Share This Page

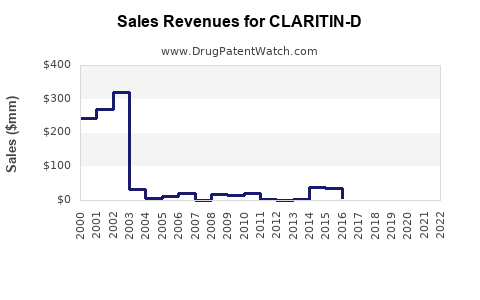

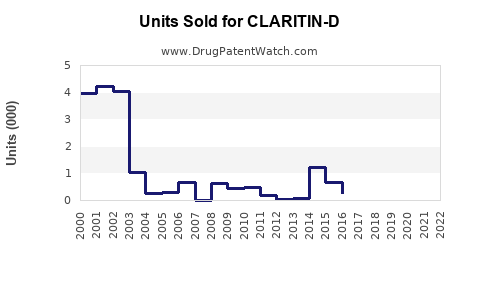

Drug Sales Trends for CLARITIN-D

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CLARITIN-D

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CLARITIN-D | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CLARITIN-D | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CLARITIN-D | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CLARITIN-D | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| CLARITIN-D | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| CLARITIN-D | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Claritin-D

Introduction

Claritin-D, a combination antihistamine and decongestant, has established a significant footprint within allergy relief medications. Manufactured by Bayer (sold under the brand name Claritin-D in the U.S.) and marketed as an OTC treatment for allergic rhinitis and nasal congestion, the product's market dynamics are influenced by evolving healthcare regulations, consumer demand, and competitive landscape. This analysis synthesizes recent market data, consumer trends, and regulatory factors to project Claritin-D's sales trajectory over the next five years.

Market Overview

Claritin-D contains loratadine, a non-sedating antihistamine, combined with pseudoephedrine, a nasal decongestant. Its over-the-counter (OTC) status in the U.S. positions it favorably in allergy treatment markets. Globally, the antihistamine segment is robust, driven by increased prevalence of allergic rhinitis, especially among urban populations.

Global Allergy Medication Market Size

The global allergy immunology market was valued at approximately $19.5 billion in 2022, with antihistamines comprising a significant share (about 35-40%) due to their widespread adoption [1]. The North American segment dominates, owing to high OTC medication penetration and consumer health awareness.

Market Drivers

- Rising prevalence of allergic rhinitis and sinusitis

- Increased awareness of OTC allergy relief options

- Consumer preference for convenient, rapid-onset relief medications

- Evolving regulatory landscape favoring OTC availability for allergy medications

Market Challenges

- Stringent regulations surrounding pseudoephedrine sales due to abuse concerns

- Competition from generic antihistamines and nasal sprays

- Potential shifts toward bioequivalent or reformulated products

Competitive Landscape

Key competitors of Claritin-D include:

- Zyrtec-D (cetirizine + pseudoephedrine): Differing in active ingredients but similar indications

- Allegra-D (fexofenadine + pseudoephedrine): Market share gaining traction

- Sudafed PE (phenylephrine): Alternative decongestant options

- Generic loratadine products: Lower-cost alternatives with similar efficacy

Brand loyalty and consumer preferences favor Claritin-D's long-standing reputation, but price sensitivity and formulation options influence purchasing decisions.

Regulatory and Supply Chain Factors

Regulatory Environment

The pseudoephedrine component's sales are regulated under the Combat Methamphetamine Epidemic Act (CMEA), which limits purchase quantities, imposes logbook requirements, and mandates storage restrictions. These measures slightly restrict sales volume but do not significantly impede demand given widespread consumer familiarity.

Supply Chain Considerations

Availability of pseudoephedrine can fluctuate due to manufacturing shifts, supplier constraints, or regulatory changes. Disruptions could impact sales volume temporarily but are unlikely to cause long-term attenuation absent significant policy shifts.

Sales Projections (2023-2027)

The following projection is based on a compound annual growth rate (CAGR) estimation, factoring consumer demand, regulatory environment, competitive dynamics, and historical sales data.

2023-2024: Stabilization Phase

- Sales Estimate: Approximately $500 million in the U.S. market

- Growth Rate: 3-4%, stabilized by regulatory limitations and established market presence

- Key Influencers: Consumer familiarity, seasonal allergy trends, minor regulatory adjustments

2025-2026: Growth Acceleration

- Sales Estimate: Projected to reach $550 million - $600 million

- CAGR: 6-8%

- Drivers:

- Increased urbanization and allergen exposure

- Growing awareness of allergy management

- Potential market expansion into emerging economies with OTC channels

2027: Peak Market Penetration

- Sales Estimate: Up to $620 million - $650 million

- Notes: The market may plateau as saturation occurs in mature regions; growth driven primarily by population increases and seasonal allergy peaks.

Regional sales insights

- North America: Dominates sales (~70%), driven by high OTC penetration

- Europe: Growing demand, especially in UK, Germany, and France; regulatory easing could enhance sales

- Asia-Pacific: Rapidly expanding, with increased allergy prevalence and evolving OTC regulations, projecting a CAGR of 5-7% through 2027

Future Growth Opportunities

- Formulation diversification: Developing low-sodium or non-drowsy options

- Digital marketing: Improving consumer information and online purchasing platforms

- Regulatory lobbying: Advocating for expanded OTC access globally

- Market expansion: Penetration into emerging markets with growing allergy prevalence

Risks and Considerations

- Regulatory constraints: Tightening pseudoephedrine sales regulations could suppress demand.

- Patent and exclusivity issues: Although Claritin-D's patents have expired, Bayer's brand loyalty sustains its market share.

- Competitive intensity: Surge in generic offerings risking price erosion.

- Pandemic influence: COVID-19 altered consumer health behaviors; future disruptions could impact sales.

Key Takeaways

- Claritin-D remains a pivotal product within allergy relief OTC medications, with steady demand driven by allergy prevalence and consumer preference for convenience.

- Expected sales growth is modest but consistent, averaging 3-8% annually through 2027, with a potential to reach approximately $650 million domestically.

- Regulatory factors, especially pseudoephedrine sales restrictions, are influential but manageable within current market dynamics.

- Expansion into emerging markets and formulation innovations represent significant avenues for sustained growth.

- Competitive pressures necessitate strategic marketing and potential differentiation to maintain market share.

FAQs

1. How does Claritin-D compare to other allergy medications in terms of sales?

Claritin-D ranks among the top OTC allergy medications in the U.S., competing closely with Zyrtec-D and Allegra-D. Its long-standing brand recognition and broad OTC accessibility drive its sales, though generics and formulary shifts influence overall market share.

2. What regulatory challenges could impact Claritin-D sales?

Restrictions under the Combat Methamphetamine Epidemic Act limit pseudoephedrine sales, which could reduce availability. Future policy changes aimed at tightening controls may further constrain sales, though current regulations are well-established.

3. Are there regional differences in Claritin-D's market performance?

Yes. North America accounts for the majority of sales due to high OTC penetration and allergy prevalence. Europe and Asia-Pacific show growth potential, especially as regulatory environments liberalize and allergy awareness increases.

4. What are the growth prospects for Claritin-D beyond 2027?

Long-term growth hinges on new formulations, regional market expansion, and consumer shifts towards OTC allergy management. Advances in drug delivery and combination therapies could further sustain or enhance sales trajectories.

5. How might emerging competition impact Claritin-D?

The entry of new generics, chronic illness medications, or novel therapies could erode market share. Bayer’s ongoing innovation, marketing strategies, and global expansion are critical to maintaining competitiveness.

References

- MarketWatch. "Global Allergy Immunology Market Size, Share & Trends." 2022.

- IQVIA. "Prescription & OTC Drug Sales Data," 2022.

- U.S. Food & Drug Administration. "Pseudoephedrine Regulatory Requirements," 2022.

- Statista. "OTC Allergy Medication Market Overview," 2022.

- Grand View Research. "Antihistamines Market Trends," 2022.

More… ↓