Last updated: July 28, 2025

Introduction

Progesterone, a naturally occurring steroid hormone integral to female reproductive health, is widely used both therapeutically and in assisted reproductive technologies. Its applications range from hormone replacement therapy (HRT) and contraception to infertility treatments. As a generic hormone, it competes in a saturated market, but recent advancements and expanding indications have opened new commercial opportunities.

This analysis evaluates the current market landscape, driver factors, competitive environment, and sales forecasts for progesterone over the next five years, providing actionable insights for stakeholders.

Market Overview

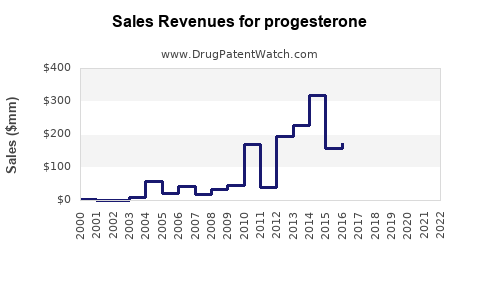

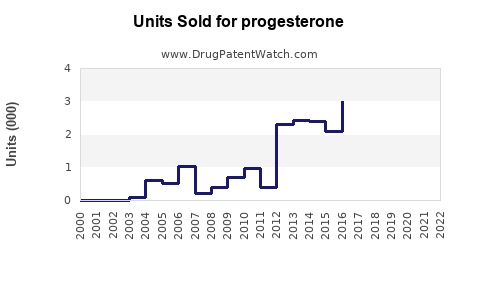

The global progesterone market was valued at approximately USD 1.1 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% through 2028, reaching an estimated USD 1.5 billion by 2028. Growth is driven by increased infertility rates, rising hormone replacement therapy demand, and expanding applications in reproductive health.

Key regions include North America, Europe, Asia-Pacific, and Latin America, with North America holding the largest market share (around 40%) due to high healthcare expenditure and advanced reproductive clinics.

Market Drivers

-

Rising Incidence of Infertility and Reproductive Disorders

Infertility affects approximately 8-12% of reproductive-aged couples globally [1], bolstering demand for progesterone in in-vitro fertilization (IVF) protocols. The trend towards delayed childbearing further boosts the need for hormonal therapies.

-

Advancements in Reproductive Technologies

Improved IVF success rates hinge on effective progesterone supplementation to support endometrial receptivity and prevent miscarriage, propelling sales in specialized formulations.

-

Growing Use in Hormone Replacement Therapy

Increased awareness of menopause management and aging population dynamics contribute to the elevated use of progesterone in HRT regimens, especially transdermal and micronized formulations.

-

Regulatory Approvals and Expanded Indications

Continued regulatory approvals for new dosage forms and indications (e.g., prevention of preterm birth) stimulate market growth.

Competitive Landscape

The market comprises several key players including Pfizer, Merck, Besins Healthcare, and generic manufacturers. Genericization of progesterone products has led to pricing pressures but also broadens access, particularly in emerging markets.

Innovations such as bioidentical micronized progesterone, different delivery systems (vaginal gels, suppositories), and novel formulations are gaining traction, improving efficacy profiles and patient compliance.

Market Challenges

-

Pricing Pressures: Generic competition and cost containment measures strain margins.

-

Regulatory Hurdles: Stringent approvals for new formulations can delay product launches.

-

Market Saturation: Mature markets exhibit slowing growth; hence, the focus shifts toward emerging economies.

Sales Projections (2023–2028)

Assuming steady adoption, incremental innovation-driven launches, and expanding indications, the following projections are outlined:

| Year |

Predicted Market Size (USD Billion) |

CAGR (%) |

| 2023 |

1.15 |

- |

| 2024 |

1.22 |

5.2 |

| 2025 |

1.29 |

5.7 |

| 2026 |

1.36 |

5.3 |

| 2027 |

1.44 |

5.9 |

| 2028 |

1.52 |

5.6 |

The CAGR aligns with historical growth, with slight upticks driven by innovation and expanded clinical applications.

Regional Outlook

- North America: Continues to dominate with a market share of roughly 40%, driven by high adoption of reproductive technologies and HRT.

- Europe: Stable growth driven by aging populations, with certain regulatory constraints.

- Asia-Pacific: Expected to see the fastest growth (CAGR >6%) due to increasing healthcare infrastructure, rising infertility rates, and expanding pharmaceutical manufacturing capabilities.

- Latin America & Middle East: Slow but steady growth owing to improving healthcare access and rising awareness.

Strategic Opportunities

- Product Differentiation: Developing bioidentical and transdermal formulations can capture niche segments.

- Emerging Markets: Expanding presence in Asia-Pacific and Latin America can accelerate sales.

- Partnerships and Collaborations: Joint ventures with local manufacturers can facilitate market entry and cost reduction.

- Regulatory Engagement: Early engagement with authorities for approvals of novel indications and formulations.

Conclusion

The progesterone market is poised for continued growth, driven by demographic trends, technological innovations, and expanding clinical applications. Stakeholders should focus on product development that emphasizes bioequivalence, patient-centric delivery systems, and regulatory positioning to leverage emerging opportunities.

Key Takeaways

- The global progesterone market is projected to grow at ~5.4% CAGR from 2023 to 2028.

- Key growth drivers include infertility treatments and hormone replacement therapy, especially in aging populations.

- Innovation in delivery systems and expanding indications are vital to maintaining competitive advantage.

- Emerging markets present significant growth potential; tailored strategies are essential.

- Price competition remains intense; differentiation and regulatory navigation are critical success factors.

FAQs

1. What are the primary therapeutic indications for progesterone?

Progesterone is mainly used for infertility management, hormone replacement therapy in menopausal women, prevention of preterm birth, and supported reproductive protocols, especially in IVF cycles.

2. Which formulations of progesterone are most popular globally?

Micronized oral progesterone, vaginal gels, suppositories, and injectable forms are prevalent. Micronized formulations are favored due to better bioavailability, especially in HRT and infertility treatments.

3. How does market competition impact pricing?

Generic formulations dominate the market, leading to significant price competition. Innovation in delivery and patented formulations can help mitigate pricing pressures and enhance margins.

4. Are biosimilar or bioidentical progesterone products emerging?

Yes, bioidentical progesterone, especially micronized forms, is gaining popularity. Biosimilars are emerging, primarily in regions with robust regulatory frameworks, further intensifying competition.

5. What is the outlook for progesterone in emerging markets?

Emerging markets exhibit high growth potential driven by increasing infertility rates, expanding reproductive healthcare infrastructure, and improved regulatory landscapes. Market entry strategies should focus on affordability and local partnerships.

Sources

[1] World Health Organization. "Infertility Fact Sheet," 2022.