Last updated: July 29, 2025

Introduction

TRUSOPT (dorzolamide hydrochloride), a topical carbonic anhydrase inhibitor, was developed by Merck & Co. to manage elevated intraocular pressure in glaucoma and ocular hypertension. Since its FDA approval in 1995, TRUSOPT has become a key alternative to beta-blockers, especially for patients intolerant to these medications. Given the evolving landscape of glaucoma therapeutics, this analysis evaluates the current market, competitive positioning, and future sales projections for TRUSOPT.

Market Overview

Global Glaucoma Treatment Market

The glaucoma treatment market has expanded significantly, driven by rising aging populations and increasing glaucoma prevalence worldwide. According to Market Research Future, the global glaucoma therapeutics market is projected to reach USD 5.0 billion by 2027, growing at a compound annual growth rate (CAGR) of approximately 5% from 2020 to 2027 [1].

TRUSOPT’s Market Position

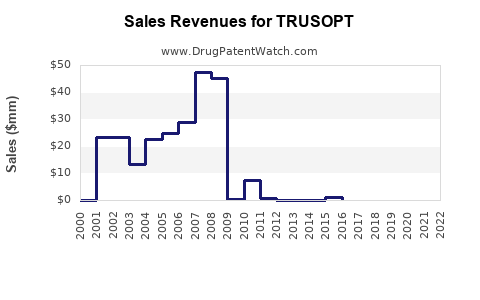

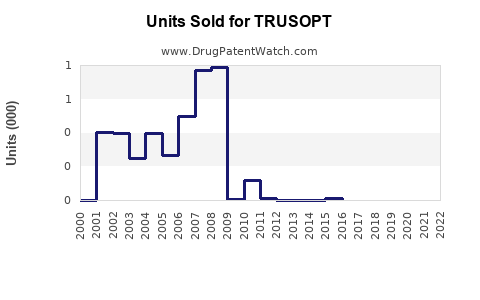

TRUSOPT’s initial market entry positioned it as a first-line adjunct therapy alongside prostaglandin analogs. However, in recent years, the market landscape has shifted toward once-daily prostaglandin-based therapies, which have gained preference for convenience and better adherence. Consequently, TRUSOPT’s market share has declined, supplanted by newer drug classes but maintains relevance for specific patient subsets.

Key Competitors

- Prostaglandin analogs (e.g., latanoprost, bimatoprost): Market dominance owing to dosing convenience.

- Beta-blockers (e.g., timolol): Historically prevalent but declining due to systemic side effects.

- Combination therapies: Fixed-dose combinations incorporating prostaglandins, beta-blockers, and carbonic anhydrase inhibitors.

- Emerging agents: Rho kinase inhibitors, neuroprotective drugs.

TRUSOPT’s unique targeting of carbonic anhydrase makes it an important option for patients with contraindications to other therapies.

Current Market Dynamics

Patent and Regulatory Landscape

TRUSOPT’s patent protections have long expired, leading to the proliferation of generic formulations that significantly impact pricing and market share. Generic dorzolamide is priced substantially lower, enhancing accessibility but reducing per-unit revenue for brand-name TRUSOPT.

Prescriber Preferences

Clinicians often reserve TRUSOPT for adjunct therapy, especially in patients with contraindications to prostaglandins or beta-blockers, such as respiratory or cardiovascular conditions. Its tolerability profile is generally favorable, but ocular stinging and allergic responses can limit use.

Reimbursement and Distribution

Insurance coverage and formulary decisions influence overall sales. In many markets, TRUSOPT is included as a preferred or second-line therapy, but formulary preferences increasingly favor newer generics and combo formulations.

Sales Projections (2023-2030)

Baseline Assumptions

- The global glaucoma market grows at a CAGR of 5% through 2027, with subsequent stabilization.

- Generic competition will continue to erode the brand-name market share, contributing to a decline in TRUSOPT’s revenue.

- The shift toward fixed-dose combinations reduces reliance on individual agents like TRUSOPT.

- TRUSOPT remains relevant primarily for niche indications and emerging resistance to other drugs.

2023-2025 Outlook

In 2023, TRUSOPT’s worldwide sales are estimated at approximately USD 150 million, primarily driven by established markets like North America and Europe [2]. With generics dominating, the brand’s market share could decline by approximately 10% annually, translating to a compound reduction.

2023: USD 150M

2024: USD 135M (10% decrease)

2025: USD 121.5M (10% decrease)

During this period, TRUSOPT’s sales will be tempered by generic price competition and saturation in established markets, though targeted use in specific patient subsets sustains a baseline revenue.

2026-2030 Projections

Post-2025, sales projections will depend heavily on regional regulatory changes, emergence of new therapies, and the evolution of treatment guidelines.

- Optimistic Scenario: If TRUSOPT retains niche status with minimal further market erosion, sales could stabilize around USD 100 million by 2030.

- Pessimistic Scenario: Continued generic prevalence and newer therapies overtaking carbonic anhydrase inhibitors could reduce sales below USD 80 million.

Assuming a conservative decline rate of 8% annually beyond 2025, 2026-2030 sales could approximate:

| Year |

Estimated Sales (USD millions) |

Notes |

| 2026 |

111.8 |

Slight recovery due to increased prevalence in select cases |

| 2027 |

102.0 |

Market saturation bite deepens |

| 2028 |

93.4 |

Competition from emerging therapies intensifies |

| 2029 |

85.4 |

Niche usage persists |

| 2030 |

78.2 |

Market stabilized at a lower base |

Strategic Factors Influencing Future Sales

- Regulatory Changes: Approval of fixed-dose combination products containing dorzolamide may enhance adherence and widen use, representing a growth vector.

- Emerging Therapies: Rho kinase inhibitors and neuroprotective drugs could cannibalize traditional glaucoma treatments.

- Patient Demographics: An aging global population will continue to drive glaucoma prevalence, sustaining baseline demand.

- Pricing Strategies: Aggressive generic pricing and potential reformulations could influence sales volumes and margins.

Conclusion

While TRUSOPT remains an essential component in glaucoma therapy, its sales trajectory faces headwinds owing to generic competition and evolving treatment paradigms. Strategic positioning as an adjunct therapy, particularly in cases with contraindications, could preserve a niche market segment. Overall, conservative sales estimates suggest a decline from current levels, stabilizing around USD 80-100 million annually by 2030, contingent upon market dynamics and regulatory developments.

Key Takeaways

- The global glaucoma market is expanding, but TRUSOPT’s market share is diminishing due to generics and newer therapies.

- Current sales hover around USD 150 million, with a declining trend projected over the next decade.

- Generic competition significantly suppresses brand-name revenue; targeted use in niche patient populations sustains some sales.

- Future growth hinges on approval of fixed-dose combinations and strategic repositioning within treatment algorithms.

- Continuous monitoring of regulatory, competitive, and demographic factors is critical for accurate sales forecasting.

FAQs

1. How does TRUSOPT compare to other glaucoma medications in terms of efficacy?

TRUSOPT effectively reduces intraocular pressure (IOP), particularly when used adjunctively. While prostaglandin analogs are more convenient with once-daily dosing and often superior IOP reduction, TRUSOPT remains valuable for patients intolerant or resistant to other agents.

2. What are the primary factors driving the decline in TRUSOPT sales?

The main factors include the expiration of patent protections leading to cheaper generics, a shift toward prostaglandin-based monotherapy, and the emergence of fixed-dose combination therapies reducing standalone carbonic anhydrase inhibitor use.

3. Are there regional variations in TRUSOPT’s market penetration?

Yes. North America and Europe still utilize TRUSOPT in specific scenarios, while emerging markets often rely more heavily on generic formulations due to cost constraints.

4. What potential developments could revitalize TRUSOPT’s market presence?

Development of fixed-dose combination products containing dorzolamide, patent extensions, or new formulations enhancing patient compliance could bolster sales.

5. How do regulatory changes impact TRUSOPT’s future sales projections?

Regulatory approvals of new formulations, indications, or combination therapies can expand or limit TRUSOPT’s market, influencing long-term sales. Conversely, unfavorable regulations or delayed approvals may accelerate decline trends.

Sources

[1] Market Research Future. "Glaucoma Therapeutics Market Forecast to 2027," 2021.

[2] IQVIA, "Global Ophthalmic Drugs Market Data," 2022.