Last updated: July 27, 2025

Introduction

Cefuroxime, a second-generation cephalosporin antibiotic, has established a critical role in combating bacterial infections, particularly respiratory tract infections, urinary tract infections, and skin infections. Its broad-spectrum activity, favorable pharmacokinetics, and safety profile contribute to a steady demand within the antibiotics market. As antibiotic resistance evolves and healthcare landscapes shift, understanding Cefuroxime’s market dynamics and future sales trajectories is vital for stakeholders across pharmaceutical manufacturing, distribution, and investment.

Market Overview

The global antibiotics market, estimated at approximately USD 52 billion in 2022, demonstrates consistent growth driven by increasing infectious disease prevalence, expanding healthcare infrastructure, and rising awareness regarding bacterial infections. Cefuroxime contributes a notable segment within this market, valued at an estimated USD 1.2 billion in 2022, with poised growth fueled by its efficacy and versatility.

Factors influencing Cefuroxime’s market include:

- Growing prevalence of respiratory and urinary tract infections

- Rising antibiotic prescription rates in emerging markets

- Implementations of antimicrobial stewardship programs potentially restraining overuse

- Competition from newer antibiotics and generics

- Rising antibiotic resistance concerns, prompting both opportunities for new formulations and challenges for existing therapies

Market Drivers

-

Epidemiology of Bacterial Infections

The World Health Organization (WHO) reports a high burden of bacterial respiratory infections, particularly in developing economies where access to healthcare is expanding. The rising incidence of community-acquired pneumonia and sinusitis boosts demand for Cefuroxime, especially in outpatient settings.

-

Antibiotic Prescription Trends

Physicians increasingly favor broad-spectrum antibiotics like Cefuroxime for empirical therapy, especially in regions with high bacterial resistance. Its oral and injectable forms provide flexible administration options, ensuring patient compliance and broad application.

-

Healthcare Infrastructure Expansion

Rapid healthcare infrastructure development in Asia-Pacific and Latin America directly correlates with increased antibiotic consumption, including Cefuroxime, in healthcare and outpatient sectors.

-

Generic Drug Availability

Several pharmaceutical companies produce generic Cefuroxime, facilitating price competition and accessibility, particularly in cost-sensitive markets.

Market Challenges

-

Antibiotic Resistance

Emerging resistance, notably against cephalosporins, limits Cefuroxime’s long-term effectiveness, necessitating continuous formulation innovations and stewardship programs.

-

Regulatory and Stewardship Policies

Stringent regulations and initiatives aimed at curbing antibiotic misuse can hinder market growth, especially in developed nations.

-

Competition from Newer Agents

Novel antibiotics with activity against resistant strains are increasingly replacing older cephalosporins, impacting Cefuroxime’s market share.

-

Market Saturation in Developed Countries

Mature markets exhibit slower growth due to established prescribing patterns and antibiotic stewardship efforts.

Regional Market Insights

-

North America

Dominates with a market share estimated at 35%, driven by high healthcare expenditure, comprehensive diagnostic facilities, and antibiotic prescribing practices. Growth remains stable, with mild expansion expected.

-

Europe

Accounts for approximately 28% of the global Cefuroxime market, with a focus on outpatient treatment and hospital usage. Antibiotic stewardship policies may temper growth but ensure steady demand.

-

Asia-Pacific

The fastest-growing region, with CAGR estimates around 6-8% (2022–2027). Factors include expanding healthcare access, rising bacterial infection rates, and increasing adoption of antibiotics in outpatient care.

-

Latin America and Middle East & Africa

Show promising growth potential with CAGR estimates of 5-7%, driven by improving healthcare infrastructure and increasing awareness.

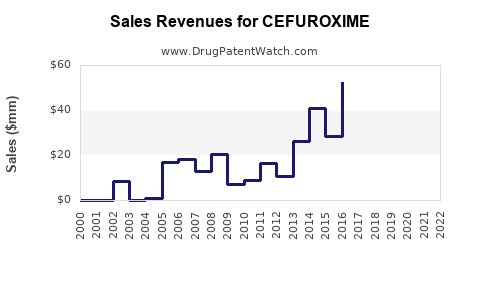

Sales Projections (2023–2028)

Based on current trends, market drivers, and regional dynamics, Cefuroxime's sales are projected to grow robustly over the next five years:

| Year |

Estimated Global Sales (USD billion) |

Growth Rate |

| 2023 |

1.33 |

— |

| 2024 |

1.45 |

9.0% |

| 2025 |

1.58 |

9.0% |

| 2026 |

1.73 |

9.5% |

| 2027 |

1.88 |

8.7% |

| 2028 |

2.05 |

9.0% |

The CAGR for Cefuroxime sales over this period is estimated at approximately 8.8%. Growth will be primarily driven by Asia-Pacific, with emerging markets expanding their healthcare capacities and antibiotic utilization.

Key Factors Impacting Sales Growth

- Emerging Market Penetration: Increased access to antibiotics and rising bacterial infection rates will accelerate demand.

- Formulation Innovation: Development of more convenient formulations (e.g., extended-release, combination therapies) will sustain physician and patient interest.

- Antimicrobial Stewardship: While potentially limiting overprescription, stewardship initiatives push for targeted and appropriate Cefuroxime use, possibly constraining volume growth but ensuring sustained demand.

- Resistance Management: The emergence of resistant strains could provoke the need for formulations with broader spectra, indirectly impacting Cefuroxime sales positively or negatively depending on efficacy.

Competitive Landscape

The competitive environment comprises global pharmaceutical giants like GlaxoSmithKline, Novartis, and Teva, alongside numerous regional manufacturers offering generic versions. Patent expirations and cost pressures favor generic proliferation, but innovation in formulations and combination therapies remain strategic priorities.

Differentiators for market success include:

- Price competitiveness

- Bioavailability and pharmacokinetics

- Spectrum of activity for resistant strains

- Ease of administration

Conclusion

Cefuroxime maintains relevance within the antibiotics market owing to its established efficacy, safety, and versatility. Future growth hinges on regional expansion, formulation innovations, and effective stewardship policies. While resistance and regulatory environments present challenges, strategic positioning in emerging markets and diversified offerings can sustain sales momentum.

Key Takeaways

- Steady Market Growth: Cefuroxime’s global sales are projected to grow at an approximately 8.8% CAGR from 2023 to 2028, reaching around USD 2.05 billion.

- Regional Drivers: Asia-Pacific's rapid healthcare expansion and rising bacterial infections will dominate growth, followed by North America and Europe’s stable markets.

- Market Challenges: Resistance development, regulatory restrictions, and competition from newer antibiotics require strategic responses, including innovation and stewardship.

- Opportunities: Formulation improvements, combination therapies, and expanding access in emerging economies present significant growth avenues.

- Strategic Focus: Companies investing in cost-effective production, resistance management, and targeted therapies will enhance competitive positioning.

FAQs

1. How does antibiotic resistance impact Cefuroxime sales?

Rising resistance reduces Cefuroxime's clinical efficacy against certain bacteria, which can diminish prescribing rates. Conversely, resistance issues may also stimulate demand for newer formulations or combination therapies, balancing short-term declines with long-term innovations.

2. What are key regional growth areas for Cefuroxime?

Emerging markets in Asia-Pacific, Latin America, and Africa offer substantial growth opportunities due to expanding healthcare infrastructure, higher infection prevalence, and increased antibiotic access.

3. How do regulatory policies influence Cefuroxime market projections?

Stringent regulatory environments and antimicrobial stewardship initiatives can limit overprescription, potentially slowing volume growth but promoting targeted use, which may sustain pricing and profitability.

4. What innovation strategies are expected to drive Cefuroxime's future sales?

Developing novel formulations with extended release, improved bioavailability, and combination therapies targeting resistant bacteria can differentiate products and open new market segments.

5. How significant is the market share of generic Cefuroxime?

Generics account for a majority of Cefuroxime sales due to cost advantages. Their role in expanding access, especially in low- and middle-income countries, makes them pivotal in overall market growth.

Sources:

[1] Global Market Insights. Antibiotics Market Analysis, 2022.

[2] WHO. Global Burden of Bacterial Infections, 2021.

[3] IQVIA. Healthcare Data and Prescribing Trends, 2022.

[4] Frost & Sullivan. Regional Pharmaceuticals Market Reports, 2022.

[5] Clinical Pharmacology. Cefuroxime Pharmacokinetics and Resistance Data, 2021.