Last updated: July 28, 2025

Introduction

Fosamax, with the active ingredient alendronate sodium, is a bisphosphonate derivative approved for the prevention and treatment of osteoporosis in postmenopausal women and men, as well as for Paget’s disease of the bone. Since its initial approval in the late 1990s, Fosamax has become one of the leading medications in the osteoporosis market. This analysis evaluates the current market landscape, competitive positioning, regulatory considerations, and future sales projections.

Market Overview

Global Osteoporosis Market Dynamics

The global osteoporosis market was valued at approximately USD 8.8 billion in 2022 and is projected to reach USD 11.3 billion by 2030, growing at a CAGR of around 3.4% (2023–2030) [1]. The aging global population, increasing awareness about bone health, and expanding treatment options drive this growth. The osteoporosis segment accounts for a significant portion of this market, with bisphosphonates comprising the bulk of prescribed therapies.

Fosamax’s Market Position

Fosamax has historically been a dominant player, holding one of the largest market shares among oral bisphosphonates. Its efficacy, long-term clinical data, and longstanding FDA approval have cemented its position. Despite competition from newer agents (e.g., denosumab, zoledronic acid, oral ibandronate), Fosamax remains a cornerstone for osteoporosis management, especially in the United States and Europe.

Regulatory Landscape

While Fosamax faced regulatory scrutiny — notably concerning osteonecrosis of the jaw and atypical femoral fractures — these issues have been largely mitigated through updated prescribing guidelines. Patent exclusivity has expired in several jurisdictions, allowing generic versions to enter the market, impacting revenue streams but expanding access and overall market size.

Market Drivers and Challenges

Key Drivers

- Aging Demographics: Increased prevalence of osteoporosis among postmenopausal women and the elderly.

- Awareness Campaigns: Improved screening protocols and education on osteoporosis risk.

- Efficacy and Durability: Long-term safety and efficacy data bolster physician confidence.

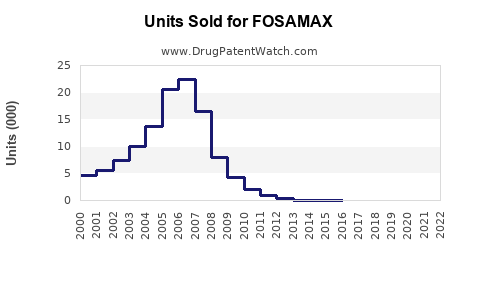

- Generic Availability: Post-patent expiration, generic alendronate has increased treatment affordability, boosting sales volume.

Challenges

- Side Effect Profile: Concerns over bisphosphonate-related adverse effects may limit long-term compliance.

- Emergence of New Therapies: Biologics like denosumab offer alternative mechanisms with potentially improved safety profiles.

- Patient Compliance: Oral administration challenges and gastrointestinal side effects reduce adherence.

Sales Projections

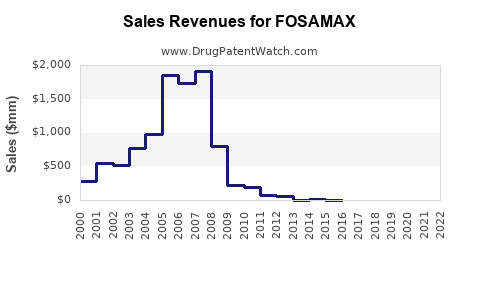

Historical Sales Data

Fosamax achieved peak worldwide sales of approximately USD 3.1 billion in 2007 (pre-generic entry), with U.S. revenues constituting a significant share. Post-patent loss in 2011 in the U.S., sales declined sharply due to generic competition, but overall global revenue remained substantial due to continued prescriptions in emerging markets and Europe.

Future Revenue Estimates (2023–2030)

- 2023–2025: Sales are expected to stabilize near USD 1–1.2 billion annually, driven by the continued use of branded Fosamax in niche segments and conservative prescribing in specific markets.

- 2026–2030: The market is projected to expand modestly to USD 1.5 billion annually, primarily from emerging markets with increasing osteoporosis awareness and healthcare infrastructure.

Contributing Factors

- Generic Penetration: Generics dominate in the U.S. and Europe, suppressing branded Fosamax sales but creating volume through lower prices.

- Market Penetration in Developing Countries: Rapid growth due to increasing aging populations and growing healthcare access.

- Patient Preferences: Preference for oral formulations over injections sustains demand, barring significant safety concerns.

Impact of New Treatments

While bisphosphonates face competition, the perceived safety and familiarity of Fosamax mitigate immediate declines. However, novel agents may gradually erode market share unless differentiation emerges through combination therapies or improved safety profiles.

Competitive Landscape

The osteoporosis market features several key players:

- Denosumab (Prolia): Subcutaneous biologic with growing acceptance owing to better adherence.

- Zoledronic Acid (Reclast): Annual IV bisphosphonate favored in certain populations.

- Ibandronate (Boniva): Monthly or quarterly oral/IV options.

- Romosozumab: An anabolic monoclonal antibody with strong efficacy signals.

Despite this, Fosamax’s entrenched clinical use and extensive safety data preserve its relevance, especially where cost considerations are paramount.

Regulatory and Market Access Considerations

Recent guidelines emphasize risk-benefit assessments for bisphosphonate therapy duration, impacting prescribing patterns. The increased use of fracture risk assessment tools like FRAX influences therapy initiation decisions. Reimbursement policies, especially in Europe, favor cost-effective options, benefiting generics.

Conclusion and Forward Outlook

Fosamax remains a significant player within the osteoporosis therapeutic landscape. Its long-standing clinical data and established manufacturing presence position it favorably among generic bisphosphonates. While revenue streams have declined from historical peaks, ongoing demand in emerging markets and stable prescribing in developed nations support a steady revenue base.

The forecast indicates a cautiously optimistic future, with incremental sales growth driven by demographic trends and healthcare infrastructure improvements. Strategic positioning—such as developing combination formulations or integrating with novel delivery systems—may enhance long-term sustainability.

Key Takeaways

- Fosamax’s global sales are projected to stabilize around USD 1–1.5 billion annually through 2030.

- Generics and emerging markets will sustain volume growth, offsetting decline in branded sales.

- Competition from newer therapies necessitates ongoing differentiation and strategic adaptation.

- Market pilots involving improved safety profiles and patient compliance can bolster demand.

- Regulatory developments emphasizing personalized medicine and risk mitigation will influence prescribing dynamics.

FAQs

1. What is the primary demographic driving Fosamax sales?

The main consumers are postmenopausal women, elderly individuals, and patients with osteoporosis or Paget’s disease, highlighting the aging population as a critical driver.

2. How has patent expiration impacted Fosamax sales?

Patent expiry in key markets like the U.S. (2011) led to the introduction of generics, significantly reducing branded sales but expanding total market volume and access.

3. Are there any upcoming regulatory changes that could affect Fosamax?

Guidelines emphasizing optimal therapy duration and risk assessments for bisphosphonates may influence prescribing patterns, but no immediate regulatory restrictions are expected for Fosamax.

4. How does Fosamax compare with newer osteoporosis treatments?

While newer agents like denosumab offer alternative mechanisms and potentially improved safety profiles, Fosamax benefits from extensive clinical data and lower cost, preserving its relevance.

5. What market opportunities exist for Fosamax moving forward?

Expanding into developing countries, enhancing formulations for better adherence, and leveraging long-term safety data are key opportunities to sustain and grow Fosamax’s market presence.

Sources

[1] Grand View Research, “Osteoporosis Drugs Market Size & Trends,” 2022.