Last updated: August 6, 2025

Introduction

Pseudoephedrine, a widely used decongestant, is integral to over-the-counter (OTC) cold and allergy medications. Its primary application is alleviating nasal congestion, but regulatory controls due to its use as a precursor in methamphetamine synthesis have markedly impacted its market dynamics. This analysis examines current market size, key drivers, regulatory landscape, and future sales projections, providing critical insights for stakeholders navigating this complex landscape.

Market Overview

Global Market Size

The global pseudoephedrine market was valued at approximately USD 2.1 billion in 2022. The North American region accounted for nearly 50% of the market, driven by high OTC drug consumption and established supply chains. Europe represents around 25%, with emerging markets in Asia-Pacific progressively expanding their share. The market’s growth factors include rising prevalence of respiratory illnesses, increased consumer awareness, and expansion of OTC drug formulations.

Key Market Segments

- Product Type: Tablets, syrups, sprays. Tablets dominate sales, constituting over 70% of the market.

- Distribution Channels: Pharmacies, online platforms, healthcare providers. Pharmacies remain the primary distribution channel, though e-commerce is witnessing rapid adoption.

- Application: OTC cold and allergy remedies, combination drugs, prescription medications. OTC applications represent roughly 85% of total sales.

Regulatory Environment Impact

The stringent regulations governing pseudoephedrine sales significantly influence market size and sales projections. Countries such as the US, Canada, and many European nations enforce mandatory sales records, quantity restrictions, and licensing requirements.

US Regulations

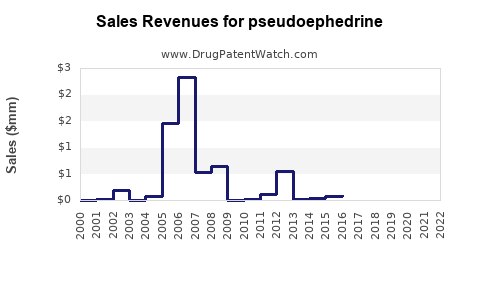

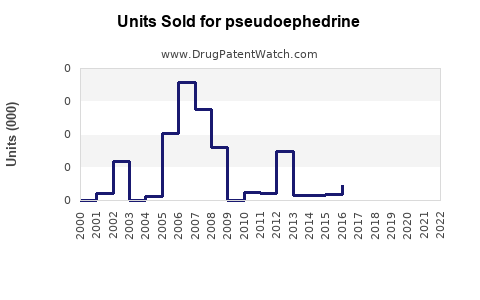

In the US, pseudoephedrine is classified as a List I chemical under the Combat Methamphetamine Epidemic Act (CMEA) of 2005, requiring retail sales to occur behind the counter with record-keeping and daily purchase limits (3.6 grams per day, 9 grams per 30 days) [1]. These measures have led to a decline in OTC sales, estimated at a compound annual growth rate (CAGR) of approximately 2% over the past decade.

Global Regulatory Trends

Emerging markets are adopting similar regulations, often modeled after US and European frameworks. This regulatory tightening constrains consumer access, impacting sales trajectories.

Market Drivers

- Growing Respiratory Disease Burden: Increased incidence of allergic rhinitis, sinusitis, and common cold cases sustains demand.

- Consumer Preference for OTC: Preference for self-medication encourages OTC sales, although constrained by regulatory barriers.

- Pharmaceutical Innovations: Development of combination products with pseudoephedrine enhances market penetration.

- Regulatory Measures and Law Enforcement: While restrictive, they also fuel black-market activities, influencing overall market dynamics.

Market Restraints

- Regulatory Restrictions: Limiting purchase volumes impacts sales potential.

- Shift Towards Alternative Decongestants: Development of safer alternatives like phenylephrine—although its efficacy remains debated—diverts some market share.

- Illicit Market Activities: The diversion of pseudoephedrine for illicit methamphetamine synthesis constrains legitimate sales.

Sales Projections (2023–2030)

Methodology

Forecasting integrates epidemiological data, regulatory trends, and historical sales patterns. Conservative estimates assume continued regulatory restrictions but account for market adaptation through formulation innovations and digital distribution.

Projected Market Growth

- 2023: USD 2.2 billion

- 2024–2026: CAGR of 2–3%, driven by growth in emerging markets and product innovation.

- 2027–2030: Market stabilization at approximately USD 2.5 billion due to regulatory saturation and consumer shift toward alternative therapies.

Factors Supporting Growth

- Expansion of OTC formulations with modified pseudoephedrine content.

- Increasing digital sales channels.

- Growing awareness of combination decongestant medications.

Factors Limiting Growth

- Stringent regulation proliferation.

- Consumer shift toward alternative therapies.

- Potential legal crackdowns on diversion activities.

Regional Outlook

- North America: Moderate growth (~2%) due to mature regulatory landscape.

- Europe: Stable with growth opportunities in emerging markets.

- Asia-Pacific: Highest CAGR potential (~4%) owing to expanding healthcare infrastructure and increasing respiratory disease prevalence.

Competitive Landscape

Major pharmaceutical players such as Johnson & Johnson, GlaxoSmithKline, and Teva Pharmaceuticals hold significant market share through OTC formulations and generic products. Their focus includes compliance with regulatory frameworks and innovation in delivery systems to sustain sales.

Conclusion

While pseudoephedrine remains a crucial decongestant, regulatory constraints have curtailed its growth potential in traditional markets. Future sales will likely depend on regulatory adaptation, product innovation, and expanding into emerging markets. Companies must also monitor and mitigate illicit activities impacting market integrity.

Key Takeaways

- The global pseudoephedrine market was valued at roughly USD 2.1 billion in 2022, with moderate growth projections.

- Stringent regulations significantly influence sales, especially in North America and Europe, enforcing strict purchase limits and record-keeping.

- Emerging markets in Asia-Pacific offer promising growth opportunities, driven by healthcare infrastructure development and increased disease burden.

- Market expansion hinges on formulation innovations, digital channels, and navigating regulatory environments adeptly.

- Stakeholders must balance legitimate market growth with anti-diversion measures to ensure sustainable operations.

FAQs

1. How have recent regulations affected pseudoephedrine sales?

Regulations such as the US’s Combat Methamphetamine Epidemic Act have drastically limited OTC sales, leading to a CAGR of around 2% in recent years and pushing sales toward pharmacy-registered transactions and digital platforms.

2. Are alternative decongestants substituting pseudoephedrine?

Yes. Phenylephrine and other non-precursor decongestants are gaining popularity despite debates over their efficacy, which influences pseudoephedrine’s market share.

3. What opportunities exist in emerging markets?

Growing healthcare infrastructure, increasing respiratory illnesses, and less mature regulatory environments present substantial expansion opportunities, with projected CAGR around 4%.

4. How does illicit diversion impact legitimate sales?

Diversion of pseudoephedrine for methamphetamine production leads to stricter regulations, reduced supply, and increased operational costs for legitimate manufacturers, ultimately constraining market growth.

5. What innovations could bolster pseudoephedrine sales?

Formulation advancements, combination products, and digital OTC sales channels may enhance accessibility and compliance, supporting sustained demand despite regulatory hurdles.

References

[1] United States Drug Enforcement Administration. "Combat Methamphetamine Epidemic Act of 2005." 2005.