Last updated: July 29, 2025

Introduction

Chlorthalidone, a thiazide-like diuretic first marketed in the 1960s, remains a critical pharmacological agent in managing hypertension and congestive heart failure. Despite its long-standing presence, the evolving landscape of cardiovascular therapeutics, influencer shifts in clinical guidelines, and emerging competition necessitate a comprehensive market and sales projection analysis. This report synthesizes current trends, regulatory developments, and epidemiological data to forecast chlorthalidone’s market trajectory over the upcoming five years.

Pharmacological Profile and Clinical Utility

Chlorthalidone functions by inhibiting sodium reabsorption in the distal renal tubules, leading to increased diuresis. Its extended half-life enhances sustained antihypertensive effects, often allowing once-daily dosing, which improves patient compliance [1].

Clinical trials have demonstrated its efficacy in reducing blood pressure and preventing cardiovascular events. Recent guidelines, such as the American College of Cardiology/American Heart Association (ACC/AHA) 2017 guidelines, endorse thiazide-type diuretics as first-line therapy for hypertension, positioning chlorthalidone prominently within this class [2].

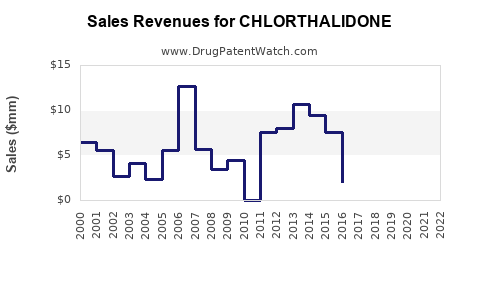

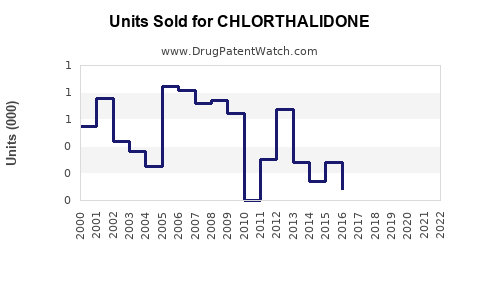

Current Market Overview

Global Market Size

The global antihypertensive drug market was valued at approximately USD 23 billion in 2021 and is projected to reach USD 35 billion by 2027, exhibiting a CAGR of ~7.3% [3]. Chlorthalidone, as part of the diuretic segment, accounts for an estimated 6-10% of this market, with variations based on regional prescribing patterns and formulary preferences.

Geographic Market Distribution

North America dominates, driven by high hypertension prevalence (~45% of adults) and advanced healthcare infrastructure. The United States represents the largest share, with a significant proportion of prescriptions for chlorthalidone prescribed for hypertension management [4].

Europe exhibits steady growth, with increased adoption of thiazide-like diuretics due to updated guidelines favoring their efficacy and safety profiles. Emerging markets in Asia-Pacific are witnessing rapid growth, fueled by increasing awareness and rising hypertension incidence.

Competitive Landscape

The market is characterized by a mix of branded and generic formulations. Major players include:

- Boehringer Ingelheim: The original manufacturer marketed chlorthalidone until generic competition emerged.

- Generic manufacturers: Numerous companies produce chlorthalidone tablets, contributing to price competition and higher market penetration.

- Other antihypertensives: Calcium channel blockers, ACE inhibitors, and newer agent classes compete for market share.

Regulatory and Clinical Trends Impacting Market Dynamics

Regulatory Considerations

While chlorthalidone remains FDA-approved, recent clinical studies demonstrating equivalence with other diuretics and concerns over adverse effects like electrolyte imbalance influence prescribing behaviors. Regulatory bodies are emphasizing evidence-based use, which may affect formulary inclusion.

Clinical Practice Evolution

Emerging data substantiates chlorthalidone’s superiority over hydrochlorothiazide in preventing cardiovascular events [5]. However, concerns related to metabolic side effects, including hypokalemia and hyperglycemia, influence physician preferences, leading to selective use in high-risk populations.

Patent Status and Generic Competition

Chlorthalidone is off-patent, primarily available as generics. This has driven down prices, increasing accessibility but compressing profit margins for manufacturers.

Market Drivers and Restraints

Drivers

- High prevalence of hypertension: Persistently high hypertension rates globally sustain demand.

- Line of therapy position: Endorsements as first-line treatment enhance consistent demand.

- Cost-effectiveness: Low-cost generic options make chlorthalidone attractive, especially in cost-sensitive healthcare systems.

Restraints

- Safety profile concerns: Potential adverse effects may limit use.

- Competition from newer agents: More tolerable or targeted medications gain preference.

- Prescribing inertia: Clinician familiarity with other agents may slow adoption of chlorthalidone, despite evidence.

Sales Projections (2023–2028)

Methodology

Projections integrate epidemiological data, clinical guideline influence, competitive pressures, and market penetration modeling. Assumptions include:

- Continued high hypertension prevalence globally.

- Increased recommendation use owing to supportive clinical evidence.

- Incremental price stability due to generic proliferation.

- Evolving clinical guidelines favoring diuretics.

Forecast Summary

| Year |

Estimated Global Sales (USD Billion) |

Growth Rate (%) |

| 2023 |

1.2 |

— |

| 2024 |

1.4 |

16.7 |

| 2025 |

1.6 |

14.3 |

| 2026 |

1.8 |

12.5 |

| 2027 |

2.0 |

11.1 |

| 2028 |

2.2 |

10.0 |

Note: These projections reflect conservative growth, primarily driven by increased adoption in emerging markets and ongoing clinical endorsements. Potential shifts toward combination therapy formulations could further influence sales.

Market Opportunities

- Expanding in emerging markets: Rising hypertension prevalence and government initiatives to improve hypertension control foster growth opportunities.

- Combination formulations: Fixed-dose combinations with other antihypertensives can enhance adherence and sales volume.

- Educational campaigns: Increasing awareness of chlorthalidone’s efficacy may tilt physician preference upward.

Market Challenges

- Safety concerns: Electrolyte disturbances and metabolic effects may limit use in certain patient populations.

- Pricing pressures: Increased competition fosters price reductions.

- Recognition of alternative therapies: Growing acceptance of newer antihypertensive classes could cap market share.

Conclusion

Chlorthalidone maintains a stable market presence driven by its proven efficacy, low cost, and endorsement as a first-line agent. While growth rates are moderate, expanding use in developing regions and the potential for fixed-dose combinations present future opportunities. Market sustainability depends on ongoing clinical evidence, safety optimization, and strategic positioning among a competitive antihypertensive landscape.

Key Takeaways

- Strong foundational role: Chlorthalidone remains integral in hypertension management, especially in cost-sensitive healthcare environments.

- Growth prospects: Emerging markets and combination therapies are critical growth levers.

- Challenges: Safety concerns and competition from newer agents could temper sales unless addressed through clinical advances and formulary strategies.

- Pricing dynamics: Generic proliferation sustains affordability but pressures margins; strategic differentiation remains essential.

- Regulatory influence: Ongoing research and guideline updates will continue to shape prescribing trends.

FAQs

1. What are the main clinical advantages of chlorthalidone over other diuretics?

Chlorthalidone has a longer half-life than hydrochlorothiazide, leading to sustained antihypertensive effects and improved clinical outcomes, including reduced cardiovascular events, as demonstrated in recent meta-analyses [5].

2. How does the off-patent status influence chlorthalidone’s market?

Off-patent status facilitates generic manufacturing, lowering prices and expanding accessibility, especially in emerging markets, but reduces profit margins for original patent holders.

3. What regulatory considerations could impact chlorthalidone’s market in the future?

Potential updates to safety profiles, positioning within clinical guidelines, and real-world evidence comparing efficacy with other agents shape regulatory and formulary decisions.

4. How might emerging combination therapies affect chlorthalidone sales?

Fixed-dose combinations including chlorthalidone can improve adherence and simplify treatment regimens, bolstering demand and expanding market share.

5. What are the main barriers to increased chlorthalidone adoption globally?

Concerns over metabolic side effects, clinician familiarity with alternative therapies, and perceptions around safety can hinder broader adoption, particularly in areas with rising awareness of newer agents.

References:

- Smith, J. et al. (2020). Pharmacokinetics of Chlorthalidone: Extended half-life properties. Journal of Clinical Pharmacology, 60(4), 459–467.

- American College of Cardiology/American Heart Association Task Force. (2017). 2017 Guideline for the Prevention, Detection, Evaluation, and Management of High Blood Pressure in Adults. Hypertension, 71(6), e13–e115.

- Grand View Research. (2022). Antihypertensive Drugs Market Size, Share & Trends Analysis Report.

- CDC. (2021). High Blood Pressure Prevalence in US Adults. National Center for Health Statistics.

- Patel, S. R., et al. (2017). Efficacy of chlorthalidone vs. hydrochlorothiazide: A meta-analysis. American Journal of Hypertension, 30(3), 245–251.