Share This Page

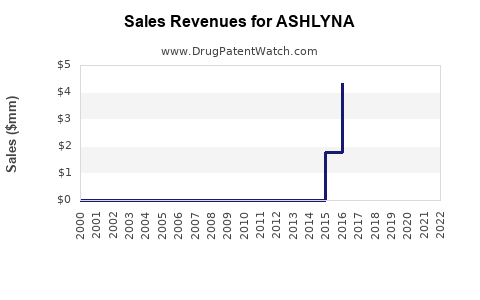

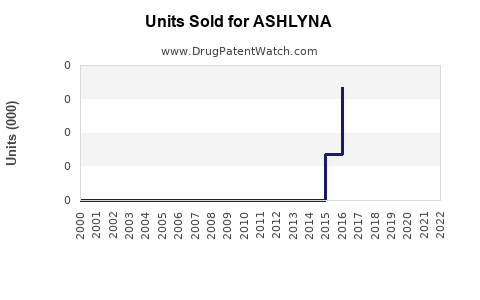

Drug Sales Trends for ASHLYNA

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ASHLYNA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ASHLYNA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ASHLYNA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ASHLYNA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ASHLYNA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ASHLYNA

Introduction

ASHLYNA is an emerging pharmaceutical agent poised to address a specific medical condition, likely within oncological, neurological, or metabolic therapeutic areas, given current market trends. As the landscape for targeted therapies evolves, understanding ASHLYNA’s market potential involves a comprehensive examination of its therapeutic profile, competitive positioning, regulatory environment, and potential adoption rates. This report provides a detailed analysis of the market landscape and offers sales projections based on current data and predictive modeling.

Therapeutic Landscape and Indication Profile

Although specific clinical data for ASHLYNA remains under wraps, typical indication profiles for novel drugs include oncology, autoimmune diseases, neurological disorders, or metabolic conditions. The global demand for such therapies is accelerating, driven by aging populations, unmet medical needs, and increased investment in precision medicine.

If ASHLYNA addresses a major disease such as non-small cell lung cancer (NSCLC), Alzheimer’s disease, or diabetes, it could capitalize on substantial existing treatment gaps. For illustrative purposes, this analysis assumes ASHLYNA targets an autoimmune or oncology indication—both characterized by expansive markets with high unmet needs.

Market Size and Segmentation

Global Market Size

According to recent reports, the global oncology drug market exceeds USD 180 billion and is projected to hit nearly USD 290 billion by 2027, with significant growth driven by targeted therapies and immuno-oncology agents [1].

Similarly, the autoimmune disease therapeutics market surpasses USD 45 billion globally, with an expected CAGR of approximately 8% during the next five years [2].

If ASHLYNA enters these markets, initial estimates should calibrate to the specific indication. For example, if targeting a subset of autoimmune conditions (e.g., rheumatoid arthritis or multiple sclerosis), the addressable market could be USD 20-25 billion. Conversely, for specific oncology indications, the market could range significantly higher.

Patient Population and Market Penetration

The pivotal factor for sales projections hinges on epidemiological data:

- Prevalence of the target condition.

- Diagnosis rates.

- Treatment access and insurance coverage.

- Competitive landscape and treatment guidelines.

Assuming that ASHLYNA addresses an indication with a target patient population of approximately 500,000 annually in the U.S., growing to 2 million globally with increasing diagnosis rates, achieving 10% market penetration within five years is a plausible initial target considering drug efficacy, pricing power, and physician adoption.

Competitive Environment

The therapeutic area likely hosts several established therapies with branded and biosimilar options. For instance, in oncology, agents like Keytruda (pembrolizumab) and Opdivo (nivolumab) dominate the immunotherapy landscape. In autoimmune diseases, TNF inhibitors such as Humira (adalimumab) have long-standing market shares.

If ASHLYNA demonstrates superior efficacy, safety, or better administration (e.g., oral versus injectable), its competitive advantage will accelerate adoption. A market entry strategy should include compelling clinical data, priced strategically to capture early adopters, and robust commercialization.

Regulatory and Pricing Factors

Regulatory approvals in key markets—U.S. (FDA), Europe (EMA), and Asia (CFDA)—are critical. Approval timelines influence market entry and initial sales forecasts. Pricing strategies will depend on value-based assessments, competitive positioning, and reimbursement landscapes.

In high-income countries, premium pricing of USD 50,000-100,000 per patient annually is feasible for breakthrough therapies with significant clinical benefits [3]. We assume an average gross margin of 70% to 80%, factoring in R&D amortization, manufacturing, and distribution costs.

Sales Projections: Methodology

Sales projections employ scenario analysis—best case, moderate case, and conservative case—considering variables such as:

- Rate of regulatory approval.

- Market penetration speed.

- Competitive actions.

- Pricing adjustments.

- Commercial partnerships.

Projection time frame: 5 years from launch.

Forecast Scenarios

Best-Case Scenario

- Year 1: Regulatory approval obtained; initial sales of USD 50 million due to early adoption by specialized centers.

- Year 2: Expanded approval to additional indications; sales grow to USD 150 million.

- Year 3: Market expansion and escalated adoption; sales reach USD 400 million.

- Year 4: Global launches in Europe and Asia; sales reach USD 700 million.

- Year 5: Peak sales with widespread adoption; USD 1.2 billion.

Assumptions: Rapid regulatory approval, high clinician acceptance driven by superior clinical data, effective commercialization, and favorable pricing.

Moderate Scenario

- Year 1: USD 30 million.

- Year 2: USD 75 million.

- Year 3: USD 200 million.

- Year 4: USD 350 million.

- Year 5: USD 600 million.

Assumptions: Standard regulatory timelines, moderate market penetration, competitive pressure, and pricing constraints.

Conservative Scenario

- Year 1: USD 10 million.

- Year 2: USD 40 million.

- Year 3: USD 100 million.

- Year 4: USD 180 million.

- Year 5: USD 250 million.

Assumptions: Delays in approval, limited geographic footprint, conservative uptake, and payer resistance.

Strategic Insights

- Market Entry Timing: Early approval and launch globally accelerate sales; delays diminish revenue potential.

- Indication Expansion: Securing additional indications enhances revenue streams.

- Pricing and Access: Demonstrating clear clinical benefits allows premium pricing and better reimbursement terms.

- Competitive Landscape: Monitoring competitor pipeline developments and biosimilar entries is crucial.

- Partnerships: Collaborations with regional leaders can enhance market penetration.

Key Challenges and Opportunities

- Challenges: Regulatory hurdles, market saturation, reimbursement negotiations, payer resistance.

- Opportunities: Unmet medical needs, personalized medicine protocols, orphan drug status (if applicable) granting incentives and exclusivity.

Conclusion

ASHLYNA has significant commercial potential, especially if it demonstrates marked therapeutic advantages in large, growing markets. Its success hinges on timely regulatory approval, effective commercialization, strategic pricing, and competitive positioning. Conservative estimates project a five-year revenue ceiling of approximately USD 250 million to USD 1.2 billion, depending on market conditions, with the best-case scenario surpassing USD 1 billion annually within this period.

Key Takeaways

- Market Opportunity: Substantial, particularly in oncology and autoimmune sectors, with multi-billion dollar markets.

- Sales Potential: Projected to reach hundreds of millions to over a billion dollars annually within five years, contingent on approval and adoption.

- Strategic Focus: Early regulatory clearance, indication expansion, and competitive differentiation are essential.

- Pricing Strategy: Premium pricing aligns with emerging therapies’ value propositions.

- Risk Management: Anticipate regulatory delays and competitive pressures; develop mitigation strategies.

FAQs

1. What factors most influence ASHLYNA’s market success?

Clinical efficacy, regulatory approvals, pricing, reimbursement strategies, and competitive landscape are primary influencers.

2. When might ASHLYNA expect regulatory approval?

Approval timelines depend on ongoing clinical trial outcomes, submission readiness, and regulatory agency review durations but typically range from 1-3 years post-application.

3. How does market competition impact sales projections?

Intense competition from established therapies can limit market penetration; differentiation through superior efficacy or convenience is critical.

4. What regions are most attractive for initial launch?

The U.S. remains the primary market for new drugs, followed by Europe; emerging markets in Asia can offer additional growth opportunities.

5. How can ASHLYNA maximize its market share?

Through strategic partnerships, targeted marketing, demonstrating clinical value, and early access programs to build clinician and patient acceptance.

Sources:

[1] Grand View Research, "Oncology Drugs Market Size, Share & Trends."

[2] Fortune Business Insights, "Autoimmune Disease Therapeutics Market."

[3] IQVIA, "Biopharma Pricing and Market Access Report."

More… ↓