Last updated: July 27, 2025

Introduction

WELCHOL (colesevelam hydrochloride) is a bile acid sequestrant approved by the FDA primarily for managing type 2 diabetes mellitus and hyperlipidemia. As a non-absorbed polymer that lowers LDL cholesterol and improves glycemic control, WELCHOL occupies a niche at the intersection of metabolic and cardiovascular therapy. Understanding its market landscape, competitive positioning, and sales forecasts is critical for stakeholders evaluating investment potential or strategic planning related to this medication.

Market Overview

Therapeutic Indications and Patient Demographics

WELCHOL’s two primary indications—glycemic management in type 2 diabetes and hypercholesterolemia—align with expanding markets driven by escalating global prevalence of metabolic syndromes.

- Type 2 Diabetes: As of 2022, the International Diabetes Federation (IDF) estimates over 537 million adults worldwide living with diabetes, with projections surpassing 700 million by 2045. The rising incidence fuels demand for adjunct therapies that offer lipid and glucose benefits.

- Hyperlipidemia: Cardiovascular disease remains the leading cause of mortality globally. Elevated LDL cholesterol levels, which WELCHOL effectively reduces, are a central modifiable risk factor.

Market Size and Growth Drivers

The global bile acid sequestrant market is incrementally growing, driven by increased awareness of cardiovascular risk factors 1. WELCHOL’s unique dual efficacy makes it an attractive option amidst a landscape dominated by statins, SGLT2 inhibitors, and GLP-1 receptor agonists.

Key growth drivers include:

- The aging population increasing the prevalence of metabolic syndrome.

- Elevated statin intolerance, prompting alternative lipid-lowering therapies.

- The shift towards comprehensive metabolic management, integrating glycemic and lipid control.

Competitive Landscape

WELCHOL faces competition from various drug classes:

- Statins: These remain the frontline lipid-lowering agents, with sales exceeding $20 billion annually globally 2.

- Ezetimibe: Often used as adjunct therapy, with estimated global sales of approximately $2 billion.

- PCSK9 inhibitors: Expensive injectable agents, with rising adoption in high-risk lipid patients.

- Other bile acid sequestrants: Cholestyramine and colestipol have similar mechanisms but are less preferred due to tolerability issues.

WELCHOL distinguishes itself with a favorable side effect profile and dual indications, which provide a competitive edge over older bile acid sequestrants.

Sales Performance and Trends

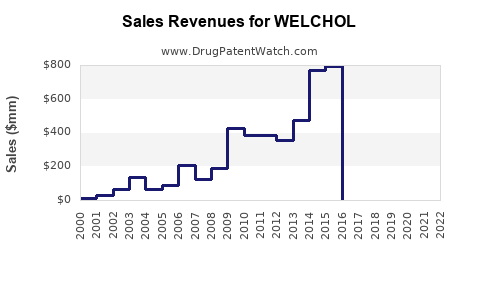

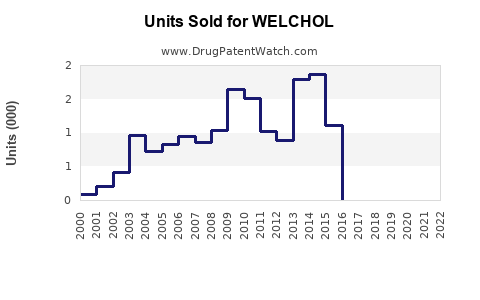

Historical Sales Data

Since its FDA approval in 2000, WELCHOL has experienced steady, albeit modest, growth. The branded drug's annual sales peaked at approximately $250 million in 2015, driven by increased prescriptions for hyperlipidemia and emerging use in glycemic control.

Post-2015, sales plateaued due to generic competition and limited marketing resources, with recent estimates suggesting annual revenues around $150 million. The drug's niche status reduces aggressive promotional activities but sustains consistent demand among specialists.

Impact of Prescription Trends

- Guideline Endorsements: While WELCHOL is included in guidelines for diabetes and hyperlipidemia management, newer agents like SGLT2 inhibitors and PCSK9 inhibitors have overshadowed it in the market.

- Physician Adoption: Its use remains largely confined to patients with statin intolerance or specific cases requiring dual control, limiting broad market penetration.

- Patient Preferences: Gastrointestinal tolerability is generally favorable, but some patients experience constipation or bloating, impacting adherence.

Market Challenges

- Limited Awareness: Compared to blockbuster agents, WELCHOL suffers from lower brand visibility.

- Pricing and Reimbursement: While relatively affordable, reimbursement variability and insurance formularies influence sales.

- Generic Competition: Colesevelam is available as a generic, exerting pressure on the brand's market share.

Sales Projections (2023-2028)

Considering current market trends, competitive pressures, and epidemiological data, future sales trajectories for WELCHOL are as follows:

Scenario 1: Conservative Growth

- Assumptions: Stable demand within niche populations; no major marketing investments; ongoing generic competition.

- Projection: Year-over-year (YoY) sales decline of approximately 2-3%, stabilizing around $120 million by 2028.

Scenario 2: Moderate Growth via Indication Expansion

- Assumptions: Increased awareness among primary care physicians; inclusion in newer treatment guidelines; expansion into obesity-related metabolic syndrome management.

- Projection: Incremental sales growth of 5-7% annually, reaching approximately $180 million by 2028.

Scenario 3: Aggressive Market Penetration

- Assumptions: Significant marketing push; combination therapy positioning; robust reimbursement strategies.

- Projection: Sales growth of 10%+ annually, potentially exceeding $250 million by 2028.

Given current market dynamics, the most probable outlook aligns with Scenario 2, with potential for upside if new indications or combination strategies are developed.

Strategic Opportunities and Risks

Opportunities

- Market Differentiation: Positioning WELCHOL as an adjunct for patients intolerant to statins offers growth prospects.

- Combination Therapies: Developing fixed-dose combinations with other lipid or glycemic agents can improve adherence and efficacy.

- Guideline Inclusion: Advocacy for WELCHOL's inclusion in updated treatment protocols could boost prescriber confidence and sales.

Risks

- Generic Competition: Significantly impacts pricing and market share.

- Emergence of Newer Agents: SGLT2 inhibitors and PCSK9 inhibitors offer superior efficacy in some patient subsets.

- Regulatory Limitations: Restrictions on new indications might hamper growth.

Conclusion

WELCHOL’s position in the metabolic disease treatment landscape remains niche but strategic. Its dual effectiveness in managing hyperlipidemia and blood glucose positions it well for targeted patient populations. However, sales growth hinges on increased awareness, indication expansion, and competitive positioning amidst a landscape dominated by potent novel agents. Conservative forecasts suggest stable but modest sales, with moderate upside potential contingent on strategic marketing, clinical adoption, and regulatory advancements.

Key Takeaways

- WELCHOL targets high-risk metabolic patients, but faces significant competition from statins, PCSK9 inhibitors, and newer antidiabetic agents.

- The global bile acid sequestrant market shows gradual growth aligned with rising cardiovascular and diabetes prevalence.

- Historical sales peaked around $250 million but have declined due to generics and limited promotional efforts.

- Future sales are projected to stagnate or grow modestly, with potential upticks driven by guideline updates, indication expansion, and combination therapies.

- Strategic initiatives focusing on niche markets, improving prescriber awareness, and leveraging data on dual benefits are essential to sustain and grow WELCHOL’s market share.

FAQs

1. What are the main advantages of WELCHOL over other lipid-lowering agents?

WELCHOL uniquely improves both LDL cholesterol and blood glucose levels, making it suitable for patients with metabolic syndrome who require integrated therapy. Its non-absorbed polymer profile results in fewer systemic side effects.

2. How does the competitive landscape affect WELCHOL’s market potential?

The dominance of statins and the emergence of potent injectables like PCSK9 inhibitors restrict WELCHOL to niche segments, limiting rapid growth but ensuring sustained demand among specific patient groups.

3. Can WELCHOL be used in combination with other antidiabetic or lipid-lowering therapies?

Yes, WELCHOL is often prescribed alongside statins and oral antidiabetics, and studies support its safety and efficacy in combination regimens, which may broaden its use.

4. What are the barriers to increasing WELCHOL’s market share?

Barriers include generic competition, limited prescriber awareness, restricted indications, and the availability of newer, more efficacious agents.

5. What strategic moves could expand WELCHOL’s market reach?

Investing in clinical trials for new indications, integrating into treatment guidelines, enhancing physician education, and developing combination products are key strategies to boost sales.

Sources

- GlobeNewswire. "Bile Acid Sequestrants Market Analysis & Trends". 2022.

- FierceBiotech. "Global Statin Market Data". 2022.