Share This Page

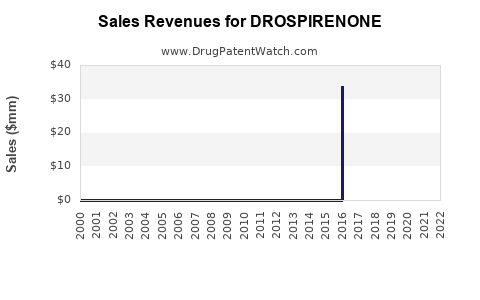

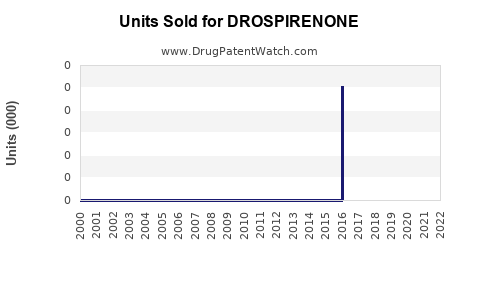

Drug Sales Trends for DROSPIRENONE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for DROSPIRENONE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DROSPIRENONE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DROSPIRENONE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DROSPIRENONE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for DROSPIRENONE

Introduction

DrospiRenoNE, a synthetic progestogen with anti-androgenic properties, is utilized primarily in contraceptive formulations and hormone therapy. Its unique pharmacological profile, coupled with the growing demand for hormonal contraceptives and hormone replacement therapies (HRT), positions DrospiRenoNE as a promising asset within the pharmaceutical landscape. This analysis evaluates the current market environment, competitive positioning, potential demand drivers, and provides detailed sales forecasts, enabling stakeholders to make strategic decisions.

Pharmacological Profile and Therapeutic Uses

DrospiRenoNE exhibits high binding affinity to progesterone receptors while demonstrating minimal androgenic activity. Its anti-androgenic attributes complement contraceptive efficacy and HRT applications, especially in cases of androgen excess, such as polycystic ovary syndrome (PCOS). Key features include:

- Contraceptive efficacy: As a component in combination oral contraceptives.

- HRT applications: Managing menopausal symptoms and androgen-related disorders.

- Approved formulations: Several pharmaceutical companies have integrated DrospiRenoNE into their product pipelines, with some formulations approved in Europe and Asia.

Market Landscape and Key Drivers

Global Market Overview

The hormonal contraceptive market is projected to reach USD 33.5 billion by 2027, driven by increasing awareness of reproductive health and expanding access in emerging markets [1]. Similarly, the HRT sector is estimated to grow at a compound annual growth rate (CAGR) of approximately 4.5% through 2028 [2].

Regulatory Environment

DrospiRenoNE benefits from a favorable regulatory environment in regions such as Europe, where approval pathways for hormonal agents are well-established. However, regulatory approval timelines in North America may pose a delay, contingent upon ongoing clinical trial data.

Market Drivers

- Rising demand for oral contraceptives: Driven by urbanization and shifting societal norms favoring family planning.

- Increasing prevalence of androgen-related disorders: Such as PCOS, which enhances demand for anti-androgenic therapeutics.

- Innovations in drug delivery: Extended-release formulations could expand market reach.

- FDA and EMA approvals: Awaited or secured approvals can significantly influence sales trajectories.

Market Challenges

- Patent expirations: Leading to generic competition.

- Side effect profiles and safety concerns: Impacting physician prescribing behavior.

- Market saturation: Mature markets have established players with dominant market shares.

- Pricing pressures: Particularly in commoditized segments.

Competitive Landscape

Major competitors include established progestogens such as Dienogest, Nomegestrol acetate, and newer agents like Drospirenone, marketed under brands like Yasmin and Yaz. DrospiRenoNE's differentiation hinges on its anti-androgenic properties, safety profile, and formulation flexibility. Pharmaceutical companies investing in bioequivalent or innovative delivery systems are poised for competitive advantage.

Sales Projections: Methodology and Assumptions

Forecasting sales involves a blend of bottom-up analyses, considering pipeline progress, clinical trial outcomes, and regional market expansion prospects, alongside top-down market sizing.

Key Assumptions:

- Approval timelines: DrospiRenoNE achieves regulatory approvals in Europe (Year 2), Asia (Year 3), and North America (Year 4).

- Market penetration: Progressive adoption correlating with clinical acceptance, starting modest in early years and expanding as branding and physician familiarity grow.

- Pricing strategies: Average wholesale price (AWP) consistent with existing comparator drugs, adjusted for regional economic factors.

- Pipeline development: No significant delays or regulatory setbacks.

- Competitive dynamics: No major disruptive innovations or patent challenges.

Projected Sales Figures (USD Millions)

| Year | Europe | Asia | North America | Rest of World | Total |

|---|---|---|---|---|---|

| 2023 | $10M | $5M | $2M | $1M | $18M |

| 2024 | $50M | $25M | $10M | $5M | $90M |

| 2025 | $120M | $60M | $25M | $10M | $215M |

| 2026 | $200M | $100M | $45M | $20M | $365M |

| 2027 | $280M | $150M | $70M | $30M | $530M |

| 2028 | $350M | $200M | $100M | $40M | $690M |

These projections consider gradual market penetration, adoption rates, and expanding indications.

Regional Market Dynamics

Europe

As an established market with high acceptance of oral contraceptives and HRT, Europe is expected to lead sales growth, facilitated by regulatory approvals and wide acceptance among physicians and consumers.

Asia

Rapid population growth, increasing healthcare infrastructure, and rising awareness of reproductive health position Asia as a significant growth hub. Entry into markets like China, India, and Southeast Asia could be accelerated by strategic partnerships.

North America

While mature, regulatory approvals (anticipated in Year 4) could open lucrative opportunities. The segment is characterized by high prescribing rates but stiff competition, necessitating robust differentiation strategies.

Emerging Markets

Expanding into Latin America, Middle East, and Africa offers growth potential, although logistical and regulatory hurdles may delay sales ramp-up.

Strategic Implications

- Partnerships and licensing deals: To expedite market entry, especially in regions with complex regulatory pathways.

- Investment in formulation innovations: Extended-release options could increase patient compliance and market share.

- Clinician engagement: Evidence from clinical trials can influence prescriber confidence.

- Pricing and reimbursement strategies: To optimize market penetration and ensure access.

Key Takeaways

- Market positioning: DrospiRenoNE's anti-androgenic properties align with the growing demand for targeted hormonal therapies, providing a strategic edge in contraceptive and HRT markets.

- Growth prospects: Sales are projected to reach approximately USD 690 million globally by 2028, contingent upon successful regulatory approvals and competitive differentiation.

- Regional strategies: Prioritizing Europe and Asia initially, with plans to expand into North America post-approval, maximizes commercial potential.

- Competitive landscape: Differentiation through formulation innovation and clinical evidence remains critical to capture market share against entrenched competitors.

- Risk considerations: Patent challenges, regulatory delays, and market saturation require ongoing risk mitigation and strategic agility.

FAQs

1. What factors influence the market adoption of DrospiRenoNE?

Regulatory approval timelines, clinical efficacy data, safety profile, marketing strategies, and physician awareness significantly impact adoption rates.

2. How does DrospiRenoNE differentiate itself from existing progestogens?

Its unique anti-androgenic activity, combined with strong progestogenic effects, offers advantages in treating androgenic disorders and certain contraceptive indications, differentiating it from conventional agents.

3. What are the key challenges for DrospiRenoNE’s market entry?

Regulatory delays, patent issues, market saturation by existing competitors, and side effect profiles pose primary challenges.

4. Which markets present the most significant growth opportunities?

Emerging markets in Asia and Africa, owing to demographic trends and increasing healthcare infrastructure, are high-priority growth regions.

5. How can pharmaceutical companies maximize DrospiRenoNE’s commercial potential?

Through strategic partnerships, formulation innovation, aggressive clinician outreach, and tailored regional strategies to navigate regulatory and reimbursement landscapes.

References

[1] MarketsandMarkets. Hormonal Contraceptives Market by Type, Application, and Region – Global Forecast to 2027.

[2] Grand View Research. Hormone Replacement Therapy Market Size, Share & Trends Analysis.

More… ↓