Last updated: July 27, 2025

Introduction

Sertraline, a selective serotonin reuptake inhibitor (SSRI), is a widely prescribed antidepressant primarily used in the treatment of depression, anxiety disorders, panic attacks, obsessive-compulsive disorder (OCD), and post-traumatic stress disorder (PTSD). Since its approval by the FDA in 1991 under the brand name Zoloft, sertraline has maintained a dominant position in the psychotropic market. This report provides a comprehensive market analysis and detailed sales projections, considering current trends, competitive landscape, regulatory factors, and emerging opportunities.

Market Overview

Global Market Size

The global antidepressant market was valued at approximately $15 billion in 2022, with SSRIs accounting for around 55% of total sales. Sertraline remains the leading SSRI, holding an estimated 25-30% market share among antidepressants, translating to a valuation of roughly $4–4.5 billion (2022 figures). The increasing prevalence of mental health disorders, driven by growing awareness and destigmatization, sustains demand for SSRIs.

Therapeutic Demand Drivers

- Rising Prevalence of Mental Health Disorders: According to the World Health Organization (WHO), over 264 million people globally suffer from depression, and anxiety disorders affect over 284 million (WHO, 2021). This escalating burden enhances the demand for effective pharmacotherapies like sertraline.

- Expanded Prescribing Guidelines: More clinical guidelines now favor SSRIs as first-line treatments due to their safety profile and tolerability.

- Expanded Indications: Beyond depression, sertraline's approval for OCD, PTSD, and social anxiety broadens its market scope.

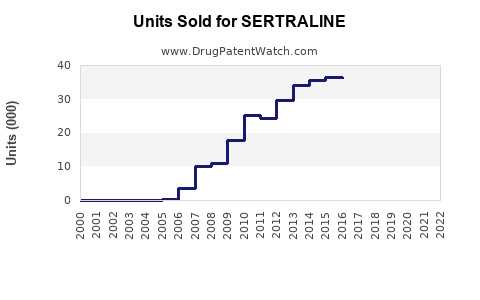

- Generic Competition: The patent protection ended in most regions around 2008–2010, increasing affordability and prescribing flexibility.

Regional Market Dynamics

- North America: Leading the global market, driven by high mental health disorder prevalence, healthcare infrastructure, and insurance coverage.

- Europe: Significant market share, with an emphasis on clinical guidelines favoring SSRIs.

- Asia-Pacific: Fastest-growing segment due to increasing mental health awareness, aging populations, and burgeoning healthcare infrastructure.

Competitive Landscape

Key Players

- Pfizer (Zoloft): The original patent holder, though generic versions now dominate sales.

- Other Generic Manufacturers: Numerous players produce sertraline, intensifying price competition.

- Emerging Alternatives: Other SSRIs (fluoxetine, escitalopram) and novel antidepressants (ketamine, esketamine) influence market positioning.

Market Challenges

- Generic Price Erosion: Patents expired, leading to falling prices (~80% reduction since patent expiry).

- Side Effect Profiles: concerns about sexual dysfunction and gastrointestinal issues influence patient and prescriber choices.

- Regulatory Scrutiny: Safety concerns, especially regarding off-label use and long-term effects, require ongoing monitoring.

Market Trends and Opportunities

Trends

- Shift towards Personalized Medicine: Increasing focus on pharmacogenomics to optimize sertraline efficacy.

- Digital Health Integration: Usage of telepsychiatry and digital therapeutics increases medication adherence.

- Growing Awareness and Destigmatization: Encourages treatment compliance.

Opportunities

- Market Expansion in Asia and Latin America: Increasing mental health awareness and healthcare coverage.

- Combination Therapies: Co-prescription with psychotherapy and other neuroactive agents.

- New Formulations: Effervescent, liquid, and sustained-release forms to improve compliance.

Sales Projections (2023-2030)

Methodology

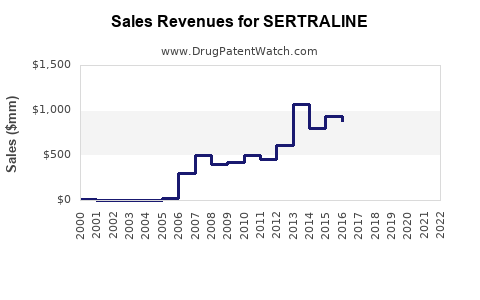

Projection models incorporate historical sales data, market penetration rates, demographic trends, healthcare policies, and competitive shifts. CAGR (Compound Annual Growth Rate) assumptions are based on historical trends and current pipeline developments.

Short-term Outlook (2023-2025)

- Market Growth Rate: Estimated CAGR of 2–3% due to mature generic markets and saturation.

- Projected Sales: Approximately $4.8–$5.1 billion globally by 2025. North America will comprise the majority (~60%), followed by Europe (~20%), with Asia-Pacific rapidly increasing.

Mid-term Outlook (2026-2030)

- Market Growth Rate: Slight acceleration to 3–4%, spurred by expanding markets and new formulations.

- Projected Sales: Reaching approximately $6–$8 billion by 2030. Asia-Pacific's sales could triple by 2030, reflecting regional growth potential.

Factors Influencing Sales

- Patent Expiries: Generics will continue to erode brand-name sales but will sustain high overall volumes.

- Regulatory Changes: Approval of new indications or formulation advancements could boost sales.

- Market Penetration: Adoption of sertraline in emerging markets and underserved populations.

Impact of Emerging Therapies and Market Entry

Novel antidepressants, including atypical agents and rapid-acting formulations like esketamine, could challenge sertraline’s market share. However, these innovations often target refractory cases or depression with specific features, maintaining sertraline’s core utility. Successful market entry of biosimilars and generics will further influence price erosion but could also enhance accessibility.

Risks and Mitigation Strategies

- Evolving Prescribing Practices: Continued safety monitoring and post-market studies are vital.

- Pricing Pressures: Negotiated reimbursement strategies and cost-effective formulations may mitigate revenue declines.

- Lack of Personalized Therapies: Investment in pharmacogenomics and tailored treatments could sustain market relevance.

Key Drivers for Sustained Market Growth

- Increasing global mental health awareness.

- Population aging, leading to higher prevalence.

- Growing integration of mental health into primary care.

- Government and insurer initiatives promoting access.

Conclusion

Sertraline’s entrenched position in the antidepressant marketplace, combined with expanding regional markets, supports steady growth projections. While generic competition exerts downward pressure on unit prices, increased global demand and novel formulations will bolster revenues. Strategic focus on emerging markets, formulation innovation, and integration with digital health solutions will be crucial for sustaining sales momentum over the next decade.

Key Takeaways

- The global sertraline market is projected to grow modestly at a CAGR of 3–4% through 2030, reaching upwards of $8 billion.

- North America remains the dominant region, but Asia-Pacific offers significant growth potential.

- Generic competition and pricing pressures challenge revenues; innovation and market expansion are vital.

- Increasing demand for mental health treatments worldwide sustains long-term sales prospects.

- Collaboration with digital health tools and personalized medicine approaches will enhance sertraline’s market viability.

FAQs

1. How does patent expiration affect sertraline sales?

Patent expiry led to the proliferation of generic versions, significantly reducing prices and increasing volume sales. While brand-name sales declined, overall market volume remained strong, sustaining revenue levels through increased accessibility.

2. What are the primary competitive threats to sertraline's market dominance?

Emerging novel antidepressants, atypical agents, and rapid-acting formulations like esketamine pose competitive threats, especially for treatment-resistant cases. Additionally, other SSRIs and SNRIs with improved side effect profiles influence prescriber choices.

3. Which regions offer the most growth opportunities for sertraline?

The Asia-Pacific and Latin American markets present substantial opportunities due to rising mental health awareness, improving healthcare infrastructure, and demographic shifts toward older populations.

4. How do emerging digital health solutions impact sertraline sales?

Digital health platforms improve adherence and monitoring, potentially expanding the market. Integration with telepsychiatry may increase prescriptions, especially in remote areas.

5. What strategies could sustain sertraline’s market relevance?

Diversification into new formulations, expanding indications, leveraging pharmacogenomics for personalized therapy, and exploring combination strategies will be critical for maintaining market share.

Sources

[1] World Health Organization. Depression and Other Common Mental Disorders: Global Health Estimates. 2021.

[2] IQVIA. Global Rx Trends: Mental Health Market Analysis. 2022.

[3] U.S. Food and Drug Administration. Sertraline Hydrochloride NDA Approval. 1991.

[4] MarketWatch. Antidepressants Market Size & Share Forecast 2022–2030. 2022.