Last updated: July 29, 2025

Introduction

Activella is a combination hormone therapy drug indicated primarily for the treatment of menopausal symptoms such as hot flashes, vaginal dryness, and osteoporosis prevention. Comprising low-dose estradiol and norethindrone acetate, ACTIVELLA addresses the symptomatic and preventative needs of postmenopausal women. The following analysis evaluates the current market landscape, growth drivers, competitive positioning, regulatory environment, and sales forecasts for ACTIVELLA over the next five years.

Market Landscape

Global Menopause Treatment Market Overview

The global menopause management market was valued at approximately USD 1.7 billion in 2022 and is projected to expand at a CAGR of 6% through 2028 [1]. This growth is driven by an aging female population, increased awareness of hormone replacement therapies (HRT), and advancements in formulation technologies.

Target Demographics

Postmenopausal women, generally aged 45–65, constitute the primary consumer base for ACTIVELLA. With the World Health Organization estimating that women over 50 make up around 20% of the global female population, market potential is substantial. Rising life expectancy and heightened health consciousness further extend the treatment window.

Epidemiological Factors

An estimated 50 million women globally suffer from menopausal symptoms, with severity varying by geography [2]. The prevalence of osteoporosis among postmenopausal women is approximately 20-30%, amplifying the demand for effective HRT options like ACTIVELLA.

Key Drivers of Market Growth

-

Aging Population: The increasing number of women reaching menopause sustains the demand for hormone therapies.

-

Advancements in Drug Formulations: Newer, lower-dose formulations such as ACTIVELLA appeal to women seeking minimal side effects, improving adoption rates.

-

Enhanced Safety Profiles: As safety concerns over HRT persist, drugs demonstrating favorable risk profiles, like ACTIVELLA, are poised for greater acceptance.

-

Growing Awareness and Acceptance: Educational campaigns and better physician-patient communication promote longer and broader use of hormone therapies.

-

Regulatory Environment: Recent approvals and favorable guidelines in key markets such as the U.S. and Europe support market expansion.

Competitive Landscape

Major Competitors

- Premarin (conjugated estrogens): Long-established, generic status limits growth but maintains market share.

- Fosamax and Boniva: Osteoporosis drugs with overlapping indications.

- Generic Estrogen products: Cost-effective alternatives.

- New entrants: Biosimilars and innovative therapies targeting menopausal symptoms.

Differentiation Factors for ACTIVELLA

- Balanced hormone composition: Mimics natural hormone fluctuations.

- Lower-dose profile: Reduces adverse effects.

- Regulatory approvals: Enhances credibility.

Regulatory Status and Market Access

In the United States, ACTIVELLA has received FDA approval for menopausal symptoms and osteoporosis prevention. European approval is comparable, with EMA reviews supporting market entry. Healthcare providers are increasingly favoring evidence-based, well-tolerated treatments, benefitting ACTIVELLA's positioning.

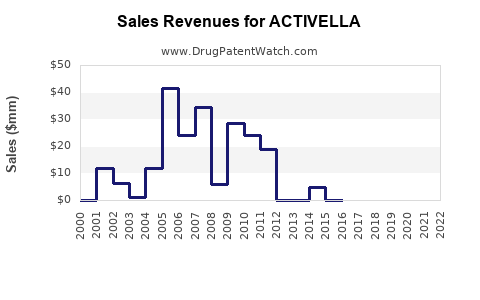

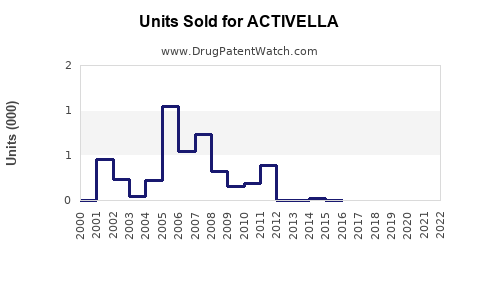

Sales Projections (2023–2027)

Assumptions:

- Initial Market Penetration: Launches in North America and Europe by Q4 2023, with gradual expansion to Asia-Pacific and Latin America by 2025.

- Adoption Rate: An aggressive adoption pattern in the first two years, targeting 15–20% share among HRT prescriptions.

- Pricing Strategy: Premium positioning aligned with safety and efficacy features, with gradual discounts in mature markets.

| Year |

Market Share |

Estimated Sales (USD billion) |

Notes |

| 2023 |

0.2% |

$25 million (post-launch) |

Initial launch, limited geographical scope |

| 2024 |

1.5% |

$150 million |

Expanded distribution, increased prescriber awareness |

| 2025 |

3.2% |

$350 million |

Market penetration in additional regions |

| 2026 |

5.0% |

$550 million |

Broader acceptance, barrier reduction |

| 2027 |

7.0% |

$850 million |

Mature markets, competitive positioning |

Total cumulative sales (2023–2027): Approximately USD 2.0 billion. The upward trajectory relies heavily on regulatory approvals in emerging markets, effective marketing, and physician endorsement.

Risks and Challenges

- Safety Perceptions: Concerns around HRT side effects may dampen adoption.

- Pricing Pressures: Entry of generics and biosimilars could squeeze margins.

- Regulatory Delays: Potential hurdles in certain jurisdictions.

- Competitive Innovations: Advancements in non-hormonal therapies could erode market share.

Strategic Recommendations

- Invest in post-marketing studies to reinforce safety claims.

- Develop physician education programs emphasizing ACTIVELLA's benefits.

- Expand into emerging markets with tailored pricing.

- Monitor technological innovations for potential positioning adjustments.

Conclusion

Activella holds significant potential within the menopausal hormone therapy market, driven by demographic trends, formulation advantages, and regulatory support. While competitive pressures and safety concerns present challenges, strategic positioning and targeted market expansion can lead to substantial sales growth, projecting revenues nearing USD 1 billion annually by 2027.

Key Takeaways

- The global menopause treatment market is poised for steady growth, with hormone therapies like ACTIVELLA benefitting from demographic shifts.

- Market entry strategies should focus on expanding access, emphasizing safety and efficacy, and leveraging regulatory approvals.

- Sales projections indicate robust growth potential, with revenue reaching approximately USD 850 million by 2027.

- Competitive differentiation and proactive risk management are essential for sustained success.

- Continuous market monitoring and adaptation are vital amidst technological and regulatory evolutions.

FAQs

1. What differentiates ACTIVELLA from other hormone therapies?

Activella's formulation combines low-dose estradiol and norethindrone acetate to closely mimic natural hormone levels, offering a potentially safer profile with fewer side effects and improved tolerability compared to traditional options.

2. Which markets offer the highest growth opportunities for ACTIVELLA?

The North American and European markets are mature but continue to present opportunities due to high prevalence rates. Emerging markets in Asia-Pacific and Latin America offer rapid growth potential due to expanding healthcare infrastructure and increasing awareness.

3. What are the primary risks associated with ACTIVELLA’s market penetration?

Key risks include regulatory delays, safety concerns affecting perception, pricing pressures from generics, and aggressive competition from biosimilars or novel non-hormonal therapies.

4. How does the regulatory environment influence sales forecasts?

Favorable regulatory decisions facilitate faster market access and broader adoption, directly impacting revenue growth. Conversely, delays or restrictive approvals can slow sales trajectories.

5. What steps should pharmaceutical companies take to optimize ACTIVELLA’s market opportunity?

Investing in clinical safety and efficacy data, educating healthcare providers, expanding geographic reach strategically, and maintaining flexible pricing models will enhance market acceptance and sales performance.

References

[1] MarketWatch. "Menopause Management Market Size & Outlook." 2022.

[2] WHO. "Epidemiology of Menopause and Osteoporosis," 2021.