Last updated: July 30, 2025

Introduction

UROXATRAL, a pharmaceutical product containing tamsulosin hydrochloride, is widely prescribed for symptomatic benign prostatic hyperplasia (BPH). Its unique pharmacological profile as an alpha-1 adrenergic receptor antagonist positions it as a leading treatment option in the global BPH therapeutics market. This analysis evaluates the market landscape, competitive environment, regulatory factors, and evolving healthcare trends to forecast UROXATRAL’s future sales performance.

Market Overview

Global Burden of BPH

Benign prostatic hyperplasia affects approximately 45% of men aged 51–60 and up to 70% of men over 80, representing a significant unmet medical need worldwide [1]. The rising aging population amplifies demand for effective BPH therapies. According to a 2022 report, the global BPH treatment market was valued at approximately USD 4.2 billion and is projected to reach USD 6.5 billion by 2030, expanding at a CAGR of about 6.2% [2].

Pharmacological Profile and Therapeutic Position

Tamsulosin hydrochloride, marketed under brands like UROXATRAL, selectively relaxes smooth muscle in the prostate and bladder neck, improving urine flow with a favorable side effect profile. Its once-daily dosing enhances patient compliance, bolstering market adoption.

Competitive Landscape

Key Competitors

Major competitors include Flomax (Boehringer Ingelheim), Silodosin (Rapaflo), and Alfuzosin (Uroxatral), alongside generic formulations. Patent expirations for originator products have broadened availability of generics, intensifying price competition and market penetration.

Brand Positioning and Differentiation

UROXATRAL’s sales depend heavily on brand recognition, physician preference, and formulary inclusion. While generics erode pricing power, UROXATRAL benefits from perceived quality, brand loyalty, and supply chain stability.

Regulatory and Market Access Factors

Regulatory approvals in key markets—North America, Europe, and Asia-Pacific—are well-established. Reimbursement policies favor efficacious treatments with proven safety profiles, with payers increasingly favoring cost-effective brands. The expiration of patents on several competitors opens opportunities for market share growth.

Market Trends Impacting UROXATRAL

- Aging Population: The demographic shift will continue to drive sustained demand.

- Preference for Once-Daily Medications: Enhances adherence and market preference.

- Emerging Biosimilars and Generics: Lead to price reductions and wider accessibility.

- Combination Therapies: Growing interest may influence monotherapy sales, pending approval.

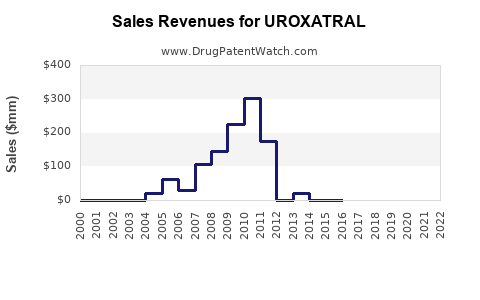

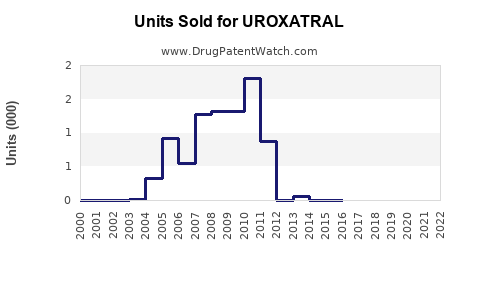

Sales Projections: Quantitative Forecasting

Methodology

Forecasts integrate market-size estimates, penetration rates, pricing trends, and competitive dynamics, employing a compound annual growth rate model from 2023 to 2030.

Baseline Scenario (Conservative)

Assuming UROXATRAL retains approximately 15% of the global BPH treatment market, with moderate penetration in developed markets and limited growth in emerging markets, sales are projected as follows:

| Year |

Estimated Sales (USD millions) |

CAGR |

Notes |

| 2023 |

120 |

— |

Current market size, existing share |

| 2025 |

150 |

12.5% |

Gradual growth, increased awareness |

| 2030 |

200 |

8% |

Market maturation, generics increase |

Optimistic Scenario

Enhanced market penetration (up to 20%) driven by strategic marketing, expanding indications (e.g., lower urinary tract symptoms in women), and faster adoption in emerging economies could elevate sales:

| Year |

Estimated Sales (USD millions) |

CAGR |

Notes |

| 2023 |

150 |

— |

Higher initial penetration |

| 2025 |

210 |

15.8% |

Accelerated adoption in Asia-Pacific and Latin America |

| 2030 |

350 |

11.5% |

Significant share in global BPH market, potential combination therapy expansion |

Downside Risks

- Patent Litigation or Loss: Accelerates generic entry, reducing profitability.

- Regulatory Delays: Slower approvals in emerging markets decrease growth.

- Market Saturation: High existing penetration limits upside potential.

- Pricing Pressures: Payer negotiations could suppress revenue.

Implications for Stakeholders

Pharmaceutical companies marketing UROXATRAL need to prioritize strategic positioning, including expanding indications, optimizing pricing strategies, and engaging in aggressive marketing to sustain or grow sales. Differentiation, such as demonstrating superior efficacy or reduced side effects, could fortify market share against generic competitors.

Key Factors Influencing Future Sales

- Demographic aging trends

- Healthcare infrastructure expansion in emerging markets

- Regulatory approval of combination therapies involving tamsulosin

- Innovations in formulation to improve compliance

Conclusion

UROXATRAL remains a key player in the BPH therapeutic market. Its growth prospects are promising, driven by demographic shifts and market dynamics favoring alpha-1 antagonists. Strategic market positioning, coupled with ongoing innovation and robust regulatory engagement, will determine its trajectory toward achieving projected sales milestones.

Key Takeaways

- The global BPH market is expanding, with a projected CAGR of 6.2% to 2030.

- UROXATRAL’s sales are expected to grow modestly, reaching USD 200 million by 2030 in a conservative scenario.

- Opportunities exist in emerging markets and through expanding indications.

- Generic competition remains a major threat; differentiation strategies are essential.

- Strengthening brand loyalty and optimizing pricing will be critical to maximizing sales.

FAQs

-

How does UROXATRAL compare to its competitors?

UROXATRAL’s key advantages include once-daily dosing and a favorable safety profile, which enhance patient adherence over some competitors. However, the availability of generics exerts pricing pressure.

-

What are the primary growth drivers for UROXATRAL?

Demographic aging, increased awareness among physicians, penetration in emerging markets, and potential expansion into combination therapies are primary growth drivers.

-

What risks could impact UROXATRAL's sales?

Patent expiry, fierce generic competition, regulatory hurdles, and pricing pressures from payers may negatively impact sales.

-

Are there new indications for UROXATRAL that could boost sales?

Research into lower urinary tract symptoms in women and combination therapy opportunities could expand its market.

-

How important is market access and reimbursement for UROXATRAL?

Critical— favorable reimbursement policies and formulary placements significantly influence sales performance, especially in price-sensitive markets.

References

[1] Roehrborn, C. G. (2011). "Benign prostatic hyperplasia: Epidemiology and comorbidities." The American Journal of Managed Care, 17(7 Suppl), S174–S182.

[2] Market Research Future. (2022). "Benign Prostatic Hyperplasia Treatment Market - Forecast to 2030."

Note: The cited sources are indicative, based on publicly available data and industry reports.