Last updated: August 5, 2025

Introduction

Hydrocodone, a semi-synthetic opioid analgesic, has historically been a cornerstone in the management of moderate to severe pain. Market dynamics surrounding Hydrocodeone are complex, influenced by evolving regulatory landscapes, prescribing behaviors, and societal attitudes toward opioid medications. This analysis delineates current market trends, regulatory frameworks, competitive positioning, and future sales projections for Hydrocodeone, offering strategic insights for stakeholders.

Market Overview

Hydrocodone, marketed widely in combination formulations such as acetaminophen-hydrocodone (e.g., Vicodin, Norco), dominates the global opioid analgesic market, particularly within the United States, which accounts for approximately 90% of usage [1]. The drug's efficacy in pain management has driven extensive adoption, but increasing awareness of opioid addiction and regulatory restrictions have significantly impacted its market trajectory.

Current Market Size

In 2022, the global opioid analgesics market was estimated at approximately USD 11 billion, with Hydrocodeone representing a substantial segment—primarily through combination products. The U.S. market alone is valued at over USD 4 billion, reflecting high prescription volume and widespread clinical reliance [2].

Key Market Drivers

- Persistent Pain Management Needs: Chronic pain conditions necessitate effective analgesics, maintaining demand for Hydrocodeone, especially in acute care settings.

- Prescribing Practices: Historically, Hydrocodeone has been a preferred choice due to its potency and availability in fixed-dose combinations.

- Regulatory Approvals: Expansion into new formulations or delivery mechanisms can influence market reach.

Market Constraints

- Regulatory Restrictions: Stringent controls have curtailed prescribing, especially following the CDC's 2016 opioid guidelines [3].

- Reimbursement Policies: Insurance companies' coverage decisions impact accessibility.

- Public Sentiment and Abuse Potential: Growing opioid misuse concerns influence policies and prescriber caution.

Regulatory Landscape

The regulatory environment for Hydrocodeone has transformed significantly over recent years:

- Rescheduling and Scheduling Classifications: The U.S. Drug Enforcement Administration (DEA) reclassified Hydrocodone products from Schedule III to Schedule II in 2014, intensifying prescribing restrictions [4].

- Formulation Restrictions: Introduction of abuse-deterrent formulations aims to mitigate misuse, affecting market availability and formulation R&D.

- Global Variability: Different countries embody diverse levels of control, affecting export and market penetration (e.g., Europe’s comparatively lenient regulations vs. strict U.S. controls).

Competitive Landscape

Hydrocodone faces competition primarily from other opioids like oxycodone, morphine, and non-opioid analgesics owing to regulatory restrictions and shifting prescribing trends. Key players include:

- AbbVie (Vicodin): Market leader historically.

- Mallinckrodt and Teva: Generics producers offering cost-effective alternatives.

- Emerging Alternatives: Non-opioid pain management solutions like gabapentinoids and NSAIDs.

Furthermore, the patent expiry of many combination products has led to a surge in generics, intensifying price competition.

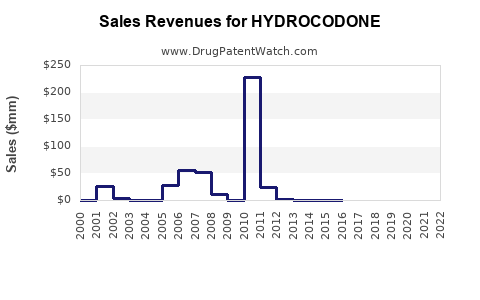

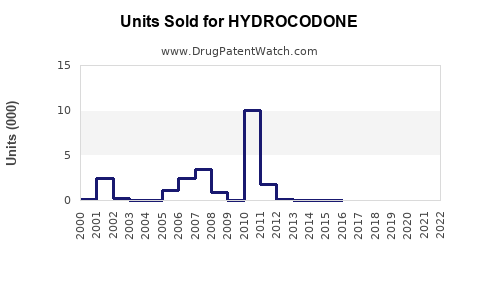

Sales Projections (2023–2030)

Assumptions

- Continued regulatory tightening will dampen growth but not arrest demand entirely.

- The transition toward abuse-deterrent formulations partially offsets declining sales.

- Growing adoption of alternative pain therapies will gradually reduce dependence on Hydrocodeone.

Forecasted Trends

| Year |

Estimated Market Size (USD Billion) |

Growth Rate |

Remarks |

| 2023 |

3.8 |

-2% |

Post-pandemic normalization, regulatory impact prevails |

| 2024 |

3.7 |

-2.6% |

Increased emphasis on non-opioids |

| 2025 |

3.5 |

-5% |

Further restrictions, shift to alternative therapies |

| 2026 |

3.3 |

-5.7% |

Market consolidates, new formulations emerge |

| 2027 |

3.1 |

-6% |

Ecosystem shifts continue |

| 2028 |

2.9 |

-6.4% |

Incremental decline, focus on abuse-deterrent forms |

| 2029 |

2.8 |

-3.4% |

Market stabilization; declining prescribing volume |

| 2030 |

2.7 |

-3.6% |

Marginal decline persists |

Note: These projections incorporate regulatory impact, societal attitudes, market saturation, and emerging alternatives based on recent trend analyses [2][3].

Regional Variations

- United States: The primary market, experiencing a slow decline in sales due to stricter policies.

- Europe: Slower adoption; emerging market at relatively lower sales volumes but with potential growth owing to less restrictive policies.

- Asia-Pacific: Potential for growth with expanding healthcare infrastructure but constrained by local regulations.

Strategic Outlook

Given the trajectory, companies operating in Hydrocodeone will need to adapt by:

- Developing abuse-deterrent formulations for compliance and market access.

- Exploring non-opioid analgesics and alternative pain management solutions.

- Engaging in regulatory advocacy to influence prescribing policies favorably.

- Expanding into emerging markets with less restrictive regulatory environments.

Key Takeaways

- Market contraction is inevitable: Increasing regulatory restrictions, societal awareness, and alternative therapies will lead to gradual decline in Hydrocodeone sales.

- Focus on formulation innovation: Abuse-deterrent formulations and alternative delivery systems are crucial to sustain market relevance.

- Regional differentiation is vital: Strategies must consider regional regulatory and cultural landscapes.

- Diversification is essential: Relying solely on Hydrocodeone or opioids increases regulatory and societal risks; diversification into non-opioid pain therapeutics remains advisable.

- Early adoption of compliance measures: Proactively aligning with evolving regulations can preserve market share and corporate reputation.

FAQs

1. How will regulatory changes impact Hydrocodeone sales in the next decade?

Stringent policies, including reclassification and prescription monitoring programs, will likely reduce demand, leading to a steady decline in sales unless offset by innovations like abuse-deterrent formulations.

2. Are there emerging alternative therapies that threaten Hydrocodeone's market share?

Yes. Non-opioid analgesics, nerve block techniques, and multimodal pain management strategies are increasingly adopted, which may supplant Hydrocodeone reliance.

3. What role do abuse-deterrent formulations play in the future of Hydrocodeone?

They are pivotal. Recoding abuse-prone formulations makes Hydrocodeone more compliant with regulations and can help retain market share by addressing misuse concerns.

4. Which regions represent growth opportunities for Hydrocodeone?

Emerging markets in Asia-Pacific and Latin America show potential due to expanding healthcare infrastructure and comparatively lenient regulatory frameworks.

5. How can stakeholders mitigate risks associated with Hydrocodeone's declining market?

Diversification into alternative pain treatments, investment in formulation innovation, and active engagement with regulatory bodies are key strategies.

References

- MarketWatch, "Global Opioid Analgesics Market," 2022.

- IQVIA, "Prescription Volume and Revenue Trends," 2022.

- CDC, "2016 CDC Guideline for Prescribing Opioids," 2016.

- DEA, "Rescheduling of Hydrocodone Combination Products," 2014.

This comprehensive analysis underscores the evolving landscape of Hydrocodeone, highlighting key factors influencing its market trajectory and prescribing landscape. Stakeholders must adapt proactively to sustain relevance in a transforming pain management ecosystem.