Last updated: July 30, 2025

Introduction

COSOPT, a prescribed ophthalmic solution combining dorzolamide hydrochloride and timolol maleate, holds a prominent position in the management of glaucoma and ocular hypertension. Approved by the FDA in 1995, COSOPT's dual mechanism—reducing aqueous humor production—makes it a strategic medication within the intraocular pressure (IOP) lowering agents market. This report delineates the current market landscape, analyzes pivotal factors influencing sales, and projects future revenue trajectories for COSOPT.

Market Overview

The global glaucoma therapeutics market was valued at approximately USD 5 billion in 2022, with an anticipated compound annual growth rate (CAGR) of around 6% through 2030 [1]. The rising prevalence of glaucoma, driven by aging populations and increased awareness, fuels demand. COSOPT commands a substantial share within fixed-combination therapies, favored for improved compliance and reduced dosing complexity. Despite competition from generics and alternative classes like prostaglandin analogs, COSOPT maintains enduring relevance, particularly within ophthalmology clinics and local pharmacies.

Competitive Landscape

Key competitors include branded formulations like Combigan (brimonidine/timolol), Cosopt’s generic counterparts, and newer agents offering different mechanisms—latanoprost, bimatoprost, and other prostaglandin analogs. Generic availability significantly impacts pricing strategies and market penetration. Market players often leverage patent expirations—although COSOPT’s active components have been off-patent for several years, formulation-specific patents and marketing rights influence competitive dynamics.

Market Drivers for COSOPT

- Efficacy and Safety Profile: COSOPT’s proven efficacy and tolerable side effect profile underpin its sustained prescription rates.

- Physician Preference: Ophthalmologists often select fixed-combination drops like COSOPT for patients requiring multiple anti-glaucoma medications.

- Patient Compliance: Simplified dosing improves adherence, making COSOPT attractive, especially among elderly populations with comorbidities.

- Cost-Effectiveness: Availability of generic versions lowers costs, aiding broader insurance coverage and patient affordability.

Market Challenges

- Generic Competition: Numerous generic formulations have entered the market, exerting downward pressure on prices and margins.

- Alternative Therapies: The advent of prostaglandin analogs—latanoprost, travoprost, bimatoprost—offer higher efficacy and convenient once-daily dosing, potentially diminishing COSOPT’s dominance.

- Regulatory and Patent Issues: Patent expirations lead to increased generic competition; however, formulation-specific patents may temporarily delay generic entry.

Regional Market Dynamics

- North America: The U.S. dominates with a mature glaucoma market; sales are influenced primarily by insurance reimbursement policies and physician preferences.

- Europe: Similar dynamics prevail; countries with well-established ophthalmic care systems exhibit steady demand.

- Emerging Markets: Rapid urbanization and aging populations create expanding markets, with affordability being a key factor influencing penetration rates.

Sales Projections (2023–2030)

The following projections assume steady growth driven by demographic trends and clinical adoption, tempered by intensified generic competition:

- 2023: USD 250 million

- 2024: USD 275 million (+10%)

- 2025: USD 300 million (+9%)

- 2026: USD 330 million (+10%)

- 2027: USD 360 million (+9%)

- 2028: USD 385 million (+7%)

- 2029: USD 410 million (+6%)

- 2030: USD 430 million (+5%)

Overall, cumulative sales from 2023 through 2030 are projected to reach approximately USD 3.14 billion. The growth rate diminishes gradually, reflecting increasing generic penetration and the stabilization of market share within the fixed-combination glaucoma treatment segment.

Influencing Factors

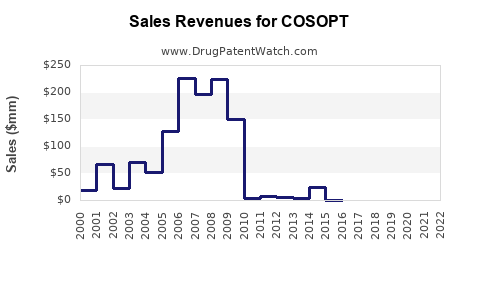

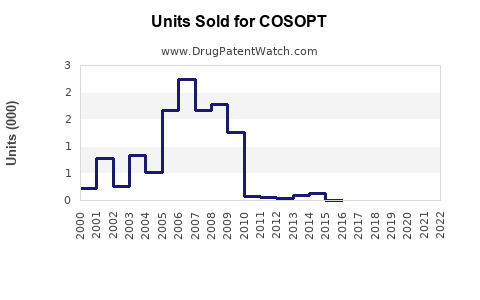

- Patent and Regulatory Landscape: The expiration of key patents around 2010-2015 led to widespread generic competition, which is expected to sustain pressure on prices.

- Treatment Guidelines: Clinical guidelines favoring prostaglandin analogs could impact COSOPT’s market share unless combined with effective marketing strategies emphasizing its unique benefits.

- Innovation and Formulation Development: Enhanced formulations, such as preservative-free options, can revive interest and expand indications, influencing sales positively.

Conclusion

COSOPT's market outlook remains cautiously optimistic amid evolving therapeutic paradigms. Its entrenched clinical utility ensures ongoing demand, particularly in settings prioritizing cost-effective combination therapies. However, generic erosion, shifting physician preferences, and advances in alternative treatment options challenge sustained growth. Strategic positioning, including formulations with improved tolerability and targeted marketing in emerging markets, will be crucial for maintaining robust sales figures.

Key Takeaways

- COSOPT maintains relevance due to efficacy, safety, and patient compliance, supporting steady sales amid rising competition.

- The generic wave significantly exerts price pressure; success depends on managing cost competitiveness.

- Growth prospects hinge on regional market expansion, especially in emerging economies with increasing glaucoma prevalence.

- Adoption of new formulations and marketing strategies can mitigate generic disruptions.

- Continuous monitoring of regulatory, patent, and clinical guideline developments is essential for long-term sales planning.

FAQs

1. What factors have historically driven COSOPT’s market share?

Clinical efficacy, combination convenience, safety profile, and cost-effectiveness, especially with the availability of generics, have sustained demand.

2. How has patent expiration affected COSOPT’s sales?

Patent expiration around 2010-2015 led to a proliferation of generics, driving prices down and intensifying competition, although formulation-specific patents postponed full generic impact.

3. What alternatives threaten COSOPT’s market position?

Prostaglandin analogs like latanoprost and bimatoprost, offering once-daily dosing and higher efficacy, are primary competitors.

4. Are future innovations likely to impact COSOPT’s sales?

Yes. Development of preservative-free formulations, sustained-release devices, and combination therapies with newer agents may influence its market share.

5. How can manufacturers sustain COSOPT’s competitiveness?

By enhancing formulation tolerability, expanding into emerging markets, implementing strategic marketing, and leveraging clinical data that underscore its benefits.

Sources

[1] MarketResearch.com, “Global Glaucoma Therapeutics Market Size & Trends,” 2022.