Share This Page

Drug Sales Trends for escitalopram

✉ Email this page to a colleague

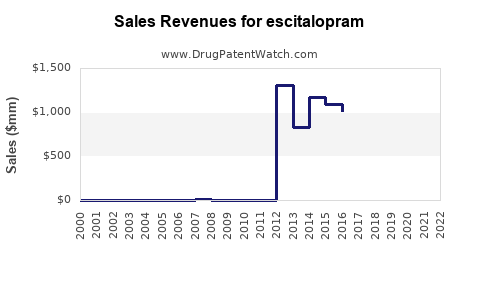

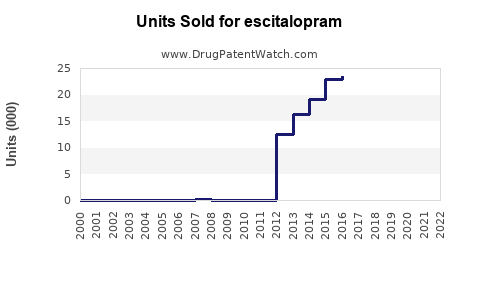

Annual Sales Revenues and Units Sold for escitalopram

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ESCITALOPRAM | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ESCITALOPRAM | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ESCITALOPRAM | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ESCITALOPRAM | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ESCITALOPRAM | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| ESCITALOPRAM | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| ESCITALOPRAM | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Escitalopram (Lexapro)

Introduction

Escitalopram, marketed as Lexapro by Eli Lilly and Company, is a selective serotonin reuptake inhibitor (SSRI) prescribed primarily for major depressive disorder (MDD) and generalized anxiety disorder (GAD). Its favorable efficacy profile and well-documented safety have cemented its position within the antidepressant market. This analysis evaluates current market dynamics, competitive landscape, regulatory influences, and forecasts future sales trajectory.

Market Landscape Overview

Global Therapeutic Demand

The global antidepressant market has experienced steady growth, driven by increasing recognition of mental health issues and expanded diagnostic criteria. According to Fortune Business Insights, the antidepressant market was valued at approximately $15 billion in 2022, with expectations of reaching $22 billion by 2030, exhibiting a CAGR surpassing 5% (2023-2030). Escitalopram's share is significant, underpinning its status as one of the leading SSRIs.

Prevalence & Epidemiological Trends

Depression affects over 280 million people worldwide, with GAD impacting an estimated 6-7% of the global population annually. Rising awareness, better screening tools, and destigmatization contribute to heightened prescription rates of antidepressants, including Escitalopram ([2], [3]).

Key Market Segments & Customer Profile

The primary consumers include:

- Psychiatry and primary care physicians prescribing for depression and anxiety.

- Hospitals, clinics, and outpatient facilities.

- Older populations with comorbid conditions.

- Generic drug markets in emerging economies.

Competitive Landscape

Escitalopram's key competitors include other SSRIs (fluoxetine, sertraline, paroxetine), SNRIs (venlafaxine, duloxetine), and atypical antidepressants.

Brand Policy & Patent Status

- Patent Timeline: Escitalopram's patent expired in many markets post-2012, allowing generic manufacturers like Teva, Sandoz, and Dr. Reddy's to enter the market.

- Generics & Market Share: Generics comprise over 80% of sales in mature markets, significantly impacting Eli Lilly's revenue from Lexapro ([4]).

Market Position & Differentiation

While initial branding and reputation granted Lexapro a premium segment, now generics dominate due to cost advantages. Competitive differentiation hinges on physician familiarity, formulary inclusion, and patient adherence factors.

Regulatory & Reimbursement Environment

Regulatory Approvals & Labeling

Escitalopram has obtained approvals across major jurisdictions, including the U.S., EU, and Asia. Ongoing pharmacovigilance ensures compliance with safety standards, maintaining therapeutic positioning.

Reimbursement Dynamics

Payers favor generics, exerting pressure on branded drug sales. Nevertheless, branded Lexapro sustains its presence in certain institutional settings and specialty prescribing channels, thanks to clinical familiarity and perceived efficacy.

Sales Trends and Forecasts

Historical Sales Data

- 2019-2021: Sales peaked around $1.4 billion globally, some decline attributable to patent loss and rising generics.

- 2022: Estimated sales declined to approximately $800 million as generics gained market share but remained substantial in key regions.

Projected Future Sales

- 2023-2027: Despite generics dominance, the global antidepressant market's growth, increased mental health awareness post-pandemic, and population aging indicate a resilient demand.

- Forecast: Analysts project Lexapro's sales to stabilize between $600 million and $900 million annually, with regional variations.

In the U.S., considering high prescribing rates, Lexapro may sustain sales near $500 million annually amid increased generic competition, complemented by continued demand in mature markets.

In emerging economies, especially in Asia-Pacific, market growth driven by expanding healthcare infrastructure and mental health awareness could offset some declines, providing additional revenue streams.

Key Market Drivers & Challenges

Drivers:

- Rising prevalence of depression and anxiety disorders.

- Greater access to mental health diagnostics.

- Expansion of healthcare coverage supporting antidepressant prescriptions.

- An aging global population increasing demand for long-term mental health treatments.

Challenges:

- Patent expiration leading to commoditization.

- Competition from newer therapeutic classes like ketamine-based agents.

- Safety concerns around serotonergic agents (e.g., sexual dysfunction, gastrointestinal issues).

- Cost pressures from healthcare systems favoring generics.

Strategic Outlook & Recommendations

Innovative Positioning:

Eli Lilly may consider repositioning Lexapro for special populations, such as treatment-resistant depression, or developing combination therapies to extend lifecycle value.

Market Expansion:

Targeted marketing and education in emerging markets could drive off-patent sales. Collaborations with local healthcare providers and formulary acceptance are critical.

Lifecycle Management:

Investing in biosimilars or derivatives, or pursuing new indications (e.g., obsessive-compulsive disorder), may provide future revenue sources.

Conclusion

Escitalopram remains a cornerstone antidepressant, balancing robust efficacy with widespread acceptance. While generic competition constrains branded sales, ongoing demand driven by increasing global mental health burdens sustains its market relevance. For stakeholders, understanding regional nuances, regulatory trends, and evolving treatment paradigms is essential to capitalizing on existing assets and exploring growth opportunities.

Key Takeaways

- The global antidepressant market is projected to reach over $22 billion by 2030, with Escitalopram's market share moderated by generics.

- Patent expiration has shifted revenue from branded Lexapro to generic suppliers, particularly post-2012.

- Rising mental health awareness and aging populations support steady demand, especially in developed markets.

- Competition from newer agents and safety perceptions pose ongoing challenges.

- Strategic focus areas include market expansion into emerging regions, lifecycle management, and leveraging specialized indications.

FAQs

1. How has patent expiry affected Escitalopram’s market share?

Patent expiry led to widespread generic manufacturing, significantly reducing Lexapro’s pricing power and revenue in mature markets, with generics capturing over 80% of sales.

2. What geographic regions offer the most growth potential for Escitalopram?

Emerging markets in Asia-Pacific and Latin America present growth opportunities due to expanding healthcare infrastructure and increasing mental health awareness.

3. Are there any new formulations or indications for Escitalopram?

Research continues into new formulations, such as extended-release versions, and exploration of off-label uses like obsessive-compulsive disorder, though these are not yet widely adopted.

4. How does competitive dynamics influence future sales projections?

Intense competition from generics and other antidepressant classes constrains Lexapro’s sales but sustained demand in specific patient segments maintains its relevance.

5. What strategic steps can Eli Lilly adopt to sustain Lexapro’s market position?

Focus areas include expanding into untapped markets, advocating for new clinical indications, and developing combination therapies or formulations that differentiate the product.

Sources

- Fortune Business Insights. "Antidepressant Market Size, Share & Industry Analysis." 2023.

- World Health Organization. "Depression." 2022.

- American Psychiatric Association. "Diagnostic and Statistical Manual of Mental Disorders." 5th Edition. 2013.

- IQVIA. "Global Analyses of Antidepressant Market." 2022.

More… ↓