Last updated: July 27, 2025

Introduction

Promethazine is a phenothiazine derivative widely used for its antiemetic, antihistaminic, sedative, and analgesic properties. Market dynamics surrounding promethazine are influenced by therapeutic applications, regulatory status, manufacturing trends, and competitive landscape. An in-depth analysis reveals opportunities and challenges, informing strategic decisions for pharmaceutical companies, investors, and healthcare stakeholders.

Therapeutic Applications and Market Demand

Promethazine primarily addresses nausea, vomiting, allergies, and motion sickness. Its versatility supports broad prescription patterns across hospitals, clinics, and retail pharmacies. The antiemetic segment constitutes the largest demand driver, especially in oncology, post-operative care, and pregnancy-related nausea management [1].

The drug's efficacy in off-label indications, such as sedative adjuncts and respiratory illnesses, has expanded its use, albeit with regulatory scrutiny due to safety concerns. Increasing prevalence of allergies worldwide, coupled with rising cancer survival rates necessitating antiemetic therapies, sustains steady demand.

Regulatory Landscape and Market Restrictions

Regulatory agencies, notably the U.S. Food and Drug Administration (FDA), have issued warnings regarding promethazine's safety profile, limiting its use in pediatric populations and emphasizing correct dosing. Such restrictions influence prescription volumes, especially in North America and European markets, potentially constraining growth. Conversely, emerging markets with less restrictive regulations and increasing healthcare infrastructure offer growth avenues.

In many jurisdictions, formulations such as tablets, syrups, and suppositories are approved, with some countries restricting injectable forms due to safety concerns [2].

Manufacturing & Supply Chain Dynamics

Major pharmaceutical corporations, such as Pfizer and Teva, manufacture promethazine, ensuring a stable supply chain. Patent status is largely expired, leading to generic proliferation and price competition, which benefits healthcare affordability but compresses profit margins for original developers.

Raw material sourcing, particularly the phenothiazine core, and regulatory compliance in manufacturing processes impact the supply. The global COVID-19 pandemic demonstrated vulnerabilities in pharmaceutical supply chains, prompting manufacturers to diversify sourcing strategies.

Competitive Landscape

The market features a mix of established generics and emerging biosimilar candidates, with limited branded drug presence due to patent expirations. New entrant levels are minimal owing to the drug’s long market presence and well-established generic options. However, competition from newer anti-nausea agents like ondansetron and dexamethasone influences market share.

Promethazine faces competition in different segments: antihistamines are increasingly replaced with second-generation non-sedating agents, yet promethazine retains niche markets due to its sedative and antiemetic versatility.

Market Size and Revenue Projection

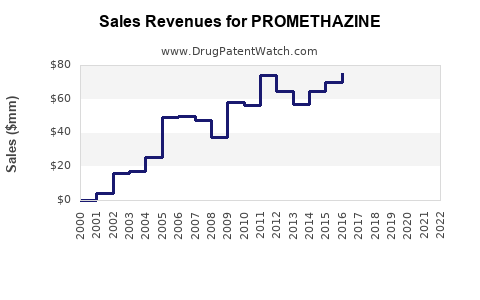

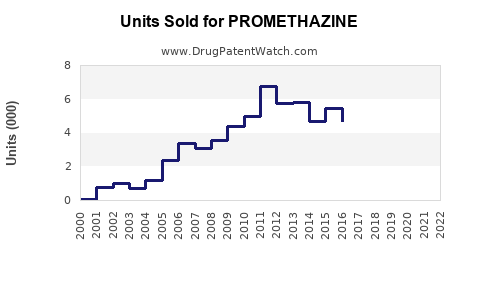

Current Market Size

The global antiemetic drugs market was valued at approximately USD 3.9 billion in 2022, with promethazine accounting for an estimated USD 200-300 million, predominantly in North America and Europe. The drug's market share is relatively stable but faces pressure from newer agents and safety regulatory constraints.

Sales Growth Drivers

- Rising Cancer Incidence: Increased chemotherapy-associated nausea enhances demand.

- Aging Population: Greater prevalence of gastrointestinal and allergic disorders.

- Expanding Use in Developing Markets: Growing healthcare access augments prescription volume.

Forecasted Trends (2023–2028)

Based on current data, a compound annual growth rate (CAGR) of 3–5% is projected for promethazine's segment within antiemetics, driven by emerging markets and new formulations. The global antiemetics market is anticipated to reach USD 6 billion by 2028, with promethazine's share expected to stabilize or slightly decline due to competitive pressures.

Projection Scenario A: Conservative

Considering regulatory restrictions and competition, sales growth remains modest at 2–3% CAGR. The market size could plateau at USD 350 million by 2028, with steady prescription volume maintained by existing clinical practices.

Projection Scenario B: Optimistic

Increased acceptance of promethazine in certain emerging markets, coupled with potential formulation innovations and expanded indications, could accelerate growth to 5% CAGR, reaching USD 400–420 million in sales by 2028.

Market Opportunities and Challenges

Opportunities

- Formulation Innovation: Development of targeted delivery systems (e.g., sustained-release formulations).

- New Indications: Research into off-label uses may expand application scope.

- Market Expansion: Penetration into Asia-Pacific and Latin America, where healthcare budgets are increasing.

- Strategic Collaborations: Partnering with local manufacturers to navigate regulatory landscapes.

Challenges

- Safety Concerns: Regulatory warnings limit pediatric and certain adult usage, constraining volume.

- Market Competition: Preference shifts toward newer, less sedating antiemetics.

- Generic Price Pressure: Diminished margins due to patent expirations.

- Regulatory Variability: Divergent approval standards can hinder global expansion.

Conclusion

Promethazine's market remains steady with predictable demand driven by its therapeutic versatility. However, regulatory restrictions, market competition, and evolving treatment paradigms necessitate cautious growth expectations. Strategic formulation development, geographical expansion, and regulatory navigation emerge as key drivers for maximizing sales potential.

Key Takeaways

- Stable Demand: Promethazine continuously addresses essential indications, ensuring a consistent market presence.

- Moderate Growth: Sales are projected to grow at 2–5% CAGR, influenced by regional market dynamics.

- Regulatory Impact: Safety warnings restrict use in certain populations, affecting volume but not overall longevity.

- Competitive Landscape: Generics dominate, with limited branded competition, but emerging alternatives challenge its market share.

- Strategic Focus: Innovation in formulations and expansion into underserved geographies can unlock growth opportunities.

FAQs

1. What therapeutic areas primarily drive promethazine demand?

Anti-nausea and anti-allergy indications, especially in chemotherapy, post-operative care, and allergy management, predominantly drive demand.

2. How do regulatory restrictions impact promethazine’s marketability?

Restrictions, particularly for pediatric use and safe dosing warnings, limit prescription volume and geographic market penetration, constraining growth potential.

3. What competitive factors influence promethazine's market positioning?

Limited branded presence, widespread generic availability, safety concerns, and competition from newer antiemetics like ondansetron shape its market share.

4. Which regions offer the most opportunities for promethazine expansion?

Emerging markets in Asia-Pacific, Latin America, and Africa, where healthcare infrastructure is expanding and regulations are less restrictive, present significant growth opportunities.

5. What developmental strategies can bolster promethazine’s market presence?

Formulation innovation, exploring new indications, strategic partnerships, and navigating regional regulations effectively are key strategies.

Sources:

[1] Grand View Research, "Anti-Emetics Market Size & Trends," 2022.

[2] FDA Drug Safety Communications, 2020.