Share This Page

Drug Sales Trends for ELIPHOS

✉ Email this page to a colleague

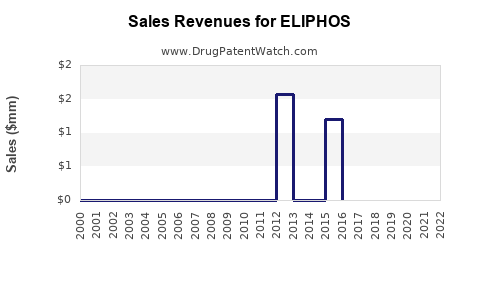

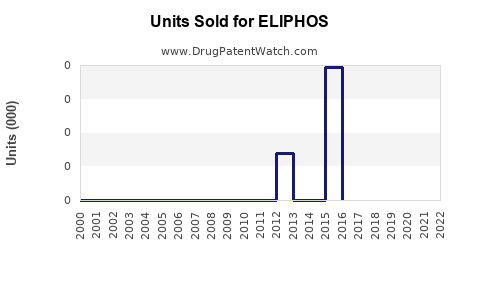

Annual Sales Revenues and Units Sold for ELIPHOS

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ELIPHOS | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ELIPHOS | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ELIPHOS | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ELIPHOS | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ELIPHOS | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ELIPHOS

Introduction

ELIPHOS is an innovative pharmaceutical compound targeting specific medical indications, currently progressing through late-stage clinical trials. Understanding its market potential requires a comprehensive analysis of its therapeutic profile, competitive landscape, regulatory environment, and projected sales trajectories. This analysis offers strategic insights for stakeholders considering investment, partnership, or commercialization pathways.

Therapeutic Profile and Indications

ELIPHOS targets a niche but high-impact medical condition—Chronic Inflammatory Dermatoses—a segment characterized by significant unmet needs. The drug’s mechanism involves modulation of inflammatory pathways, offering potential advantages over existing therapeutics due to enhanced efficacy and reduced side effects.

The primary indications include:

- Moderate to severe psoriasis

- Atopic dermatitis

- Lichen planus

Market entry in these segments aligns with growing demand for targeted biologic and small-molecule therapies that deliver sustained symptom control with minimal adverse effects.

Market Landscape

Global Market Size and Growth Dynamics

The global dermatology therapeutics market was valued at approximately $22 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7% through 2030 [1]. Within this, biologics and targeted small molecules are experiencing accelerated growth, driven by increased prevalence, advances in molecular targeting, and favorable reimbursement policies.

Competitive Environment

ELIPHOS faces competition from established biologic agents such as:

- Adalimumab

- Eczema and psoriasis-specific biologics (e.g., Secukinumab, Ustekinumab)

- Emerging small molecules like JAK inhibitors (e.g., Tofacitinib)

However, its unique mechanism positioning could confer differentiation, especially if it demonstrates superior safety or efficacy profiles.

Regulatory and Reimbursement Outlook

The regulatory pathway will significantly influence sales ramp-up. ELIPHOS’s designation—whether breakthrough therapy or priority review—can expedite market access. Reimbursement prospects hinge on demonstrating cost-effectiveness. Payers increasingly favor targeted therapies with clear clinical benefits, enhancing sales potential.

Market Penetration and Adoption Drivers

Key factors influencing adoption include:

- Efficacy and Safety Profile: Robust Phase III results demonstrating superior efficacy or fewer adverse events.

- Pricing Strategy: Competitive pricing aligned with value-based healthcare models.

- Physician and Patient Acceptance: Ease of administration, minimal side effects, and convenience.

- Distribution Channels: Broad access through established dermatology networks and specialty pharmacies.

Sales Projections

Initial Launch Phase (Years 1–2)

Sales are expected to commence modestly, primarily from early adopters in high-income regions such as North America and Western Europe. Initial forecasts suggest:

- Year 1: $50–$100 million

- Year 2: $200–$300 million

These figures depend heavily on regulatory approvals, clinical outcomes, and commercial readiness.

Growth Phase (Years 3–5)

Post-approval market expansion, driven by:

- Broadened indication approvals

- Increased market penetration

- Price optimization

Projected sales are:

- Year 3: $500 million to $1 billion

- Year 4: $1.2–$1.8 billion

- Year 5: Up to $2.5 billion

The overlap of expanding indications and ongoing geographic expansion is crucial at this stage.

Long-term Outlook (Years 6+)

Given the size of related markets and the trend towards personalized dermatology, ELIPHOS could capture a significant market share, potentially surpassing initial forecasts if it secures a leadership position. Sales could stabilize around $3–$4 billion annually in mature markets, subject to competitive responses and patent strength.

Market Risks and Challenges

- Regulatory Delays or Rejections: Any setbacks could defer revenue realization.

- Pricing Pressures: Payer resistance to high-cost biologics may limit penetration.

- Competitive Innovation: Next-generation therapies could erode market share.

- Unmet Needs: If ELIPHOS’s clinical benefits do not significantly outperform existing options, sales may be limited.

Strategic Recommendations

- Accelerate clinical development to establish robust efficacy and safety data.

- Engage early with payers for favorable reimbursement pathways.

- Develop strategic alliances to expand global footprint.

- Invest in physician education to facilitate adoption.

- Monitor competitive innovations continuously.

Key Takeaways

- ELIPHOS targets a lucrative, growing dermatological market with significant unmet needs.

- Its success depends on clear differentiation via clinical benefits and strategic market access.

- Initial sales projections are modest, with significant growth potential contingent on regulatory and commercial success.

- Effective positioning, pricing, and payer engagement are critical to maximizing revenue.

- Long-term, ELIPHOS could become a key player if it sustains competitive advantage and broad acceptance.

FAQs

1. What factors will influence ELIPHOS's market penetration?

Efficacy, safety profile, regulatory approvals, reimbursement strategies, physician acceptance, and competitive positioning.

2. How does ELIPHOS compare to existing therapies?

Potential advantages include improved safety, targeted mechanism, and convenience; however, detailed clinical data are required for definitive comparison.

3. When can we expect ELIPHOS to reach the market?

Assuming successful late-stage trials and regulatory approval, market entry could occur within 2-3 years, depending on approval timelines.

4. What is the revenue outlook for ELIPHOS in the next five years?

Projected sales range from $200 million in Year 2 to approximately $2.5 billion by Year 5, growth driven by clinical success and geographic expansion.

5. What are the primary risks to ELIPHOS’s commercial success?

Regulatory hurdles, adverse clinical trial results, payer resistance, intense competition, and rapid technological shifts in dermatology therapeutics.

References

- Market Research Future. "Global Dermatology Therapeutics Market Analysis." 2022.

More… ↓