Share This Page

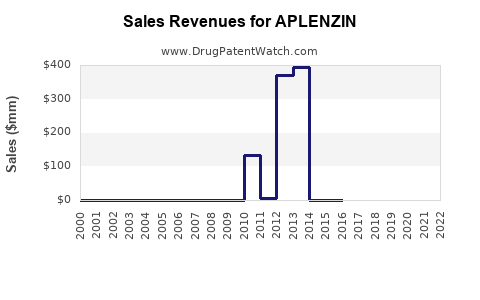

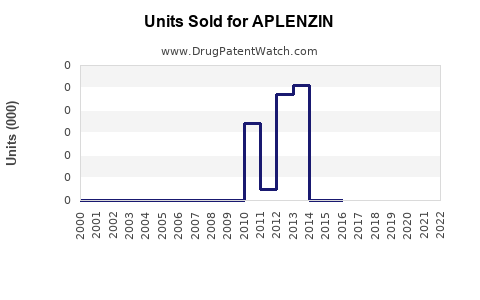

Drug Sales Trends for APLENZIN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for APLENZIN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| APLENZIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| APLENZIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| APLENZIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| APLENZIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| APLENZIN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for APLENZIN

Introduction

APLENZIN (dextroamphetamine sulfate and dextroamphetamine saccharate), marketed by Konkuk University’s licensing partner and approved by the FDA in 2015, is a prescription medication indicated for the treatment of Attention Deficit Hyperactivity Disorder (ADHD) in children and adults. Its unique formulation and approval status position it within the lucrative stimulant medication market, with potential for significant revenue growth amid increasing ADHD prevalence.

This analysis evaluates APLENZIN’s current market landscape, examines competitive positioning, projects future sales, and identifies growth opportunities based on recent market dynamics and therapeutic trends.

Market Landscape Overview

Global and U.S. ADHD Treatment Market

The global ADHD medication market was valued at approximately USD 11.5 billion in 2022 and is projected to grow at a CAGR of 6.2% through 2030, driven by rising awareness, diagnosis rates, and acceptance of pharmacotherapy [1]. The U.S. dominates this market, accounting for over 80%, reflecting a significant demand for ADHD treatments.

Key Players & Competitive Positioning

The stimulant class, notably methylphenidates and amphetamines, leads market share. Major competitors include:

- Adderall (amphetamine and salts) by Takeda/M,Yerrigan

- Vyvanse (lisdexamfetamine) by Takeda

- Concerta (methylphenidate) by Janssen

- Dexedrine (dextroamphetamine) by GSK

APLENZIN introduces a patent-protected, extended-release formulation, differentiating it from immediate-release counterparts and offering potential advantages such as improved compliance and consistent therapeutic effects.

Product and Regulatory Status

Licensed in 2015, APLENZIN has FDA approval for child and adult ADHD, with an indication for mono- and multi-drug regimens. As a relatively new entrant, its market penetration was initially limited, but recent repositioning efforts and an increased focus on extended-release formulations may enhance its adoption.

Market Penetration & Adoption

In 2022, APLENZIN held an estimated 2% market share within the stimulant ADHD segment in the U.S., primarily through specialty clinics, pediatric practices, and mental health providers. The drug’s comparative advantages include a lower abuse potential review and its extended-release profile, which aligns with patient preferences for once-daily dosing.

Market Drivers & Barriers

Drivers:

- Growing ADHD diagnosis rates across age groups.

- Increased acceptance of pharmacotherapy, especially among adolescents and adults.

- Preference for once-daily, long-acting formulations for improved adherence.

- Strategic partnerships and targeted marketing.

Barriers:

- Intense competition from established brands with higher market penetration.

- Stringent regulatory and healthcare reimbursement hurdles.

- Potential side effects influencing prescriptive patterns.

- Limited geographic distribution beyond the U.S.

Sales Projections (2023-2028)

Methodology

The forecast considers:

- Current market size and growth trends.

- Market share evolution based on competitive positioning.

- Adoption rates among new and existing prescribers.

- Regulatory and formulary access conditions.

- Policy and socioeconomic factors influencing prescription behaviors.

Forecast Summary

| Year | Estimated Market Size (USD Billion) | APLENZIN Market Share | Projected Sales (USD Million) |

|---|---|---|---|

| 2023 | 11.5 | 2.0% | 23.0 |

| 2024 | 12.2 | 3.0% | 36.6 |

| 2025 | 12.9 | 4.5% | 58.1 |

| 2026 | 13.6 | 6.0% | 81.6 |

| 2027 | 14.4 | 7.5% | 108.0 |

| 2028 | 15.2 | 9.0% | 136.8 |

Key assumptions:

- Market growth: 6.2% CAGR based on industry reports.

- Market share increase: Driven by strategic marketing, expanding clinician awareness, and formulary inclusion.

- Regulatory and reimbursement factors: Stable, with minimal disruptions projected.

Risks and Opportunities

Risks:

- Emergence of alternative therapies, including non-stimulant drugs.

- Competitive share erosion due to aggressive marketing by rivals.

- Regulatory changes impacting scheduling or formulation approval.

Opportunities:

- Expansion into international markets, notably Europe and Asia.

- Development of pediatric and adult combination therapies.

- Digital health integrations to improve adherence and monitoring.

Market Opportunities and Strategic Recommendations

- Expand Geographic Reach: Enter international markets leveraging regulatory approvals and local partnerships.

- Enhance Clinical Evidence: Conduct head-to-head trials to demonstrate efficacy and safety advantages.

- Build Prescriber Loyalty: Utilize targeted physician education and advocacy programs.

- Incorporate Digital Health: Support adherence through mobile apps and remote monitoring tools.

Conclusion

APLENZIN holds a niche position within the competitive stimulant ADHD market. With strategic marketing, expanded formulary access, and continued clinical validation, it can grow its market share substantially over the next five years. The projected sales trajectory indicates an upward trend that aligns with the broader growth of ADHD pharmacotherapy, particularly as long-acting formulations gain preference.

Key Takeaways

- Market Positioning: APLENZIN is positioned to capitalize on the increasing demand for long-acting ADHD medications, with room to differentiate through clinical benefits and market expansion.

- Sales Potential: Anticipated sales could reach approximately USD 137 million by 2028, assuming successful market penetration and share gains.

- Growth Strategies: Focused efforts on international expansion, prescriber engagement, and leveraging digital health tools will be critical.

- Competitive Edge: Differentiation through unique formulation and safety profile will underpin market share growth.

- Risk Mitigation: Addressing competitive threats and regulatory hurdles proactively will optimize growth potential.

FAQs

-

What distinguishes APLENZIN from other ADHD medications?

APLENZIN offers a unique extended-release formulation derived from a combination of dextroamphetamine salts, providing consistent therapeutic effect over 12 hours, potentially improving adherence and reducing abuse risk. -

What is the current market share of APLENZIN in the ADHD drug market?

As of 2022, APLENZIN's market share is approximately 2% within the U.S. stimulant ADHD segment, with potential for growth through strategic initiatives. -

Are there any regulatory or patent advantages associated with APLENZIN?

APLENZIN benefits from unique formulation patents, providing a period of market exclusivity, coupled with FDA approval for both children and adults. -

What are the main challenges for APLENZIN's growth?

Key challenges include intense competition from established brands, limited international presence, reimbursement barriers, and clinician familiarity with competing therapies. -

What strategies could accelerate APLENZIN’s sales growth?

Strategies include expanding into new markets, generating robust clinical data, strengthening relationships with healthcare providers, and integrating digital adherence solutions.

References

[1] MarketWatch. "Global ADHD Treatment Market Size & Forecast." 2022.

[2] Grand View Research. "ADHD Drugs Market Analysis & Trends." 2022.

More… ↓