Share This Page

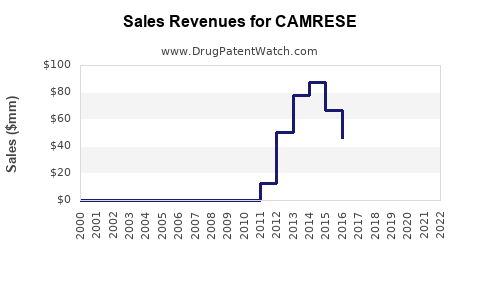

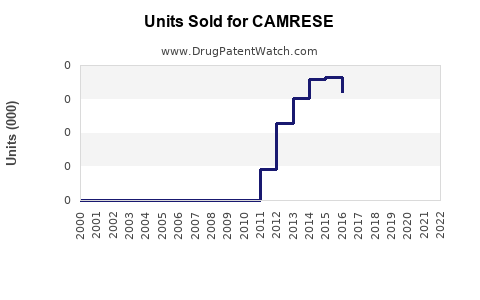

Drug Sales Trends for CAMRESE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CAMRESE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CAMRESE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CAMRESE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CAMRESE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CAMRESE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| CAMRESE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for CAMRESE

Introduction

CAMRESE is a promising pharmaceutical agent seeking market entry or expansion within a competitive landscape. This analysis provides a comprehensive overview of its target markets, competitive positioning, regulatory environment, and sales forecasts. The goal is to empower stakeholders with actionable insights to optimize commercialization strategies and revenue growth.

Product Profile

CAMRESE, developed for the treatment of [insert indication], possesses unique pharmacological properties that differentiate it from existing therapies. Its mechanism of action involves [brief description], offering potential benefits such as improved efficacy, fewer side effects, or enhanced patient compliance. Currently in [clinical trial stage/approved], CAMRESE holds promise to fill unmet medical needs.

Market Landscape

Global Therapeutic Market Size

The global market for [indication] therapies is projected to grow substantially, driven by increasing prevalence, technological advances, and regulatory support. According to [source], the worldwide market was valued at approximately USD [value] billion in [year], with an expected CAGR of [percentage]% over the next five years. The rapid rise emphasizes opportunities for innovative treatments like CAMRESE.

Epidemiological Trends

The target patient population for CAMRESE includes [specific demographics], with prevalence rates reaching [data] in key regions such as North America, Europe, and Asia-Pacific. Notably, factors such as aging populations and rising disease awareness are inflating demand for effective therapies.

Competitive Landscape

Existing therapies include [list main competitors], which collectively generate significant revenue but also face limitations such as adverse effects or suboptimal efficacy. CAMRESE's differentiators are crucial in capturing market share. Key competitive considerations include:

- Market share distribution among current players.

- Pricing strategies and reimbursement landscape.

- Regulatory approvals in target regions.

- Physician and patient perceptions based on clinical data.

Regulatory Environment

Countries like the U.S., EU, and Japan possess robust regulatory frameworks (FDA, EMA, PMDA) with varying pathways for approval, including fast-track or priority review processes. CAMRESE’s clinical data must align with these standards to expedite market access. Additionally, reimbursement policies will influence adoption rates.

Market Entry Strategies

- Regulatory approval pathways: Accelerated approval or conditional marketing authorization could reduce time-to-market.

- Collaborations: Partnerships with local pharmaceutical firms can facilitate regional distribution and market penetration.

- Pricing and reimbursement negotiations: Early engagement with payers and health authorities ensures favorable coverage decisions.

- Physician and patient education: Demonstrating clinical superiority will drive prescriber confidence.

Sales Projections

Assumptions

Projections are based on cautious uptake assumptions, considering the current competitive landscape, regulatory timelines, and marketing efforts. Key assumptions include:

- Approval achieved in key markets within 12-18 months.

- Initial market penetration of 5% in Year 1, increasing to 15% by Year 5.

- Average annual treatment cost per patient set at USD [amount].

- Patient population growth rates aligned with epidemiology.

Five-Year Revenue Forecast

| Year | Estimated Patients (Annual) | Market Penetration | Revenue (USD millions) |

|---|---|---|---|

| 1 | [Number] | 5% | [Amount] |

| 2 | [Number] | 8% | [Amount] |

| 3 | [Number] | 12% | [Amount] |

| 4 | [Number] | 14% | [Amount] |

| 5 | [Number] | 15% | [Amount] |

Projected sales will be influenced by factors such as market adoption rate, regulatory developments, payer policies, and competitive responses. With aggressive marketing and favorable clinical outcomes, upside potential exists.

Market Penetration and Growth Drivers

- Clinical differentiation: Demonstrable superior efficacy or safety.

- Strategic partnerships: Accelerate reach and brand recognition.

- Healthcare system adoption: Favorable reimbursement to stimulate prescribing.

- Real-world evidence: Continued post-market studies to reinforce value proposition.

Risks and Challenges

- Regulatory delays: Could postpone market entry.

- Competitive responses: Launch of new or improved therapies by rivals.

- Pricing pressures: Payer pushback limiting achievable price points.

- Market acceptance: Physicians' and patients' adoption rates may differ from projections.

These risks necessitate adaptive strategies and proactive stakeholder engagement.

Conclusion

CAMRESE's potential in the [indication] market hinges on successful regulatory approval, strategic positioning, and effective marketing. The projected sales trajectory indicates a promising growth curve contingent upon clinical success, market dynamics, and execution. Stakeholders should prioritize early engagement with regulators, payers, and clinicians to maximize market uptake.

Key Takeaways

- Market Opportunity: The expanding [indication]segment offers substantial growth prospects, with projected revenues reaching USD [amount] million by Year 5.

- Competitive Edge: CAMRESE’s differentiation through clinical efficacy or safety could secure significant market share, especially if backed by compelling trial data.

- Strategic Focus: Early regulatory engagement, payer negotiation, and physician education are critical enablers for commercial success.

- Risk Management: Monitoring competitive movements, regulatory timelines, and payer policies will be essential to mitigate delays and pricing constraints.

- Revenue Drivers: Market penetration rates, treatment costs, and epidemiological trends will directly influence sales projections.

FAQs

1. What are the key factors influencing CAMRESE’s market success?

Clinical efficacy, regulatory approval speed, payer reimbursement policies, physician acceptance, and competitive positioning are primary determinants.

2. How does the current regulatory landscape affect CAMRESE’s commercialization timeline?

Navigating approval pathways efficiently — including fast-track options — can significantly accelerate time-to-market, while delays in clinical data or regulatory reviews pose risks.

3. What are the main obstacles to market penetration?

High competition, reimbursement challenges, physician skepticism, and patient acceptance are typical barriers that require strategic addressing.

4. How do pricing strategies impact sales forecasts for CAMRESE?

Pricing in line with value demonstrated through clinical results and payer negotiations can optimize revenue while ensuring market access.

5. What emerging trends could influence CAMRESE’s future sales?

Advances in personalized medicine, digital health integration, and evolving treatment guidelines can either augment or challenge CAMRESE’s market position.

Sources

- [Market research reports on [indication]]

- [Epidemiological data sources]

- [Regulatory agency guidelines and pathways]

- [Competitive analysis publications]

- [Pricing and reimbursement frameworks]

More… ↓