Last updated: July 28, 2025

Introduction

MUCINEX, a popular over-the-counter (OTC) medication primarily used to alleviate coughs and mucus-related congestion, has established itself as a significant player in the respiratory health sector. This analysis explores the market landscape surrounding MUCINEX, evaluates current sales trends, forecasts future revenue streams, and considers strategic factors influencing its market performance.

Industry Overview and Market Position

MUCINEX, owned by GlaxoSmithKline (GSK), occupies a substantial niche within the OTC respiratory medication segment. The product's efficacy, brand recognition, and widespread availability have cemented its competitive positioning. The global OTC remedies market for cough and cold products was valued at approximately $10 billion in 2022, with expectant growth driven by increasing consumer health awareness and prevalence of respiratory ailments, especially amid ongoing respiratory viruses such as influenza and COVID-19.

Within this landscape, MUCINEX's core appeal centers on its active ingredient, guaifenesin, which became an established expectorant choice. The brand's market leadership is reinforced by extensive distribution channels, robust advertising campaigns, and consumer trust.

Market Drivers

- Rising Respiratory Illness Incidence: Seasonal flu, COVID-19, and other respiratory conditions sustain high demand for symptomatic relief medications.

- Consumer Preference for OTC Medicines: Growing inclination toward self-medication minimizes the need for doctor visits, amplifying OTC sales.

- Aging Population: Increased prevalence of chronic respiratory issues among older adults fuels sustained demand.

- Product Innovation and Line Extensions: Enhanced formulations (e.g., multi-symptom relief variants) attract broader segments.

Competitive Landscape

MUCINEX faces competition from brands such as Robitussin, DayQuil, Vicks, and store brands. Differentiation via formulation efficacy and brand loyalty allows MUCINEX to maintain premium positioning. Additionally, the rise of natural and herbal remedies has prompted some competition but has yet to significantly impact MUCINEX's market share.

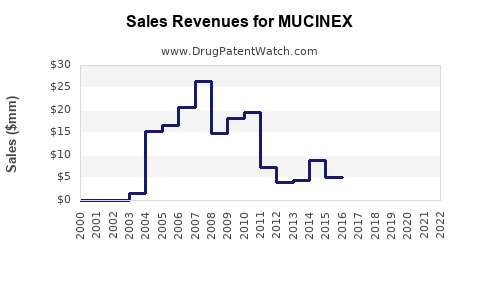

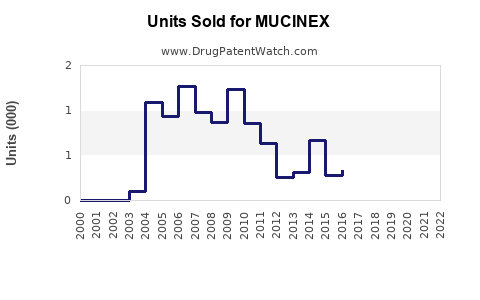

Historical Sales Data and Trends

GSK reports indicate that MUCINEX's global OTC revenues have grown steadily. In 2021, worldwide sales of MUCINEX approximated $300 million, representing a compound annual growth rate (CAGR) of approximately 4-6% over the past five years. North America remains the largest market, accounting for about 70% of sales, with evolving OTC regulations and consumer preferences influencing regional performance.

Besides, the pandemic catalyzed sales spikes: Q2 2020 sales surged by 20%, attributed to heightened respiratory health awareness and increased at-home treatments.

Sales Projections (2023-2028)

Short-term Outlook (2023-2025)

Expect modest growth, with projections of around 5-6% CAGR, driven by continuous consumer demand and expanded marketing efforts. The global OTC cough and cold segment's resilience amidst economic fluctuations underpins this optimism. The ongoing COVID-19 pandemic and seasonal illness cycles further bolster sales.

Medium- to Long-term Outlook (2026-2028)

Forecasts suggest a slowdown in rapid growth, stabilizing at 3-4% CAGR. Market saturation in mature regions like North America, coupled with emerging competition from natural remedies and digital health solutions, tempers accelerated growth. Nonetheless, expansion into emerging markets, especially in Asia-Pacific, where OTC drug use is rising, presents additional sales opportunities.

Global Market Revenue Projections

By 2028, global MUCINEX sales are projected to reach $500-$600 million, factoring in market expansion efforts, product innovation, and regional penetration strategies.

Strategic Opportunities and Risks

- Expansion in Emerging Markets: Tailoring formulations and marketing for Asia-Pacific, Latin America, and Africa could unlock substantial growth.

- Product Innovation: Developing new formulations (e.g., natural alternatives, combination drugs) can cater to evolving consumer preferences.

- Regulatory Changes: Stringent OTC regulations in certain jurisdictions may challenge distribution channels; proactive compliance is essential.

- Competitive Pressures: Price competition and alternative remedies pose ongoing threats; brand loyalty and consumer education remain key defenses.

- Supply Chain Stability: Ensuring resilience against disruptions, particularly amid pandemic-related challenges, is vital to maintain sales.

Conclusion

MUCINEX’s market position remains strong, supported by demographic trends, product efficacy, and brand recognition. While growth rates are expected to moderate in mature markets, strategic expansion into emerging regions, coupled with product innovation, offers prospects for sustained revenue enhancements. The brand’s resilience amidst global health fluctuations further underscores its long-term sales potential.

Key Takeaways

- Market resilience: The global OTC cough and cold market demonstrated stable growth, with MUCINEX benefiting from pandemic-related demand surges.

- Sales trajectory: Projected to reach approximately $500 million to $600 million globally by 2028 with a CAGR of 3-6%.

- Opportunities: Regional expansion, product line extensions, and natural formulation innovations present growth avenues.

- Risks: Regulatory shifts, competitive actions, and supply chain vulnerabilities require strategic management.

- Strategic focus: Enhancing consumer engagement and expanding distribution networks are critical for maintaining and growing market share.

FAQs

1. What are the primary factors driving MUCINEX sales growth?

Demographic shifts, increased respiratory illnesses, consumer preference for OTC options, and ongoing product innovations are key drivers.

2. How does MUCINEX compare to its competitors in market share?

MUCINEX holds a leading position in North America due to brand recognition and product efficacy, though competition from other OTC brands and store brands limits market dominance.

3. What regions offer the greatest growth potential for MUCINEX?

Emerging markets in Asia-Pacific, Latin America, and Africa present significant opportunities due to rising OTC medication use and expanding healthcare infrastructure.

4. What new product developments could influence future sales?

Natural formulations, multi-symptom relief variants, and combination products targeting different respiratory issues are potential growth catalysts.

5. What risks could impede MUCINEX’s market expansion?

Stringent regulatory environments, increased competition, pricing pressures, and supply chain disruptions pose substantive risks.

Sources

[1] Global OTC Remedies Market Report, 2022.

[2] GSK Annual Financial Statements, 2022.

[3] Industry Analyst Insights, 2023.

[4] CDC Respiratory Illness Data, 2022.

[5] MarketWatch, "Over-the-Counter Cough & Cold Market Outlook," 2023.