Share This Page

Drug Sales Trends for letrozole

✉ Email this page to a colleague

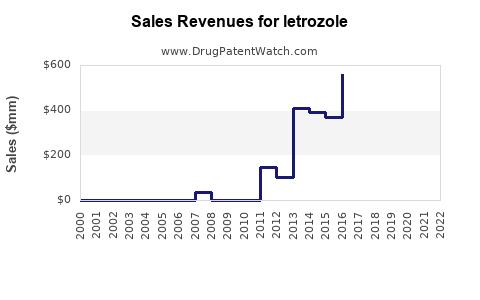

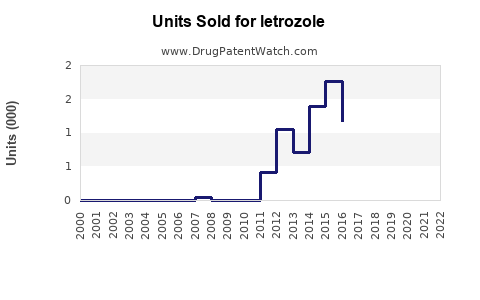

Annual Sales Revenues and Units Sold for letrozole

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| LETROZOLE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| LETROZOLE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| LETROZOLE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Letrozole

Introduction

Letrozole, a non-steroidal aromatase inhibitor, plays a pivotal role in the treatment of hormone receptor-positive breast cancer, primarily in postmenopausal women. Developed by Novartis, it has become a standard therapy in oncology, with expanding indications and a growing global footprint. This report offers a comprehensive market analysis and sales outlook for Letrozole, considering current trends, competitive landscape, regulatory factors, and evolving therapeutic needs.

Market Overview

Therapeutic Indications and Usage

Letrozole’s primary FDA-approved use is for the adjuvant treatment of hormone receptor-positive early breast cancer in postmenopausal women. It is also prescribed off-label for advanced breast cancer and as a second-line therapy following tamoxifen failure. Recently, research suggests potential off-label off-label applications, including fertility treatments and gynecomastia, expanding its early-stage solution pipeline.

Market Size and Growth Drivers

The global breast cancer market was valued at approximately USD 20 billion in 2022, with aromatase inhibitors like Letrozole accounting for a significant proportion due to their efficacy and safety profile. The rising incidence of breast cancer, especially in aging populations across North America, Europe, and Asia-Pacific, fuels demand. WHO reports an estimated annual incidence of 2.3 million new breast cancer cases globally in 2020, continuing to grow due to demographic shifts, lifestyle factors, and screening programs.

Key growth drivers include:

- Increasing adoption of hormonal therapies in early-stage breast cancer management.

- Rising awareness and screening initiatives leading to earlier detection.

- Expanding use in metastatic settings and potential off-label indications.

- Patent protection extending into the mid-2020s, allowing for stable sales pipeline; however, imminent generic competition looms.

Competitive Landscape

Letrozole’s main competitors include Anastrozole (Arimidex) and Exemestane (Aromasin), both AR inhibitors with similar efficacy profiles. Biosimilar and generic versions of Letrozole entered markets starting around 2018-2019, pressuring brand-name sales.

Emerging therapies, such as CDK4/6 inhibitors combined with endocrine therapy (e.g., Palbociclib, Ribociclib), are gaining traction, potentially impacting Letrozole’s market share. Nonetheless, Letrozole remains a first-line, cost-effective option, especially in markets with limited access to newer agents.

Market Analysis

Geographic Market Dynamics

North America:

Dominated by high adoption rates, advanced diagnostic infrastructure, and favorable reimbursement, North America accounted for over 35% of global breast cancer drug sales in 2022. The U.S. market alone exceeds USD 8 billion annually in breast cancer therapeutics.

Europe:

Established markets with high screening rates and breast cancer prevalence. The European market contributed approximately 30% of global sales, with strong demand but declining growth as generics dominate.

Asia-Pacific:

Fastest-growth region driven by increasing incidence, improved healthcare access, and expanding health insurance. China, India, and Japan represent key growth hubs, with projections indicating ≥10% CAGR over the next five years.

Latin America and Middle East:

Emerging markets with increasing adoption of hormone therapies, albeit constrained by cost and healthcare infrastructure.

Regulatory and Patent Landscape

Novartis holds key patents on Letrozole formulations, though patent cliffs are approaching. Generic manufacturers have obtained approval in numerous markets, intensifying price competition. The expiration of primary patents in Europe and the U.S. around 2024-2025 is expected to significantly impact revenue streams.

Market Trends and Future Outlook

The integration of Letrozole within combination regimens—particularly with CDK4/6 inhibitors—enhances treatment efficacy and could modify sales dynamics. Additionally, increased use in extended adjuvant therapy and in low- and middle-income countries through generics broadens market access.

Sales Projections

Short-term Outlook (2023-2025)

Pre-empting patent expiry, sales are projected to stabilize or slightly decline, influenced by generic competition. Novartis’s brand sales are expected to decrease by 15-20%, offset partially by increased volumes from emerging markets.

- Estimated global sales in 2023: USD 1.2 billion.

- Projected decline by 2025: Down to approximately USD 900 million, primarily due to generic erosion.

Mid to Long-term Outlook (2026-2030)

Post-patent expiry, the market will shift toward generics and biosimilars. However, increased and broader indications, as well as combination therapies, will sustain overall demand.

- Market volume growth driven by aging populations and increased breast cancer prevalence.

- Sales rebound expected in emerging markets due to lower-cost formulations.

- Total market value in 2030: Estimated at USD 1.2-1.4 billion globally, with brand-name sales comprising less than 25%, primarily from early adopters and high-income regions.

Key Variables Influencing Sales

- Patent expiry timelines and resultant generic penetration.

- Pipeline candidates and new indications that prolong lifecycle.

- Reimbursement policies and pricing regulations.

- Competitive landscape evolution, especially the rise of combination therapies.

Strategic Considerations

For Pharmaceutical Stakeholders:

- Diversify Portfolio: Develop combination regimens and explore additional indications.

- Patent Strategy: Secure supplemental patents and manage patent cliffs proactively.

- Market Expansion: Focus on Asia-Pacific and Latin America for volume growth, leveraging local manufacturing and partnerships.

- Cost Competitiveness: Leverage generic manufacturing efficiencies to maintain market share post-patent expiry.

Conclusion

Letrozole remains a cornerstone of hormone-positive breast cancer treatment. While near-term revenue faces headwinds from patent expiration and generic entry, long-term prospects remain positive owing to expanding indications and increasing breast cancer prevalence, especially in emerging markets. Strategic positioning, pipeline innovation, and market expansion will be critical in maximizing sales potential and fostering sustainable growth.

Key Takeaways

- Dominance in breast cancer therapy: Letrozole remains a primary hormonal treatment worldwide.

- Patent lifecycle impacts sales: Patent expiry (~2024-2025) will lead to significant generic competition.

- Geographical growth opportunities: Asia-Pacific and emerging economies offer substantial volume prospects.

- Pipeline potential and combination therapies: New indications and combinations bolster long-term outlook.

- Market adaptation essential: Companies must innovate and optimize cost strategies to sustain profitability post-patent.

FAQs

1. When will Letrozole patents expire, and how will this affect the market?

Patent protections in major markets are expected to expire around 2024-2025, leading to increased generic competition and a potential 20-30% decline in brand sales. Companies can offset this through pipeline development and geographic expansion.

2. What are the main competitors to Letrozole?

Its primary competitors include Anastrozole (Arimidex) and Exemestane (Aromasin). Biosimilars and generics are increasingly entering the market, intensifying price competition.

3. Are there emerging indications that could extend Letrozole’s market life?

Research indicates potential off-label uses such as fertility enhancement and gynecomastia treatment, along with expanding use in extended adjuvant therapy and combination regimens, which may prolong its relevance.

4. How does regional healthcare infrastructure influence Letrozole sales?

High-income regions like North America and Europe demonstrate stable sales, while sales in developing regions depend significantly on healthcare access and affordability, with emerging markets showing rapid growth potential.

5. What strategies can pharmaceutical companies adopt to maximize sales of Letrozole?

Strategies include developing combination therapies, pursuing new indications, securing regional partnerships, optimizing manufacturing costs, and monitoring regulatory and patent landscapes to adapt proactively.

Sources

- World Health Organization. Breast Cancer Fact Sheet. 2021.

- Grand View Research. Breast Cancer Therapeutics Market Size & Trends. 2022.

- Novartis Annual Report 2022.

- MarketWatch. Breast Cancer Drugs Outlook. 2023.

- IQVIA. Global Oncology Market Analysis. 2022.

More… ↓