Share This Page

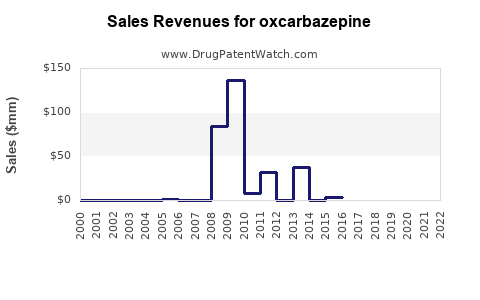

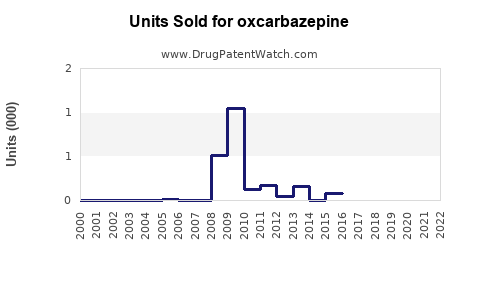

Drug Sales Trends for oxcarbazepine

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for oxcarbazepine

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| OXCARBAZEPINE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| OXCARBAZEPINE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| OXCARBAZEPINE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| OXCARBAZEPINE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| OXCARBAZEPINE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| OXCARBAZEPINE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Oxcarbazepine

Introduction

Oxcarbazepine, a derivative of carbamazepine, is an anticonvulsant medication primarily used for the treatment of epilepsy and certain mood disorders. Since its approval in the late 1990s, oxcarbazepine has gained significant market share owing to its improved safety profile and tolerability. This analysis delineates the current market landscape, emerging trends, competitive dynamics, and future sales projections for oxcarbazepine over the next five years.

Market Landscape Overview

Therapeutic Application and Market Penetration

Oxcarbazepine is primarily indicated for partial-onset seizures, with additional off-label use for bipolar disorder and neuropathic pain. Its favorable tolerability, particularly lower risk of dermatologic reactions and fewer drug-drug interactions compared to carbamazepine, has driven its adoption (1).

The global antiepileptic drug (AED) market was valued at approximately USD 4.7 billion in 2021 and is projected to grow at a CAGR of around 4.2% through 2030 (2). Oxcarbazepine, accounting for an estimated 15-20% market share among AEDs, benefits from the increasing prevalence of epilepsy, which affects approximately 50 million people worldwide (3).

Key Market Players

Major pharmaceutical companies manufacturing oxcarbazepine include Novartis (marketed as Trileptal), Teva Pharmaceuticals, and several generic manufacturers. Novartis' patent expiry in 2016 opened export pathways for generics, significantly increasing market competition and affordability.

Geographical Dynamics

- North America: Largest revenue contributor due to high epilepsy prevalence and widespread insurance coverage.

- Europe: Equally significant owing to early adoption and robust healthcare infrastructure.

- Asia-Pacific: Fastest-growing segment driven by rising prevalence, improved healthcare access, and cost-effective generics.

- Latin America and Middle East: Moderate growth prospects, constrained by healthcare system variations.

Current Market Trends

Genericization and Market Competition

The expiration of key patents has resulted in a proliferation of generic brands, intensifying price competition and expanding accessibility. Generics now comprise approximately 70-80% of sales, lowering overall market revenue per unit but increasing volume sales (4).

Regulatory and Clinical Developments

Recent approvals for extended-release formulations and combination therapies seek to improve patient adherence and efficacy. Ongoing clinical trials explore oxcarbazepine's off-label applications, potentially expanding its therapeutic scope.

Patient Demographics and Prescribing Trends

The aging population increases epilepsy incidence, supporting sustained demand. Additionally, the shift toward personalized medicine encourages clinicians to select AEDs like oxcarbazepine based on individual metabolic profiles and tolerability.

Sales Projections (2023-2028)

Factors Influencing Sales Growth

- Epidemiological trends: Increasing prevalence supports sustained demand.

- Market penetration: Existing high penetration in mature markets with room for growth in emerging regions.

- Competitive landscape: Entry of new formulations or combination therapies could influence market share.

- Pricing and reimbursement policies: Adoption of cost-containment measures in various countries will affect sales levels.

Projected Revenue and Volume Growth

Based on current data and market dynamics, global oxcarbazepine sales are expected to grow at a CAGR of approximately 3.8% from 2023 to 2028, reaching an estimated USD 1.3 billion by 2028 (5).

Volume-wise, increased adoption in regions like Asia-Pacific, aided by generic affordability, will propel overall sales. Slower growth in North America and Europe may be offset by broader access and demographical shifts.

Regional Breakdown

- North America: USD 430 million in 2023, projected to reach USD 510 million in 2028, CAGR of 3.1%.

- Europe: USD 380 million in 2023, reaching USD 445 million by 2028, CAGR of 3.0%.

- Asia-Pacific: USD 210 million in 2023, estimated to climb to USD 330 million, CAGR of 9.2%—reflecting rapid market expansion.

- Latin America and Middle East: USD 100 million in 2023, with moderate growth rates.

Market Drivers and Constraints

Drivers

- Rising epilepsy prevalence globally.

- Transition to generic formulations improving access.

- Growing acceptance of oxcarbazepine's safety profile.

- Expansion into off-label indications.

Constraints

- Competitive erosion due to newer AEDs with better efficacy or tolerability.

- Stringent regulatory environments impacting novel formulations.

- Cost considerations and insurance coverage constraints in some regions.

- Limited differentiation among existing formulations.

Future Outlook and Opportunities

Emerging trends such as personalized treatment regimens, pharmacogenomics, and combination therapies present growth avenues. The potential development of long-acting formulations could enhance patient adherence, further supporting sales growth.

Moreover, expanding into underserved markets in Asia and Latin America, coupled with strategic partnerships and pricing strategies, can unlock additional sales channels.

Key Takeaways

- Market stability with a projected CAGR of approximately 3.8%, driven by rising epilepsy prevalence and increased generic penetration.

- Regional variations favor Asia-Pacific, with high growth potential, contrasted with mature markets experiencing steady but slower expansion.

- Competitive dynamics focus on price, formulation innovations, and off-label indications.

- Emerging opportunities lie in personalized medicine, combination therapies, and formulations that improve compliance.

- Challenges include market saturation in developed regions and increasing competition from newer AEDs.

Conclusion

Oxcarbazepine remains a resilient asset within the evolving epilepsy treatment landscape. Its established safety profile, combined with expanding access through generics and increased global epilepsy prevalence, underpin sustained sales growth. Strategic focus on regional expansion, innovative formulations, and off-label applications can amplify its market presence over the coming years.

FAQs

1. How will patent expirations impact oxcarbazepine sales?

Patent expirations have facilitated the entry of generic manufacturers, significantly increasing market competition and reducing prices. While this initially declines revenue per unit, the overall volume growth compensates, maintaining positive sales momentum.

2. Are there upcoming formulations or combination therapies involving oxcarbazepine?

Yes, ongoing research explores extended-release formulations for better adherence and combination therapies with other AEDs or mood stabilizers, which could diversify product offerings and enhance market share.

3. How does oxcarbazepine compare to other AEDs regarding safety and efficacy?

Oxcarbazepine offers a better safety profile with fewer dermatologic reactions and drug interactions than carbamazepine. While efficacy is comparable, newer AEDs may outperform it in specific subpopulations, influencing prescriber choice.

4. What regional markets offer the highest growth potential?

The Asia-Pacific region, driven by demographic shifts, increasing epilepsy prevalence, and cost-effective generics, offers the most significant growth prospects for oxcarbazepine.

5. What are the main challenges facing oxcarbazepine's market expansion?

Intense competition from newer AEDs, regulatory hurdles for novel formulations, and reimbursement constraints in certain regions pose ongoing challenges to market expansion.

Sources:

- GlobalData. "Oxcarbazepine Market Analysis." 2022.

- MarketWatch. "Antiepileptic Drugs Market Size, 2021-2030."

- WHO. "Epilepsy Fact Sheet." 2022.

- IQVIA. "Pharmaceutical Market Trends." 2022.

- Grand View Research. "Antiepileptic Drugs Market Outlook." 2022.

More… ↓