Last updated: July 28, 2025

Introduction

Focalin (dexmethylphenidate hydrochloride) is a central nervous system stimulant primarily prescribed for Attention Deficit Hyperactivity Disorder (ADHD) and Narcolepsy. Market dynamics for Focalin stem from the expanding ADHD diagnosis rates, waxing prescription trends for stimulant medications, and evolving regulatory landscapes. This report offers a comprehensive analysis of the current market environment, competitive positioning, regulatory factors, and future sales outlook for Focalin.

Market Landscape Overview

Global Prevalence of ADHD and Narcolepsy

ADHD affects approximately 5-8% of children worldwide, with prevalence in adults ranging between 2-5% (4.4% in the US alone). The global ADHD therapeutics market was valued at ~$10 billion in 2022 and is projected to expand at a CAGR of approximately 6% through 2028 [1]. Narcolepsy, a rarer disorder, influences roughly 1 in 2,000 individuals globally, representing a niche but significant segment where stimulant therapies like Focalin may be utilized.

Key Market Drivers

- Rising Diagnosis and Awareness: Increased recognition of ADHD in children and adults leads to higher medication demand.

- Preference for Short-Acting Stimulants: Prescribers often favor Focalin due to its rapid onset and nominal duration, making it suitable for flexible dosing.

- Advancements in Formulations: Development of extended-release (XR) formulations broadens therapeutic options, though Focalin remains primarily popular as a short-acting agent.

- Regulatory Changes: Enhanced prescribing guidelines and controlled substance regulations influence prescribing behaviors.

Competitive Landscape

Focalin faces competition from other stimulants such as Adderall (mixed amphetamine salts), Vyvanse (lisdexamfetamine), Ritalin (methylphenidate), and generic methylphenidate formulations.

- Market Position: Focalin's distinguishing feature is its pharmacokinetic profile; dexmethylphenidate, as the active enantiomer of methylphenidate, offers a potentially improved side effect profile and efficacy.

- Pricing and Reimbursement: As a branded medication, Focalin commands premium pricing over generics, though insurance coverage and formulary placement influence sales margins.

- Patent and Patent Expiry: Focalin's patent protection expired in 2010 (US patent), enabling generic versions to enter the market, intensifying competition.

Regulatory Environment

The regulatory landscape directly impacts Focalin’s sales trajectory:

- Controlled Substance Classification: Focalin is Schedule II under the DEA, confirming high abuse potential, leading to stringent prescribing and dispensing regulations.

- Labeling and Prescribing Guidelines: The FDA emphasizes cautious use, especially in pediatric populations, with mandated Risk Evaluation and Mitigation Strategies (REMS) programs.

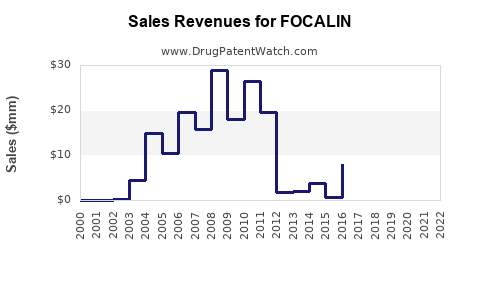

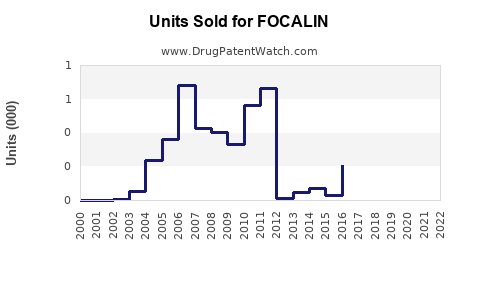

Sales Trends and Historical Data

Historically, Focalin's US sales reached approximately $600 million annually prior to patent expiry, reflecting its popularity in stimulant therapy for ADHD. Post-generic entry, sales declined sharply, but the brand sustains residual market share through brand loyalty and prescriber preference.

- Market Share Post-Patent Expiry: Estimated at ~25% of methylphenidate prescriptions in the US have shifted to generics, with Focalin retaining a niche segment (~10%) among short-acting stimulants.

- Global Sales: Minimal outside the US market due to limited regulatory approval and manufacturer focus, but emerging markets show increasing interest.

Future Sales Projections

Scenario 1: Conservative Approach

- Assumptions: Continued dominance of generics; regulatory restrictions tighten; prescriber preference shifts toward newer agents with abuse-deterrent features.

- Projection: US Sales decline to ~$200 million by 2027, driven chiefly by residual brand loyalty, with limited growth outside North America.

Scenario 2: Optimistic Outlook

- Assumptions: Increased ADHD diagnosis, expanded approved indications, and reintroduction of extended-release formulations.

- Projection: US Sales could rebound to ~$350 million by 2027, fueled by targeted marketing, formulary access, and niche applications in treatment-resistant populations.

Global Opportunities

While currently limited, countries experiencing rising ADHD awareness could generate incremental sales, reaching a global total of ~$150 million by 2027 under favorable conditions.

Strategic Opportunities and Challenges

-

Opportunities:

- Development of long-acting formulations for differentiated therapeutic profiles.

- Strategic licensing and collaborations to expand geographic reach.

- Co-marketing with generic manufacturers to sustain brand relevance.

-

Challenges:

- Regulatory pressures and increased scrutiny over stimulant abuse.

- Market saturation with generics and competing brands.

- Changing prescribing habits favoring non-stimulant or combination therapies.

Key Takeaways

- The aging patent and generic competition have significantly reduced Focalin's sales, but it remains relevant in specific niches due to its pharmacological profile.

- Growth in the ADHD market, particularly with broader adult diagnosis, offers some upside potential.

- Market share retention hinges on formulary positioning, prescriber preferences, and new formulation development.

- Regulatory monitoring remains critical given the drug’s Schedule II status.

- Diversification into emerging markets and development of novel formulations could enhance future revenues.

FAQs

1. What factors most influence Focalin sales growth?

Market expansion is primarily driven by increased ADHD diagnosis and prescriber preference for short-acting stimulants. Formulation innovations and regulatory acceptance of new indications also contribute.

2. How does Focalin compare to other ADHD medications in the market?

Focalin offers a pharmacokinetic advantage as a purified enantiomer, potentially reducing side effects and offering rapid onset. However, it faces stiff competition from generics and other branded stimulants like Vyvanse and Adderall.

3. What is the impact of patent expiration on Focalin’s market?

Patent expiry in 2010 allowed generic competitors to enter, significantly reducing brand sales and market share. The residual brand demand now relies on prescriber loyalty and formulary placement.

4. Are there upcoming regulatory developments that could affect Focalin sales?

Yes. Regulations aimed at mitigating abuse, such as stricter prescribing rules or abuse-deterrent formulations, could limit access or prescribe patterns, impacting sales.

5. What strategic moves could enhance Focalin’s market positioning?

Investing in long-acting formulations, expanding indications, exploring international markets, and forming strategic alliances with generic manufacturers could bolster Focalin sales.

References

[1] Grand View Research. ADHD Drugs Market Size, Share & Trends Analysis Report (2022).

[2] US Food & Drug Administration. Focalin Label and Regulatory Filings.

[3] IMS Health Data. Prescription Trends for ADHD Medications.

[4] World Health Organization. ADHD Prevalence and Epidemiology Reports.