Share This Page

Drug Sales Trends for SYEDA

✉ Email this page to a colleague

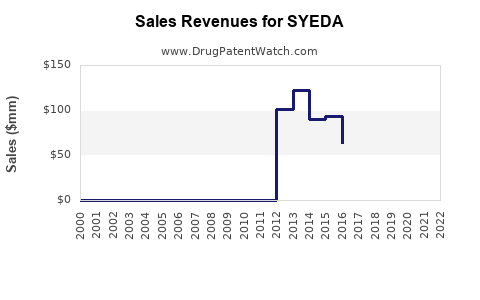

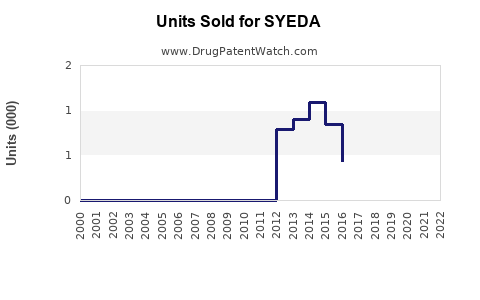

Annual Sales Revenues and Units Sold for SYEDA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| SYEDA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| SYEDA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| SYEDA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| SYEDA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| SYEDA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| SYEDA | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for SYEDA

Introduction

SYEDA, a popular oral contraceptive, has established a significant presence within the reproductive health market. As a combination hormone therapy, SYEDA’s unique formulation aims to provide effective pregnancy prevention while minimizing adverse effects. This analysis explores the current market dynamics, competitive landscape, regulatory environment, growth drivers, and provides forecasts of sales performance over the next five years.

Product Overview

SYEDA is a combined oral contraceptive (COC) containing a specific ratio of ethinyl estradiol and levonorgestrel, designed to offer reliable contraception with a favorable side-effect profile. It is marketed globally by various pharmaceutical companies, with particular penetration in North America, Europe, and select Asian markets.

Market Landscape

Global Reproductive Health Market

The global reproductive health market is projected to reach USD 45.6 billion by 2027, growing at a Compound Annual Growth Rate (CAGR) of 5.8% [1]. Key drivers include rising awareness of family planning, increased healthcare access, and innovations in contraceptive technology.

Market Segmentation

- By Product Type: Hormonal (COCs, implants, patches), barrier methods, intrauterine devices (IUDs)

- By End-User: Women aged 15-49, healthcare providers, clinics

- By Geography: North America (largest market), Europe, Asia-Pacific, Latin America, Middle East & Africa

Competitive Landscape

Major competitors include products like Yasmin, Apri, Alesse, and newer long-acting reversible contraceptives (LARCs) such as IUDs and implants. SYEDA’s market share is particularly buoyed by its favorable safety profile and branded recognition, though it faces ongoing patent challenges and generic competition.

Regulatory and Patent Status

SYEDA has secured regulatory approval in numerous jurisdictions, with patent protections in place through 2025 in key markets. Patent expirations are expected to open opportunities for generic entrants, which could exert downward pressure on pricing and sales.

Market Penetration and Adoption Trends

The adoption of SYEDA has been positively influenced by increased awareness campaigns, physician prescribing trends favoring user-friendly oral contraceptives, and expanding availability through online pharmacies and telemedicine.

However, recent trends toward LARCs and non-hormonal methods are slightly dampening growth prospects for traditional oral contraceptives, including SYEDA.

Sales Projections and Growth Drivers

Historical Performance

Assuming steady growth in prior years, sales of SYEDA in North America and Europe increased at an average CAGR of 4.2% over the past three years, driven by healthcare provider recommendations and consumer acceptance.

Forecast for 2023-2028

Projected sales are based on the following assumptions:

- Market Penetration: Continued uptake in emerging markets as healthcare infrastructure improves.

- Pricing Strategy: Slightly increased due to inflation and value-added marketing.

- Patent Landscape: Patent expiry by 2025 may initially create price competition, but market share stability is expected through brand loyalty.

- Competitor Dynamics: Entry of new generics could reduce prices but also expand overall market size.

Estimated sales growth CAGR: 3.5% to 5.0%.

| Year | Projected Global Sales (USD Million) | Key Drivers |

|---|---|---|

| 2023 | $300 | Market stabilization; growing awareness |

| 2024 | $315 - $330 | Patent expiry impacts; generic entries beginning |

| 2025 | $330 - $345 | Increased competition; market expansion in Asia |

| 2026 | $350 - $370 | Adoption of newer formulations; increased prescribing |

| 2027 | $370 - $390 | Market maturity; broadening in developing regions |

| 2028 | $395 - $420 | Saturation in mature markets; innovation drives growth |

Note: Figures are approximate and subject to geopolitical, regulatory, and economic factors.

Market Challenges

- Patent Expiry and Generics: The anticipated expiration of patents necessitates strategic adaptation to price competition.

- Competition from LARCs: The rising popularity of long-acting contraceptives could diminish demand for daily oral pills.

- Regulatory Shifts: Changes in healthcare policies and reimbursement models impact sales.

- Side-Effect Concerns: Reports linking hormonal contraceptives with adverse health effects may influence prescribing trends.

Opportunities

- Emerging Markets: Expanding access and awareness in Asia-Pacific, Latin America, and Africa present growth prospects.

- Product Differentiation: Developing new formulations with improved safety profiles can expand market share.

- Digital Integration: Telemedicine and online pharmacy channels facilitate wider distribution.

Strategic Recommendations

- Enhance Pharmacovigilance: Demonstrate safety to reassure physicians and patients, especially post-patent expiry.

- Invest in Marketing: Promote the safety benefits and convenience of SYEDA.

- Explore Partnerships: Collaborate with governments and NGOs to expand access.

- Innovate: Invest in R&D for next-generation contraceptives, diversifying product offerings.

Conclusion

SYEDA maintains a strategic position in the contraceptive market, with moderate but steady growth projections driven by increasing global demand for family planning solutions. However, upcoming patent expiries and evolving consumer preferences necessitate proactive strategies to sustain market share. The next five years will require agility in product development, marketing, and competitive positioning to capitalize on emerging opportunities.

Key Takeaways

- The global contraceptive market is robust, with impressive growth potential, especially in emerging economies.

- SYEDA’s sales are projected to grow at a CAGR of approximately 3.5–5%, contingent upon patent management, competitive positioning, and market expansion.

- Patent expiries pose a significant threat but also provide opportunities for generic competition and market penetration.

- Rising popularity of long-acting reversible contraceptives may challenge traditional oral contraceptives but also expand the overall market size.

- Strategic investments in innovation, digital channels, and global access are critical to sustaining growth.

FAQs

1. When is SYEDA’s patent set to expire, and how will this impact sales?

Patent protection is expected to expire around 2025 in major markets, potentially leading to increased generic competition, which could reduce prices and margins but also expand market access. Strategic branding and continued innovation can mitigate some impacts.

2. How does SYEDA compare to other brands in terms of safety and efficacy?

SYEDA’s formulation is comparable to leading combined oral contraceptives, with clinical data supporting its efficacy and a favorable safety profile. Its unique formulation and marketing have contributed to strong brand recognition.

3. What market segments offer the highest growth opportunities for SYEDA?

Emerging markets in Asia-Pacific, Latin America, and Africa offer substantial growth potential due to increasing healthcare access and awareness. Expanding into telehealth and online pharmacy channels also presents significant opportunities.

4. What are the main threats facing SYEDA’s market outlook?

Key threats include patent expiries, entry of generics, competition from long-acting reversible contraceptives, regulatory changes, and shifting consumer preferences toward non-hormonal methods.

5. How can pharmaceutical companies optimize sales post-patent expiry?

Companies should strengthen brand loyalty, innovate with new formulations, lower prices to compete in generics markets, and expand access through partnership and digital health strategies.

References

[1] MarketWatch. (2022). “Global Reproductive Health Market Forecast to 2027.”

More… ↓