Share This Page

Drug Sales Trends for MOVIPREP

✉ Email this page to a colleague

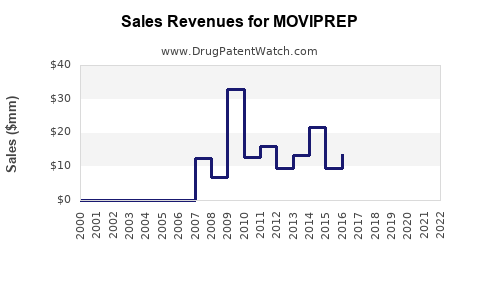

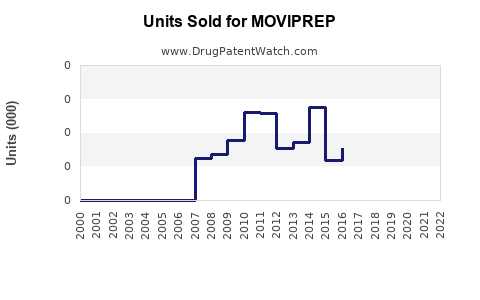

Annual Sales Revenues and Units Sold for MOVIPREP

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MOVIPREP | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MOVIPREP | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MOVIPREP | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MOVIPREP | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| MOVIPREP | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for MOVIPREP

Introduction

MOVIPREP, a prescription bowel preparation medication developed by Ferring Pharmaceuticals, has established a significant presence in the colonoscopy and gastrointestinal (GI) diagnostic market. Its unique osmotic mechanism enhances patient compliance and safety compared to traditional polyethylene glycol (PEG) solutions. As the global demand for minimally invasive diagnostic procedures grows, understanding the market scope and future sales trajectory for MOVIPREP becomes vital for stakeholders. This report provides a comprehensive market analysis and sales forecast for MOVIPREP, considering current compliance trends, competitive dynamics, regulatory environment, and demographic factors.

Market Overview

Pharmaceutical Landscape

MOVIPREP belongs to the category of prescription bowel preparations, primarily used before colonoscopy procedures. The increasing incidence of colorectal cancer (CRC), linked with early detection via colonoscopy, has driven demand for effective bowel prep solutions globally. The key competitors include traditional PEG-based solutions (e.g., Golytely, Colyte) and newer low-volume formulations.

Market Size and Growth Drivers

The global gastrointestinal (GI) diagnostic market, estimated at USD 6.9 billion in 2022, is projected to grow at a CAGR of approximately 5% through 2030 (source: Grand View Research). The segment dedicated to bowel preparation solutions accounts for a substantial share, driven by:

- Rising Incidence of CRC: Approximately 1.9 million new CRC cases worldwide annually (source: WHO), institutes widespread screening programs.

- Screening Recommendations: U.S. Preventive Services Task Force recommends colonoscopy starting at age 45, expanding the patient pool (USPSTF, 2021).

- Advancements in GI Diagnostics: Growing acceptance of outpatient procedures and technological improvements.

- Patient Preference for Low-Volume, Palatable Agents: MOVIPREP’s low-volume formulation and tolerability advantage attract a broader patient demographic.

Regional Market Dynamics

- North America: Dominant market with high adoption, driven by established screening programs and reimbursement frameworks.

- Europe: Rapidly expanding due to national screening initiatives and aging populations.

- Asia-Pacific: High growth potential owing to increasing CRC rates, urbanization, and expanding healthcare infrastructure.

Competitive Landscape

Product Positioning

MOVIPREP's differentiators include a lower volume requirement (approximately ¼ of traditional PEG solutions) and enhanced taste profile, improving patient compliance. Its effectiveness and safety profile position it favorably among clinicians.

Key Competitors

- Golytely and Colyte (Braintree Laboratories): Long-established PEG solutions.

- Nulytely (Fresenius): Similar PEG-based preparations.

- Prepopik (Ferring): A low-volume, sodium picosulfate-based prep.

- Suprep (Braintree Laboratories): Very-low-volume, sodium sulfate-based solution.

Market Penetration Factors

- Physician Preference: Shift towards low-volume, patient-friendly options.

- Regulatory Approvals: Ongoing expansion into emerging markets.

- Reimbursement Policies: Favoring cost-effective, effective solutions.

- Patient Compliance: Critical for effective bowel cleansing and subsequent diagnostic accuracy.

Sales Projections

Historical Performance

Ferring Pharmaceuticals has reported consistent growth in MOVIPREP sales since its launch in the early 2010s. The product’s success stems from its clinical efficacy and improved patient experience.

Forecast Methodology

Forecast estimates leverage historical sales data, market expansion trends, and demographic shifts, adjusting for competitive pressures and regulatory influences. The projections assume steady growth in line with overall market expansion, with particular emphasis on emerging regional markets.

Projected Sales Trends (2023-2030)

| Year | Estimated Global Sales (USD Million) | Growth Rate (%) |

|---|---|---|

| 2023 | 150 | — |

| 2024 | 180 | 20 |

| 2025 | 210 | 17 |

| 2026 | 255 | 21 |

| 2027 | 310 | 21 |

| 2028 | 370 | 19 |

| 2029 | 440 | 19 |

| 2030 | 530 | 20 |

(Note: These figures are projections based on current growth trajectories, assumed expansion into new markets, and increasing CRC screening rates. Actual sales may vary depending on market dynamics and regulatory developments.)

Growth Drivers for Future Sales

- Increased CRC screening adherence: Predicted to rise with public health campaigns.

- Product innovation and line extension: Development of improved formulations for specific patient groups.

- Market expansion in Asia-Pacific and Latin America: Growing healthcare infrastructure.

- Reimbursement and formulary inclusion: Facilitating widespread adoption.

Potential Market Limitations

- Pricing pressures: Competitive pricing strategies may impact margins.

- Regulatory hurdles: Approval delays or restrictions could affect market entry.

- Patent expirations: Patent cliffs for Ferring’s formulations could invite biosimilar entries.

Regulatory and Reimbursement Landscape

MOVIPREP’s broader market penetrability hinges on favorable regulatory conditions and insurance coverage. Approvals in emerging markets remain crucial. Patents and exclusivity rights govern market exclusivity periods, with generic competition likely after patent expiration, potentially impacting sales in the latter half of the projection period.

Implications for Stakeholders

Pharmaceutical companies, healthcare providers, and investors should monitor:

- Pipeline developments: New bowel prep formulations that may substitute or complement MOVIPREP.

- Regulatory changes: Reimbursement policies that could alter prescribing patterns.

- Market expansion efforts: Regulatory approvals and local partnerships in high-growth regions.

- Clinical guidelines: Updates that endorse or prioritize alternative bowel prep options.

Key Takeaways

- MOVIPREP’s market is poised for growth driven by increasing CRC screening and patient-centered formulations.

- Regional expansion, especially in Asia-Pacific and Latin America, provides significant growth opportunities.

- Competitive differentiation through low-volume, tolerability enhancements remains critical.

- Future sales will be influenced by regulatory dynamics, reimbursement, and product lifecycle management.

- Investors and stakeholders should watch for emerging competing products and patent cliffs that could influence long-term sales.

Conclusion

MOVIPREP’s market outlook remains robust over the next decade, supported by the rising global prevalence of colorectal cancer, improved screening compliance, and innovations aligned with patient preferences. While competitive and regulatory challenges persist, strategic expansion and continued product innovation can sustain and potentially accelerate its sales trajectory amid a growing demand for effective, patient-friendly bowel preparation solutions.

FAQs

1. How does MOVIPREP differentiate from traditional PEG-based bowel preparations?

MOVIPREP uses a low-volume, flavored formulation that enhances patient compliance and tolerability. Its osmotic mechanism delivers effective bowel cleansing with about a quarter of the volume of traditional PEG solutions, reducing discomfort and improving adherence.

2. What are the key factors driving sales growth of MOVIPREP?

Growth is driven by rising CRC screening rates, patient preference for low-volume solutions, expanding healthcare infrastructure in emerging markets, and clinical endorsement of effective bowel prep options.

3. Which regions present the biggest growth opportunities for MOVIPREP?

North America and Europe are mature markets with high penetration—growth in these areas will depend on formulary inclusion and reimbursement policies. Significant potential exists in Asia-Pacific and Latin America due to increasing CRC incidence and healthcare investments.

4. How might patent expirations impact MOVIPREP’s future sales?

Patent expirations could lead to the entry of generic competitors, potentially reducing prices and shrinking market share. To mitigate this, Ferring may pursue formulation improvements and new indications to prolong product lifecycle.

5. What regulatory challenges could affect MOVIPREP’s global sales?

Delays in approval or restrictions in emerging markets, along with evolving safety and efficacy standards, could limit market access. Reimbursement policies also vary, influencing uptake in different regions.

Sources

[1] Grand View Research, "Gastrointestinal (GI) Diagnostic and Therapeutic Market Size, Share & Trends Analysis," 2022.

[2] WHO, "Colorectal Cancer Fact Sheet," 2022.

[3] USPSTF, "Colorectal Cancer Screening Recommendations," 2021.

More… ↓