Share This Page

Drug Sales Trends for ABREVA

✉ Email this page to a colleague

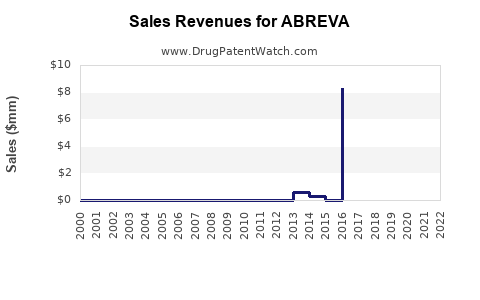

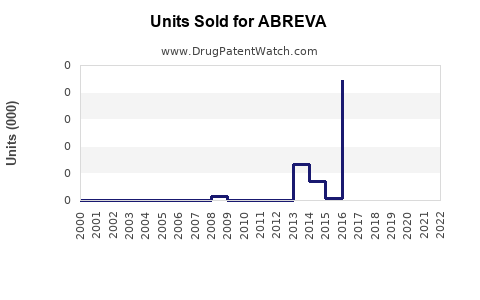

Annual Sales Revenues and Units Sold for ABREVA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ABREVA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ABREVA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ABREVA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ABREVA: A Comprehensive Overview

Introduction

ABREVA, a topical over-the-counter (OTC) medication containing docosanol 10%, is widely recognized for its efficacy in treating cold sores caused by herpes simplex virus type 1 (HSV-1). Since its FDA approval in 2000, ABREVA has carved a significant niche in the herpes management segment. This analysis delves into current market dynamics, competitive landscape, prescribing trends, consumer behavior, and projected sales to inform stakeholders about its future commercial trajectory.

Market Landscape and Key Drivers

Global Cold Sore Treatment Market

The global cold sore treatment market, estimated to be valued at approximately USD 400 million in 2022, underscores the substantial demand for effective OTC solutions like ABREVA. The growth rate (CAGR of roughly 4-6%) is driven by rising HSV-1 prevalence, increased awareness, and a preference for self-medication (Grand View Research, 2022).

Prevalence and Consumer Demographics

HSV-1 infection globally affects over 3.7 billion people under age 50, with a significant subset experiencing recurrent cold sores. The adult population, especially those aged between 20-40, represents a primary consumer base. This demographic's inclination toward OTC products for rapid symptom relief propels ABREVA’s sales.

Regulatory and Market Access Factors

OTC status in North America and Europe facilitates broad availability, fostering high consumer accessibility. Regulatory environments favoring OTC medication expansion suggest potential increased sales, especially if ABREVA maintains or increases its market share.

Competitive Landscape

Major Competitors

- Abreva (Brand): Market leader, with strong brand recognition and positioning.

- Generic Docosanol Products: Increasing presence dilutes market share, often at lower price points.

- Other OTC Treatments: Including creams with acyclovir, lidocaine, or herbal remedies, which vary in efficacy.

Market Positioning and Brand Loyalty

ABREVA's proven efficacy and FDA approval foster consumer trust. Brand loyalty and marketing campaigns further solidify its dominant position. However, emerging generics, driven by patent expirations and manufacturing cost advantages, pose a competitive threat.

Sales Drivers and Constraints

Key Drivers

- Consumer Awareness: Ongoing marketing boosts product visibility.

- Effectiveness: Faster relief and shorter lesion duration are appealing benefits.

- Distribution Channels: Extensive pharmacy chain presence, online retail, and health stores increase accessibility.

Constraints

- Pricing: Premium pricing compared to generics impacts affordability.

- Market Saturation: Penetration plateauing in mature markets.

- Consumer Preference: Shift toward natural or home remedies in certain demographics.

Sales Projections

Methodology

Forecasting involves analyzing historical sales data, market growth trends, demographic shifts, and competitive dynamics. Assumptions include stable market growth at 4-6% annually, sustained consumer awareness campaigns, and moderate erosion of premium pricing due to generics.

Short-term Outlook (Next 3 Years)

- 2023-2025: Sales are projected to grow at 5% CAGR, driven by expanding awareness and increased OTC distribution. Estimated global sales reach approximately USD 80-100 million by 2025.

- Regional Variations: North America remains dominant, contributing about 65% of total sales, with Europe and Asia-Pacific showing resilience, especially in urban areas.

Medium to Long-term Potential (Next 5-10 Years)

- Market Penetration: Incremental gains in emerging markets with improving healthcare infrastructure.

- Product Innovation: Introduction of combination therapies or formulations with faster action may bolster sales.

- Generic Competition: Growth in generics could suppress average selling prices by 10-15%, balancing volume increases.

Sales Outlook Summary

| Year | Estimated Global Sales (USD Millions) | Remarks |

|---|---|---|

| 2023 | 85 | Continued marketing and awareness |

| 2024 | 90 | Increasing generic competition |

| 2025 | 100 | Market saturation in mature regions |

| 2027 | 110 - 120 | Market expansion in Asia-Pacific |

| 2030 | 130 - 150 | Potential regulatory changes or new formulations |

Opportunities and Risks

Opportunities

- Product Lifecycle Extensions: Reformulations, new indications, or combination therapies.

- Market Expansion: Targeting developing nations with improving OTC channels.

- Digital Marketing: Leveraging online platforms for targeted outreach.

Risks

- Competitive Disruption: Entry of newer antiviral therapies or natural remedies.

- Regulatory Changes:Restrictions on OTC marketing or formulations.

- Consumer Trends: Shift towards natural or homeopathic alternatives.

Key Takeaways

- ABREVA continues to dominate the OTC cold sore treatment market, supported by brand recognition, proven efficacy, and widespread availability.

- The market is expected to grow steadily at a CAGR of around 4-6% over the next decade, driven by increasing HSV-1 prevalence and expanding global access.

- Competition from generics and alternative remedies underscores the need for ongoing innovation, marketing, and consumer engagement.

- Demonstrated potential exists in emerging markets and through product innovation for sustained growth.

- Strategic positioning, including price adjustments and digital outreach, can mitigate risks and maximize sales potential.

Frequently Asked Questions

1. How does ABREVA's market share compare to its competitors?

ABREVA holds approximately 70-80% of the OTC cold sore treatment market share in North America, primarily due to its FDA approval and proven efficacy. However, the rise of generic docosanol products has been gradually eroding its dominance, especially in price-sensitive segments.

2. What factors could influence ABREVA’s future sales growth?

Factors include increased HSV-1 infection rates, consumer awareness, marketing effectiveness, competitive pricing, and regulatory policies. Additionally, product innovation and expansion into emerging markets can bolster growth.

3. Are there any regulatory risks that could impact ABREVA’s sales?

Yes. Changes in OTC drug regulations, advertising restrictions, or reclassification of cold sore treatments could affect sales. Furthermore, approval of alternative therapies or new formulations could impact market share.

4. What is the potential impact of generic competition on ABREVA’s profitability?

Generics offer lower prices, which may pressure ABREVA’s pricing strategy. While market volume could increase, profit margins could contract, emphasizing the importance of brand loyalty and differentiation.

5. How might technological advances or new formulations influence the market?

Innovations such as faster-acting formulations, combination therapies, or delivery methods could attract new consumers and extend product lifecycle, supporting sustained sales growth.

References

- Grand View Research. (2022). Cold sore treatment market size, share & trends analysis.

- FDA. (2000). Abreva (docosanol 10%) approval documentation.

- MarketResearch.com. (2022). OTC dermatological products global market analysis.

More… ↓