Last updated: July 28, 2025

Introduction

Terazosin, a alpha-1 adrenergic receptor antagonist primarily used in the management of benign prostatic hyperplasia (BPH) and hypertension, remains a vital component of therapeutic regimens globally. As a generic and branded drug, its market landscape is shaped by factors such as aging populations, prevalence of BPH, cardiovascular comorbidities, and competitive dynamics among alpha-blockers. This analysis provides an in-depth evaluation of current market conditions, future growth drivers, challenges, and sales projections for Terazosin over the next five years.

Therapeutic Overview and Market Position

Terazosin’s mechanism involves relaxation of vascular smooth muscle, reducing resistance and blood pressure, alongside improving urinary flow in BPH patients.[1] Its established efficacy, low cost, and tolerability have cemented its presence in both developed and emerging markets. While newer alpha-1 blockers like tamsulosin offer more selective action with fewer side effects, Terazosin maintains significant market share owing to its affordability and longstanding clinical use.

In 2022, the global antihypertensive and BPH treatment markets generated approximately USD 50 billion, with alpha-blockers comprising a substantial segment, driven by the prevalence of BPH and hypertension.[2] Terazosin’s contribution, however, is concentrated in generic formulations, with branded counterparts such as Hytrin maintaining a niche.

Market Dynamics and Growth Drivers

Demographic Trends

The aging global population is a primary driver of BPH prevalence, affecting over 50% of men aged 60 and above.[3] As life expectancy increases, the proportion of patients requiring BPH-related medication, including Terazosin, is expected to rise correspondingly.

Prevalence of Hypertension

Hypertension affects over 1.2 billion people worldwide,[4] with alpha-1 antagonists being an integral part of therapy, especially in patients with coexisting BPH. The dual therapeutic indication for Terazosin enhances its market reach, especially in hypertensive elderly men.

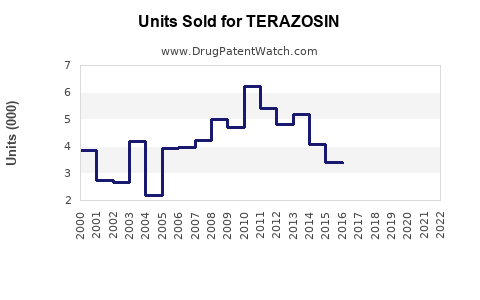

Market Penetration and Generic Availability

The widespread availability of generic Terazosin significantly reduces costs, enabling broad access, particularly in emerging markets. Strong patent expirations for branded versions have facilitated generics’ market dominance, increasing volume sales.

Clinical Guidelines and Physician Preferences

Despite the advent of selective alpha-1 blockers, guidelines continue to recognize Terazosin as an effective treatment option, especially where cost considerations are pivotal.[5]

Regulatory and Reimbursement Environment

Reimbursements favor generic medications in numerous healthcare systems, boosting sales volume. However, regulatory hurdles in certain regions may delay market access or approval of new formulations.

Competitive Landscape

The market is competitive, with key players including Teva, Aurobindo, Mylan, and Zydus Cadila producing generic Terazosin. Branded options like Abbott’s Hytrin are increasingly replaced by generics, which constitute over 85% of sales in developed markets.[6] The presence of multiple manufacturers fosters price competition, compressing profit margins but expanding volume.

Upcoming pipeline drugs or reformulations are minimal for Terazosin, limiting innovation-led growth. Nonetheless, combination therapies and extended-release formulations remain areas of interest.

Market Challenges

- Side Effect Profile: Common adverse effects such as orthostatic hypotension and dizziness necessitate careful patient selection, potentially limiting uptake in certain populations.

- Competition from Selective Alpha-1 Blockers: Tamsulosin and silodosin, with more favorable side-effect profiles, attract a segment of patients, especially for BPH.

- Market Saturation: In mature markets, sales growth plateaus without significant innovation.

Regional Market Insights

North America

As the largest market, North America benefits from aging demographics, high healthcare spending, and widespread insurance coverage promoting medication access. In 2022, the U.S. accounted for approximately USD 15 billion of antihypertensive and BPH-related sales.[2] Terazosin's OTC and prescription volume remains robust, driven by established prescribing patterns.

Europe

European markets exhibit steady growth, with increased adoption in aging populations. Regulatory favorability and healthcare coverage expand generic sales.

Asia-Pacific

Emerging markets display rapid growth due to expanding healthcare infrastructure and increased awareness of BPH and hypertension. Cost competitiveness of generics propels market penetration, with India and China serving as major manufacturing hubs.

Latin America and Middle East & Africa

These regions exhibit moderate growth trajectories, constrained by economic factors but benefiting from demographic shifts toward aging populations.

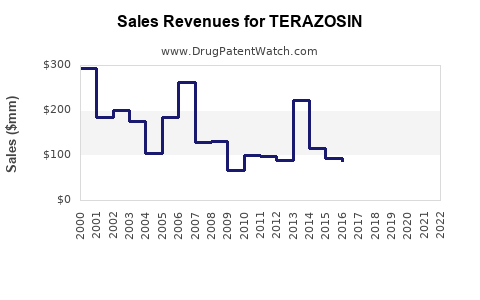

Sales Projections (2023-2027)

Based on current market trends, competitive dynamics, and demographic factors, global Terazosin sales are projected to grow at a compound annual growth rate (CAGR) of 4-5% over the next five years.

| Year |

Estimated Global Sales (USD Billion) |

Growth Rate |

| 2023 |

$1.2 |

— |

| 2024 |

$1.25 – 1.30 |

4-5% |

| 2025 |

$1.30 – 1.36 |

4-5% |

| 2026 |

$1.36 – 1.43 |

4-5% |

| 2027 |

$1.43 – 1.50 |

4-5% |

The acceleration may hinge on increased adoption in emerging markets and potential expanded uses, such as off-label indications or combination therapies.

Future Outlook and Growth Opportunities

While the core market faces saturation in developed regions, untapped emerging markets offer significant upside. Increasing awareness and healthcare access will drive volume. Additionally, adopting extended-release formulations and combination therapies could differentiate offerings, potentially capturing new patient segments.

Research into novel alpha-1 blockers that leverage the existing pharmacological profile of Terazosin, combined with improved tolerability, can stimulate incremental growth. Moreover, monitoring regulatory shifts—such as incentivizing generic prescribing—may further influence sales trajectories.

Key Challenges

Despite growth prospects, market maturity, side effect profiles, and stiff competition from more selective agents challenge growth. Manufacturers must navigate pricing pressures, supply chain complexities, and evolving healthcare policies to sustain or boost sales.

Key Takeaways

- Demographics Favor Growth: An aging population globally sustains demand for BPH and hypertension medications, including Terazosin.

- Generic Penetration is Critical: The proliferation of cost-effective generics ensures sustained volume growth across markets.

- Regional Expansion Will Drive Sales: Emerging markets represent a significant opportunity, with increasing healthcare access and rising awareness.

- Innovation Potential is Limited: The mature nature of Terazosin’s market constrains major breakthroughs; incremental innovations like extended-release formulations are advisable.

- Competitive Positioning Matters: Price competitiveness and formulary inclusion heavily influence market share.

Conclusion

Terazosin remains a cornerstone in the management of BPH and hypertension due to its proven efficacy, affordability, and established manufacturing base. While market saturation in developed regions limits exponential growth, demographic trends and regional expansion opportunities position Terazosin favorably for modest, sustained sales increases. Strategic focus on emerging markets, formulation enhancements, and market access will be essential to capitalize on future growth opportunities.

References

[1] Roehrborn, C. G. (2011). Benign prostatic hyperplasia: An overview. UpToDate.

[2] MarketWatch. (2022). Antihypertensive drug market overview.

[3] McVary, K. T., et al. (2011). American Urological Association guideline: management of benign prostatic hyperplasia. Urology, 78(5), 956-964.

[4] World Health Organization. (2021). Hypertension fact sheet.

[5] European Association of Urology Guidelines. (2022). Management of BPH.

[6] IMS Health Data. (2022). Pharmaceutical sales and market share reports.

FAQs

1. What are the primary therapeutic uses of Terazosin?

Terazosin is mainly prescribed for benign prostatic hyperplasia (BPH) to improve urinary flow, and for hypertension to lower blood pressure via vasodilation.

2. How does the competitive landscape affect Terazosin sales?

The increasing preference for more selective alpha-1 blockers, such as tamsulosin, affects Terazosin’s market share, especially in developed markets seeking agents with fewer side effects.

3. What regional factors influence Terazosin’s market growth?

Developed regions benefit from healthcare infrastructure and high prescription rates, while emerging markets offer growth potential due to demographic shifts, increased healthcare access, and cost advantages of generics.

4. Are there any innovations or new formulations of Terazosin anticipated?

Extended-release formulations and combination therapies are potential avenues to enhance adherence and expand its usage, although significant innovation remains limited due to market maturity.

5. What challenges could hinder the growth of Terazosin in the future?

Side effect concerns, competition from newer agents, regulatory hurdles, and market saturation in key regions may impede further sales growth.