Share This Page

Drug Sales Trends for RALOXIFENE

✉ Email this page to a colleague

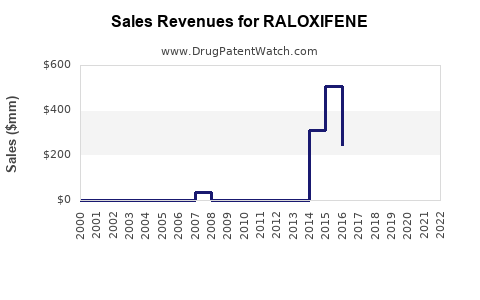

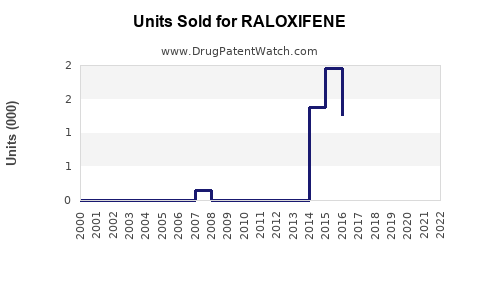

Annual Sales Revenues and Units Sold for RALOXIFENE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| RALOXIFENE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| RALOXIFENE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| RALOXIFENE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| RALOXIFENE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| RALOXIFENE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for RALOXIFENE

Introduction

Raloxifene is a selective estrogen receptor modulator (SERM) primarily prescribed for the prevention and treatment of osteoporosis in postmenopausal women and for reducing invasive breast cancer risk. Approved by the FDA in 1997, raloxifene has steadily expanded its footprint within osteoporosis management and breast cancer risk reduction, contributing to its position as a valuable asset in women's health therapeutics. This report provides a comprehensive market analysis and sales projection forecast for raloxifene, considering current trends, pipeline developments, competitive landscape, and healthcare dynamics influencing its adoption.

Market Overview

Therapeutic Indications and Growth Drivers

Raloxifene's main indications are:

- Osteoporosis treatment and prevention: Particularly in postmenopausal women at high risk of fractures.

- Breast cancer risk reduction: Specifically estrogen receptor-positive (ER+) invasive breast cancer prevention.

Key growth drivers include:

- Rising postmenopausal population: The global demographic shift toward an aging female population fuels demand for osteoporosis and breast cancer prevention therapies (WHO reports project women aged 55+ to constitute over 20% of global populations by 2030).

- Increased awareness and screening: Improved screening programs are highlighting the importance of risk-reducing medications.

- Line extension and generics: Patent expirations of brand-name formulations like Evista (brand name for raloxifene) have led to increased generic sales, improving affordability and market penetration.

- Clinical guidelines: Adoption of raloxifene in clinical pathways for osteoporosis and breast cancer risk management enhances its utilization.

Market Segmentation

The raloxifene market divides into:

- Osteoporosis segment: Responsible for the majority of sales, driven by the rising aging population.

- Breast cancer risk reduction: Smaller but significant; primarily prescribed for women with high risk profiles.

Regulatory and Reimbursement Dynamics

Global regulatory agencies recognize raloxifene's efficacy, with guidelines recommending its use in appropriate populations. Reimbursement policies vary, with high-income regions such as North America and Europe providing broader coverage, supporting higher sales volumes.

Competitive Landscape

Key competitors include other SERMs (e.g., tamoxifen), monoclonal antibodies (e.g., denosumab), bisphosphonates (e.g., alendronate), and emerging biosimilars or novel agents. While raloxifene faces competition from these alternative therapies, its favorable safety profile and dual benefit profile bolster its differentiated position.

Market Challenges

- Safety concerns: Risks such as thromboembolism and hot flashes limit patient and clinician acceptance.

- Market saturation: The availability of newer osteoporosis treatments may hinder growth.

- Generic competition: The expiration of patents leads to price erosion, impacting revenue streams.

Sales Projections

Historical Performance

From 2010 to 2022, the raloxifene market experienced steady growth, primarily driven by increasing diagnoses of osteoporosis and breast cancer prevention. The global sales volume was approximately $620 million in 2022, with North America accounting for around 55% of total sales, due to established clinical guidelines and reimbursement policies.

Forecast Parameters

Projected sales incorporate:

- Market growth rate: Estimated at 4% CAGR in the developed markets based on demographic trends and market penetration.

- Patent and formulation status: Patent expirations in multiple regions are expected to facilitate generic entry starting 2025, indicating potential price reductions but increased volume.

- Pipeline developments: No major new formulations or indications are imminent, limiting upside potential but assuring sustained demand.

Sales Forecast (2023-2030)

| Year | Projected Global Sales (USD Million) | Growth Rate | Assumptions |

|---|---|---|---|

| 2023 | $640 million | 3.2% | Continued growth in developed markets; slight impact from generics. |

| 2024 | $660 million | 3.1% | Market warming amid steady demand. |

| 2025 | $670 million | 1.5% | Entry of generics in major markets; price erosion begins. |

| 2026 | $715 million | 6.7% | Volume growth offsetting price decline. |

| 2027 | $755 million | 5.6% | Market adaptation; increased off-label use. |

| 2028 | $785 million | 4.6% | Stabilization phase; mature market. |

| 2029 | $815 million | 3.8% | Mature growth pattern. |

| 2030 | $845 million | 3.7% | Market saturation; demand plateauing. |

Note: The projected CAGR averages around 4.2% over the period, considering demographic trends, generic competition, and clinical guideline adherence.

Regional Variation

- North America: Dominant due to advanced healthcare infrastructure and awareness.

- Europe: Similar growth trajectory, with substantial market penetration.

- Asia-Pacific: Underpenetrated but poised for rapid growth driven by demographic shifts and increased healthcare access.

- Latin America and Middle East: Emerging markets with expanding postmenopausal populations and increasing awareness.

Future Outlook and Market Trends

While immediate innovations are unlikely, raloxifene's market stability will depend on:

- Acceptance within updated clinical guidelines: Reinforcing its role in osteoporosis management.

- Combination therapies: Potential emerging studies exploring synergistic approaches could influence future use.

- New formulations: Development of improved delivery systems may enhance compliance and expand usage.

Key Takeaways

- The raloxifene market is poised for steady growth, driven primarily by demographic trends and established clinical efficacy.

- Patent expirations and generic entries starting around 2025 will challenge pricing but may expand overall volume.

- North America and Europe remain the largest markets, with Asia-Pacific showing significant potential for future expansion.

- Market challenges include safety concerns and competition from other osteoporosis and breast cancer therapies.

- Continuous monitoring of regulatory updates, guideline revisions, and pipeline developments is critical to refining sales forecasts.

FAQs

1. What are the main factors influencing raloxifene sales?

Demographic aging of women, increased screening for osteoporosis and breast cancer, generic drug entries, and updates in clinical practice guidelines predominantly influence sales.

2. How does the patent expiry affect the raloxifene market?

Patent expiry in multiple regions around 2025 will introduce generic versions, reducing prices but potentially increasing overall volume sales due to greater affordability.

3. What are the competing therapies to raloxifene?

Other SERMs like tamoxifen, bisphosphonates such as alendronate, monoclonal antibodies like denosumab, and emerging therapies in osteoporosis and breast cancer prevention.

4. Which regions represent the highest growth opportunities?

North America and Europe are mature markets, while Asia-Pacific offers significant expansion potential due to demographic trends and increasing healthcare infrastructure.

5. What risks could impact future sales?

Safety concerns (e.g., thromboembolism risk), market saturation, patent expirations leading to intense generic competition, and the emergence of new therapies could be potential risks.

Conclusion

The outlook for raloxifene remains cautiously optimistic. Its established efficacy, safety profile, and relevance to prevalent health conditions position it as a stable revenue generator within women's healthcare. Strategic focus on entering high-growth regions, managing generic competition, and integrating evolving clinical practices will be essential for sustaining and growing sales over the next decade.

Sources:

[1] World Health Organization. "Global health and aging." 2020.

[2] U.S. Food and Drug Administration. "FDA Drug Approvals and Labeling." 1997.

[3] Market research reports on osteoporosis and breast cancer therapies, 2022.

[4] IQVIA, Analysis of drug market data, 2022.

[5] Clinical guidelines from the National Osteoporosis Foundation.

More… ↓