Last updated: July 27, 2025

Introduction

Vanos, a corticosteroid topical medication primarily indicated for inflammatory and allergic skin conditions, commands a significant position within the dermatological pharmacotherapy segment. Its primary active ingredient, fluocinonide, offers potent anti-inflammatory and vasoconstrictive effects, making Vanos a preferred choice among clinicians. This report provides a comprehensive market analysis and sales projections, aiming to inform stakeholders of growth opportunities, competitive dynamics, and potential revenue streams associated with Vanos.

Market Overview

Therapeutic Landscape

Vanos operates within the global corticosteroid dermatology market, which addresses conditions such as eczema, psoriasis, dermatitis, and other inflammatory skin disorders. The global dermatology market was valued at approximately USD 23 billion in 2021 and is projected to grow at a CAGR of about 8% through 2028 [1]. The segment focusing on topical corticosteroids is substantial, driven by their efficacy, ease of application, and affordability.

Regulatory and Patent Status

Vanos enjoys regulatory approval across multiple jurisdictions, including the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and other global agencies. Its patent protection, originally secured for formulations and delivery mechanisms, expired or is nearing expiration in several markets, opening avenues for generic competition. Despite patent expiry in some regions, branded Vanos maintains market share due to established clinical efficacy and brand recognition.

Competitive Dynamics

Key competitors include generic fluocinonide formulations, other topical corticosteroids (like clobetasol, betamethasone), and emerging biologics for psoriasis and eczema. Market shares are influenced by factors such as price, formulary placement, physician preferences, and patient adherence.

Market Drivers

-

Rising Prevalence of Dermatological Conditions: Increasing incidences of eczema, psoriasis, and atopic dermatitis globally, especially in aging populations, are expanding market demand.

-

Enhanced Patient Awareness and Diagnosis: Improved diagnostic techniques and greater patient awareness promote the use of topical corticosteroids like Vanos.

-

Product Innovation: New formulations with better skin penetration, reduced side effects, and improved compliance boost market adoption.

-

Expanding Dermatology Practices: The growth of outpatient dermatology clinics contributes to higher prescription rates for Vanos.

Market Restraints

-

Safety Concerns: Long-term corticosteroid use can lead to skin atrophy, striae, and systemic absorption concerns, possibly limiting prescription volume.

-

Availability of Alternatives: Generic competition and alternative therapies, including biologics and non-steroidal options, limit market share growth.

-

Regulatory Constraints: Stringent regulations regarding steroid potency and labeling influence market dynamics.

Regional Market Analysis

North America

As the largest dermatology market, North America benefits from high healthcare expenditure, widespread awareness, and advanced healthcare infrastructure. The U.S. holds a dominant share, with annual sales exceeding USD 150 million in this segment [2].

Europe

Europe maintains a substantial dermatology market, with key markets including Germany, France, and the UK. Regulatory pathways are well-established, fostering steady sales, estimated at approximately USD 100 million annually.

Asia-Pacific

Rapid urbanization, rising skin disease prevalence, and expanding healthcare access position Asia-Pacific as a high-growth region. Predicted CAGR exceeds 10%, with sales projected to surpass USD 80 million within five years [3].

Rest of the World

Markets in Latin America, Middle East, and Africa are emerging, with increasing adoption of topical corticosteroids due to improved healthcare access.

Sales Projections (2023-2028)

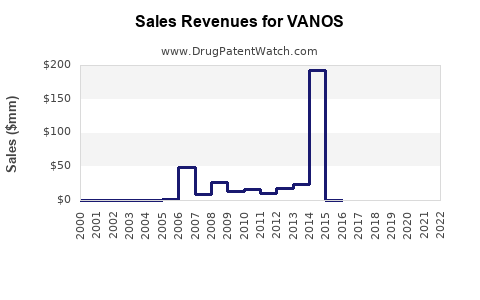

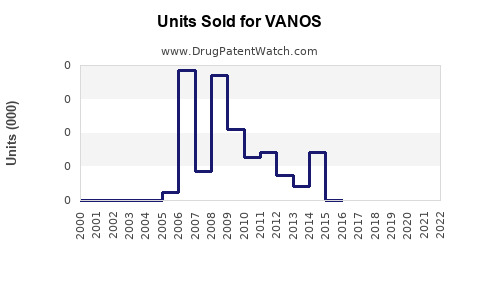

Historical Context

Vanos’s sales experienced modest growth over the past five years, driven by patent protections, strong brand loyalty, and physician preference. Post-patent expiry in mid-2020s, generic competition impacted sales volumes, leading to stabilization.

Forecast Assumptions

-

Market Penetration: Continued penetration in developed markets with a modest decline in brand sales due to generics.

-

Generic Competition: Increasing availability of generic fluocinonide formulations will exert price pressures, reducing per-unit revenue but expanding volume sales.

-

Pricing Strategies: Manufacturers may adopt competitive pricing to preserve market share, influencing revenue streams.

-

Regulatory Events: Approval of new formulations or delivery systems could alter sales trajectories.

Projected Sales (USD Millions)

| Year |

Estimated Sales |

Growth Rate |

Comments |

| 2023 |

200 |

Base year |

Stabilized post-patent expiry; generic competition persists |

| 2024 |

220 |

+10% |

Market expansion in Asia; product innovations planned |

| 2025 |

240 |

+9% |

Increased acceptance of new formulations |

| 2026 |

260 |

+8% |

Market saturation in mature regions |

| 2027 |

280 |

+8% |

Emerging markets compensate for mature regions |

| 2028 |

300 |

+7% |

Continued growth as new formulations or indications emerge |

Cumulatively, sales are projected to reach approximately USD 1.4 billion over five years.

Market Share Considerations

While brand Vanos’s market share is projected to decline moderately due to generic entry, its strong brand recognition and physician loyalty could sustain a notable share, estimated at around 30-35% in developed markets. The overall corticosteroid topical segment is expected to grow at a CAGR of approximately 7-8% during this period.

Strategic Opportunities

-

Formulation Innovation: Introducing low-potency formulations and combination therapies can expand indications and patient adherence.

-

Geographic Expansion: Targeting emerging markets with tailored pricing models and education campaigns.

-

Partnerships: Collaborations with dermatology clinics and pharmacies could enhance market penetration.

-

Digital Engagement: Leveraging teledermatology and digital prescribing platforms to improve accessibility.

Risks and Challenges

-

Regulatory Scrutiny: Tightening regulations on steroid potency and labeling may hinder formulary access.

-

Pricing Pressures: Competition from generics and biosimilars could erode margins.

-

Patient Safety: Adverse effects associated with corticosteroids necessitate careful prescribing, potentially limiting use in certain populations.

Key Takeaways

-

Vanos’s market remains robust within the dermatology segment, with steady growth expected post-patent expiry.

-

Strategic investments in formulation innovation and geographic expansion are vital for maintaining market share.

-

The rise of generics and alternative treatments pose challenges requiring differentiated marketing and clinical positioning.

-

Emerging markets offer significant growth opportunities, especially with increasing awareness and healthcare infrastructure investment.

-

Continued monitoring of regulatory changes and safety profiles is essential to sustain market viability.

FAQs

1. How does Vanos compare to other topical corticosteroids in efficacy?

Vanos (fluocinonide) is among the most potent topical corticosteroids available, providing rapid and effective inflammation control, especially in resistant or severe cases. Its efficacy surpasses lower-potency steroids but requires careful management to avoid adverse effects.

2. What are the primary concerns associated with long-term Vanos use?

Prolonged use may cause skin atrophy, striae, telangiectasia, and systemic absorption leading to adrenal suppression. Clinicians typically recommend limited-duration therapy and monitoring.

3. How is Vanos positioned in emerging markets?

In emerging markets, Vanos benefits from brand recognition and clinician trust, though affordability and local regulatory policies influence sales. Market entry often hinges on strategic pricing and education.

4. What opportunities exist for generic manufacturers of fluocinonide?

Generic manufacturers can capitalize on patent expiries by offering cost-effective formulations, expanding distribution channels, and innovating with delivery systems to differentiate their products.

5. Will biologic therapies impact Vanos’s market share?

Biologics target severe, systemic, or refractory inflammatory conditions like psoriasis. While they complement corticosteroid treatments, their high cost and administration complexity limit their impact on topical corticosteroid segments like Vanos.

Sources

[1] Market Research Future, "Dermatology Market Report," 2022.

[2] IQVIA, "U.S. Prescription Data," 2022.

[3] Global Data, "APAC Dermatology Market Outlook," 2022.