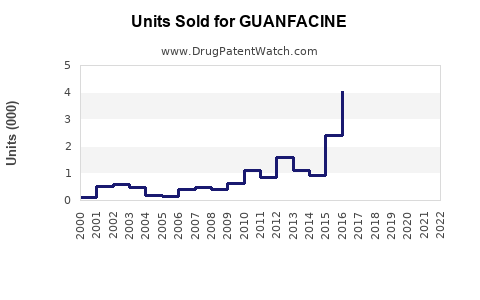

Drug Sales Trends for GUANFACINE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for GUANFACINE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| GUANFACINE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| GUANFACINE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| GUANFACINE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| GUANFACINE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| GUANFACINE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| GUANFACINE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Guanfacine

Introduction

Guanfacine, a selective alpha-2A adrenergic receptor agonist, is primarily prescribed for attention-deficit hyperactivity disorder (ADHD) and hypertension. Initially developed for hypertension, its efficacy in managing ADHD has significantly expanded its market potential. With a growing prevalence of ADHD globally and rising hypertension rates, guanfacine's commercial landscape is poised for growth. This report offers a comprehensive market analysis and sales projection, focusing on current trends, competitive dynamics, and future growth opportunities.

Therapeutic Indications and Market Drivers

ADHD Treatment

ADHD affects approximately 5-10% of children and 2-5% of adults worldwide (CDC, 2022). Guanfacine's extended-release formulation is approved in several jurisdictions for ADHD management, especially for patients with comorbid conditions or those who do not respond to stimulants. Growing awareness, reduced stigma, and expanded diagnostic criteria have driven increased prescriptions.

Hypertension Management

Although less dominant now due to the advent of newer antihypertensives, guanfacine remains a secondary or adjunct therapy for hypertension, especially in resistant cases. Its use persists in specific patient populations such as the elderly or those intolerant to other agents.

Market Drivers

- Rising Diagnoses: Increased ADHD identification across age groups boosts demand.

- Off-label Use: Emerging research supports off-label applications such as behavioral disorders in children and sleep disturbances.

- Growing Aging Population: Elevated hypertension prevalence among aging populations sustains demand in this segment.

- Advances in Formulation: The development of extended-release formulations enhances compliance and broadens patient acceptance.

Competitive Landscape

Guanfacine faces competition from other ADHD medications, including stimulants like methylphenidate and amphetamines, and non-stimulants such as clonidine and viloxazine. However, its favorable side effect profile and efficacy make it a preferred option for specific patient subsets.

Key Players:

- Shire/Takeda: Extended-release formulations (Intuniv) dominate the ADHD segment.

- Novartis and Other Generics: Offer generic versions, impacting pricing and accessibility.

The patent expiry of branded formulations is expected to catalyze generic entry, leading to price reductions and wider adoption.

Market Size and Current Sales

Global Market Overview

The global ADHD therapeutics market was valued at approximately USD 10 billion in 2022, with stimulant medications accounting for roughly 70% of sales. Guanfacine's contribution, primarily through its extended-release form (e.g., Intuniv), is estimated at USD 500–700 million globally, maintaining steady growth driven by North America and Europe.

Regional Insights

- North America: Dominates the market, accounting for over 60% of sales, attributable to high diagnosis rates and reimbursement coverage.

- Europe: Growing adoption, driven by increasing awareness.

- Asia-Pacific: Emerging market with significant growth potential, though adoption remains limited due to regulatory and cultural barriers.

Market Share Dynamics

Guanfacine holds approximately 5–7% of the total ADHD market, competing mainly with stimulant options but increasingly gaining preference in specific patient segments where stimulants are contraindicated.

Sales Projections: 2023–2030

Methodology

Projections consider demographic trends, regulatory developments, healthcare infrastructure, and competitive dynamics. Assumptions include steady market growth, increased acceptance of non-stimulant therapies, and a moderate acceleration post-patent expiry due to price competition.

Forecast

- 2023–2025: The global guanfacine market for ADHD is expected to grow at a CAGR of 8%, reaching USD 1.2 billion by 2025. Sales from existing formulations should see a compound annual increase driven by expanding diagnoses and formulary inclusion.

- 2026–2030: As patent protections expire and generics enter the market, growth may plateau or slightly decline in value terms but will expand in volume. The market could reach USD 1.8−2 billion by 2030, with a CAGR stabilizing around 4–5%.

Key Factors Influencing Growth

- Regulatory Approvals: New indications or expanded approvals (e.g., adult ADHD) will boost sales.

- Pricing Dynamics: Generics will reduce prices, but volume increases will offset lower per-unit revenues.

- Market Penetration: Better accessibility in emerging markets and inclusion in treatment guidelines will support growth.

- Technological Advancements: Innovations in drug delivery systems could enhance compliance and prescribing.

Challenges and Risks

- Intense Competition: Dominance of stimulant therapies could limit guanfacine's market share.

- Regulatory Hurdles: Delays or restrictions in expanding indications may impact growth.

- Side Effect Profile: Concerns related to sedation, hypotension, or withdrawal effects could limit prescribing.

- Market Saturation: Once generic versions dominate, profit margins may decline, impacting R&D investment.

Opportunities for Growth

- Expanding Indications: Exploration of guanfacine in sleep disorders, tic disorders, and other psychiatric conditions.

- Combination Therapies: Synergistic formulations with other agents could enhance efficacy.

- Digital Health Integration: Coupling medication with digital adherence tools to improve outcomes.

Key Takeaways

- The guanfacine market for ADHD and hypertension is positioned for moderate growth, driven by increasing diagnosis rates, expanded indications, and technological advancements.

- Patent expiries and market competition will influence pricing and sales volumes, favoring generics.

- Emerging markets present significant growth opportunities, contingent upon regulatory approvals and healthcare infrastructure development.

- Strategic positioning—such as leveraging new formulations and indications—will be critical for maximizing future sales.

- Market entrants must navigate competitive, regulatory, and safety challenges to achieve meaningful market penetration.

FAQs

1. What is the primary therapeutic use of guanfacine today?

Guanfacine is primarily used for treating ADHD, particularly in children and adults, with extended-release formulations preferred for their dosing convenience and efficacy.

2. How does guanfacine compare to stimulant medications in treating ADHD?

Guanfacine offers a non-stimulant alternative with a favorable side effect profile, especially suitable for patients intolerant to stimulants or with comorbidities like tics or sleep disturbances. However, stimulants typically have a faster onset and higher potency.

3. What factors are expected to influence guanfacine sales in the coming years?

Key factors include increasing global ADHD diagnoses, regulatory approvals for new indications, patent expiries enabling generics, and emerging markets' growth. Safety concerns and competition from newer agents also play roles.

4. Are there any recent developments that could impact guanfacine's market?

Yes, ongoing clinical trials exploring guanfacine for other psychiatric conditions and potential FDA approvals for new indications could expand its market. Additionally, technological advances may improve formulations and adherence.

5. What are the main challenges faced by guanfacine in maintaining its market position?

Challenges include stiff competition from stimulant therapies and other non-stimulant agents, regulatory hurdles, safety concerns like sedation and blood pressure effects, and price erosion due to generic competition.

Sources:

[1] Centers for Disease Control and Prevention (CDC). ADHD Prevalence Data. 2022.

[2] MarketWatch. Global ADHD Drugs Market Analysis, 2022.

[3] IQVIA. Healthcare Market Insights, 2022.

[4] FDA Database. Pediatric and Adult ADHD Approvals.

[5] Grand View Research. ADHD Therapeutics Market Size & Forecasts, 2022–2030.

More… ↓