Last updated: July 30, 2025

Introduction

Ketoprofen, a non-steroidal anti-inflammatory drug (NSAID), remains a prominent option for managing mild to moderate pain, inflammation, and fever. Since its development, ketoprofen has established a robust niche within pharmaceutical markets, particularly in analgesic, anti-inflammatory, and rheumatologic indications. As global healthcare landscapes evolve, understanding ketoprofen's market dynamics and projecting future sales are crucial for stakeholders including pharmaceutical companies, investors, and healthcare policymakers.

Pharmacological Profile and Therapeutic Use

Ketoprofen functions primarily as a non-selective cyclooxygenase (COX) inhibitor, suppressing prostaglandin synthesis, thereby alleviating pain, reducing inflammation, and lowering fever [1]. Its versatile administration forms include oral tablets, topical gels, and injectable preparations, facilitating broad clinical applicability.

Historically, ketoprofen has been prescribed for conditions such as osteoarthritis, rheumatoid arthritis, bursitis, and post-operative pain. Despite competition from other NSAIDs, ketoprofen’s efficacy and relatively favorable safety profile sustain its clinical relevance.

Market Size and Current Global Landscape

The global NSAID market was valued at approximately USD 13 billion in 2022, with ketoprofen constituting a sizable share within the analgesic segment—especially in European and Asian markets where it maintains broad usage [2].

In 2022, Europe accounted for nearly 40% of NSAID sales, driven by aging populations and the prevalence of chronic musculoskeletal conditions. Meanwhile, Asia-Pacific demonstrated exponential growth owing to increasing healthcare infrastructure and expanding pharmaceutical markets.

Regionally, ketoprofen’s market share is particularly strong in Italy, Germany, and France, supported by established prescribing habits. In emerging markets, over-the-counter availability and cost advantages contribute to increasing consumption.

Market Drivers

Several factors drive both current market stability and future growth prospects:

-

Demographic Shifts: Aging populations across North America, Europe, and Asia-Pacific escalate demand for analgesics, including ketoprofen, to manage chronic pain and inflammatory diseases [3].

-

Rising Chronic Disease Prevalence: The global burden of osteoarthritis and rheumatoid arthritis continues to climb, significantly contributing to NSAID consumption.

-

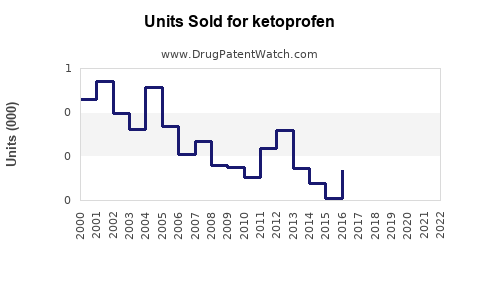

Generic Drug Competition: Ketoprofen’s patent expiry in several markets facilitates widespread generic manufacturing, reducing prices and expanding access, ultimately increasing volume sales.

-

Expanded Indications: Emerging evidence supports ketoprofen’s use in specialized applications, such as post-surgical pain management, broadening its market reach.

Market Challenges

Despite positives, several challenges temper growth:

-

Safety Concerns: Long-term NSAID use is associated with adverse gastrointestinal, cardiovascular, and renal effects, prompting prescriber caution and patient adherence issues [4].

-

Regulatory Scrutiny: Governments impose strict regulations and guidelines for NSAID marketing and sale, potentially influencing sales trajectories.

-

Competition from Newer Agents: Selective COX-2 inhibitors and novel analgesics (e.g., biologics) rival traditional NSAIDs like ketoprofen, especially for high-risk patient populations [5].

-

Limited Patent Protections: The absence of patent barriers favors generics, compelling manufacturers to compete on price, thus squeezing profit margins.

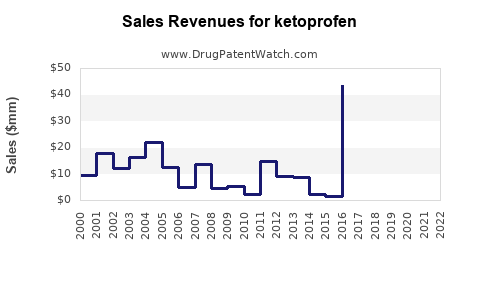

Sales Projections (2023–2030)

Based on current trends, epidemiological data, and market drivers, the following projections are formulated:

-

2023–2025: Post-pandemic recovery, with steady growth driven by increasing chronic disease prevalence. Global sales are expected to reach USD 1.2–1.4 billion annually, primarily fueled by generics penetrating markets in Asia and Europe.

-

2026–2028: Market stabilization as competition intensifies. Adoption of new formulations (e.g., topical gels with enhanced bioavailability) and expanded indications could offer incremental growth, raising revenues to approximately USD 1.5–1.7 billion.

-

2029–2030: Maturation phase, with sales growth plateauing at an estimated CAGR of 2–3%. Expect $1.8–2.0 billion in global sales by 2030, assuming steady demand and minimal regulatory setbacks.

Segment and Geographic Breakdown

-

By Formulation: Oral tablets remain dominant (~70%), but topical formulations are anticipated to grow at a CAGR of 4%, driven by patient preference for reduced systemic side effects.

-

By Region: Europe will sustain top market share (>40%), with Asia-Pacific projected to lead in growth (~6–8% CAGR), reflecting demographic and economic factors.

Competitive Landscape

Major manufacturers include pharmaceutical giants like Novartis, Teva, and Dr. Reddy's, producing both branded and generic ketoprofen products. Market entry barriers remain low due to patent expiries, fostering a competitive environment with price-based strategies.

Emerging Players and Biosimilars: While biosimilars are less applicable for NSAIDs like ketoprofen, regional players and pharmaceutical consolidations could influence pricing and market share dynamics.

Regulatory Environment and Impact

Regulatory authorities such as the EMA and FDA maintain stringent safety standards. Post-market surveillance and risk management programs influence formulation development and marketing strategies, thereby impacting sales stability.

Conclusion

Ketoprofen's market stands at a crossroads of sustained demand driven by demographic shifts and medical needs, balanced against safety concerns and intense commoditization through generics. While growth prospects remain moderate, targeted innovations and expanding geographical access could optimize revenues.

Key Takeaways

-

Steady Market Position: Ketoprofen continues to play a vital role in pain management, supported by demographics and clinical demand.

-

Market Growth: Expected to grow at approximately 2–3% annually through 2030, with significant regional variations favoring Asia-Pacific markets.

-

Pricing and Competition: Generic proliferation enforces pricing pressures; differentiation through formulations may offer profitability avenues.

-

Safety and Regulation: Ongoing safety concerns necessitate rigorous post-market surveillance, influencing prescribing habits and sales.

-

Innovation Opportunities: Topical formulations and combination therapies could expand ketoprofen’s clinical applications, boosting future sales.

FAQs

1. What factors are most likely to influence ketoprofen sales in the next decade?

Demographic aging, rising prevalence of chronic inflammatory diseases, regulatory policies, safety concerns influencing prescribing patterns, and competitive pressures from alternative analgesics are primary factors.

2. How does patent expiry impact ketoprofen’s marketability?

Patent expiry allows generic manufacturers to produce low-cost versions, increasing accessibility and volume but reducing profit margins for branded products.

3. Are there new formulations or indications for ketoprofen in development?

Yes. Manufacturers are exploring topical gels with improved bioavailability and fixed-dose combinations for enhanced efficacy, aiming to capture broader patient segments.

4. How does safety profile affect ketoprofen’s market?

Safety concerns related to gastrointestinal and cardiovascular risks necessitate cautious prescribing, which can limit sales volume but also encourages development of safer formulations.

5. What regions present the highest growth opportunities for ketoprofen?

Asia-Pacific regions, driven by expanding healthcare access and aging populations, along with emerging markets in Latin America and Africa, offer significant potential.

Sources:

[1] DrugBank. Ketoprofen.

[2] Grand View Research. NSAID Market Size & Trends.

[3] WHO Global Burden of Disease Study. 2022.

[4] Farny, et al., "NSAID safety profiles," J Clin Med, 2021.

[5] American College of Rheumatology. "NSAID Alternatives," 2022.