Share This Page

Drug Sales Trends for EFFIENT

✉ Email this page to a colleague

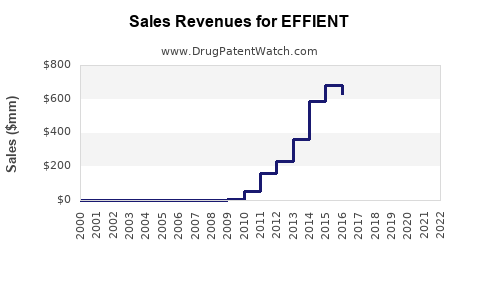

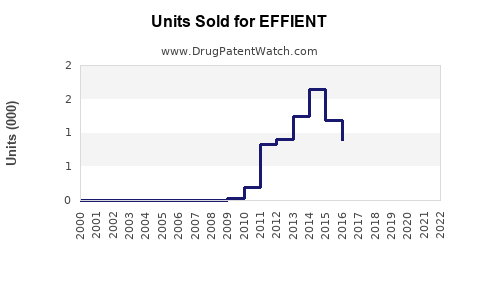

Annual Sales Revenues and Units Sold for EFFIENT

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| EFFIENT | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| EFFIENT | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| EFFIENT | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| EFFIENT | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| EFFIENT | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| EFFIENT | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for EFFIENT (Prasugrel)

Introduction

EFFIENT (prasugrel) is an antiplatelet medication developed by Eli Lilly and Co., approved primarily for the prevention of thrombotic cardiovascular events in patients with acute coronary syndromes (ACS) undergoing percutaneous coronary intervention (PCI). Given its critical role in reducing major adverse cardiovascular events (MACE), understanding its market landscape and future sales trajectory provides strategic insights for stakeholders.

Market Overview

Global Cardiovascular Disease (CVD) Burden

Cardiovascular diseases remain the leading cause of mortality worldwide, accounting for approximately 17.9 million deaths annually, with ischemic heart disease and stroke constituting the majority of these fatalities [1]. The rising prevalence of risk factors such as obesity, hypertension, and diabetes mellitus fuels the demand for effective antithrombotic therapies.

Standard of Care and Market Penetration

Antiplatelet agents—clopidogrel, prasugrel, ticagrelor, and aspirin—serve as the cornerstone in managing ACS. Despite clopidogrel’s widespread adoption, prasugrel’s superior potency and consistent pharmacodynamic profile position it as a preferred drug in high-risk PCI patients, driven by evidence from pivotal trials such as TRITON-TIMI 38.

Regulatory Approvals and Indications

Initially approved in 2009 in the US for STEMI patients undergoing PCI, EFFIENT’s indication expanded to include other ACS presentations. Its peer competition involves drugs like ticagrelor (Brilinta), which gained FDA approval in 2011 and has since expanded its indications.

Market Size and Sales Drivers

Therapeutic Market Segment

The primary sales driver remains the segment of patients undergoing PCI for ACS—an estimated 1.5 million procedures annually globally [2]. In the US alone, over 700,000 PCI procedures are conducted annually, with growth fueled by aging populations and increased procedural volume [3].

Competitive Landscape

While prasugrel’s clinical efficacy is compelling, factors such as bleeding risk and contraindications limit universal adoption. The competitive rivalry with ticagrelor, which has convenient twice-daily dosing and broader indications, has impacted prasugrel's market share.

Barriers to Market Penetration

- Bleeding Risks: Increased bleeding compared to clopidogrel affects clinician preferences.

- Guideline Recommendations: Variability in adoption based on evolving guidelines.

- Price and Reimbursement: Cost considerations influence prescription patterns.

Sales Projections (2023–2028)

Current Sales Overview

As of recent data, EFFIENT's global sales are estimated at approximately $250 million annually, with the US contributing the lion’s share due to higher PCI volumes and formulary preferences [4].

Projected Growth Factors

- Increase in PCI Procedures: Anticipated annual growth rate of 3-5% in PCI volumes globally.

- Regulatory and Label Expansion: Potential approval for broader indications, possibly in stroke prevention, could boost sales.

- Market Share Gains: Improved clinician adoption through targeted education, especially in high-risk groups.

Forecast Highlights

- 2023–2024: Revenues are expected to stabilize around $250 million, incorporating market saturation effects.

- 2025–2028: With targeted strategic initiatives and integration into treatment protocols, sales could approach $350–$400 million by 2028, assuming a compound annual growth rate (CAGR) of approximately 7-10%.

These projections factor in the introduction of generic formulations post-patent expiry, which could initially depress brand sales but open opportunities in emerging markets.

Regional Market Dynamics

United States

High procedural volumes and advanced healthcare infrastructure position the US as the lead market. Growth will depend on guideline updates and competitive positioning against ticagrelor.

Europe

Growth potential exists due to expanding PCI services, with the EU market expected to mirror US trends, albeit at a slower pace owing to regulatory variations.

Emerging Markets

Rapidly expanding healthcare access in Asia-Pacific, Latin America, and the Middle East offers growth prospects, although pricing and reimbursement challenges may temper rapid adoption.

Strategic Opportunities and Risks

Opportunities

- Label Expansion: Inflammation of indications toward stroke prevention could diversify revenue streams.

- Combination Therapies: Incorporation into multi-drug regimens for complex cardiovascular conditions.

- Market Penetration: Education campaigns emphasizing prasugrel’s benefits in appropriate patients.

Risks

- Competitive Pressure: Tighter competition from ticagrelor and emerging agents.

- Safety Concerns: Bleeding risks might limit utilization, especially in elderly or comorbid populations.

- Patent Landscape: Patent expirations may lead to generic entry, impacting brand sales.

Key Takeaways

- Market Size & Potential: The global market for prasugrel remains robust, driven by high PCI volumes and the ongoing burden of ACS.

- Competitive Dynamics: While prasugrel holds advantages in potency, emerging competition necessitates strategic positioning through clinical outcomes and physician education.

- Sales Growth Outlook: With an estimated CAGR of 7-10% over the next five years, sales could reach $350–$400 million by 2028, contingent upon market expansion and reimbursement dynamics.

- Strategic Focus: Emphasizing label expansion, regional penetration, and clinician outreach will be critical for maximizing sales.

FAQs

1. What is the primary clinical advantage of EFFIENT (prasugrel) over competing antiplatelet agents?

Prasugrel offers rapid and potent platelet inhibition, translating into reduced major adverse cardiovascular events in high-risk PCI patients, as demonstrated in the TRITON-TIMI 38 trial.

2. How does the patent landscape influence EFFIENT’s market prospects?

Patent expirations could lead to generic formulations, potentially reducing brand sales but increasing access in emerging markets, creating a dual impact landscape for Eli Lilly.

3. What are the safety considerations limiting prasugrel’s use?

Increased bleeding risk, particularly in elderly or low-weight patients, limits universal use. Careful patient selection and bleeding risk assessment are essential.

4. Can EFFIENT expand its revenue through label updates or indications?

Yes. Approved expansion into stroke prevention or other thrombotic conditions could diversify revenue streams and expand market share.

5. How will evolving clinical guidelines shape the adoption of prasugrel?

Guidelines favoring potent antiplatelet therapy in high-risk PCI cases will bolster prasugrel’s utilization, especially if supported by real-world safety and efficacy data.

References

[1] World Health Organization. Cardiovascular Diseases (CVDs) Fact Sheet. 2021.

[2] American Heart Association. Cardiovascular Disease Statistics. 2022.

[3] SCAI. PCI Procedure Trends and Technologies. 2021.

[4] MarketWatch. EFFIENT (Prasugrel) Revenue & Sales Data. 2023.

In conclusion, EFFIENT’s market outlook remains favorable amid ongoing cardiovascular disease burdens and evolving clinical practices. Strategic positioning, regulatory engagement, and clinical efficacy will drive its sales trajectory over the coming years.

More… ↓