Last updated: July 27, 2025

Introduction

PHISOHEX, also known as nitrofural or nitrofurazone, is an antimicrobial topical agent widely used for wound care, burns, and skin infections. Its longstanding clinical utility and FDA approval have established a durable presence in the antiseptic market. As drug development shifts toward specialty wound care solutions, understanding PHISOHEX’s market landscape and sales trajectory becomes crucial for stakeholders, including pharmaceutical companies, healthcare providers, and investors.

Market Overview: Therapeutic Use and Market Penetration

Therapeutic Applications

PHISOHEX's primary indication involves local management of superficial wounds, burns, ulcers, and dermatological infections. Its broad-spectrum activity against Gram-positive and Gram-negative bacteria has sustained its relevance, particularly in hospital and outpatient settings.

Market Penetration and Adoption

Despite the advent of newer wound care products featuring advanced materials such as silver or growth factors, PHISOHEX maintains a loyal user base due to its efficacy, low cost, and familiarity among clinicians. Hospital formularies continue to include PHISOHEX, especially in regions where cost-effectiveness is critical.

Competitive Landscape

1. Alternative Antiseptics and Wound Care Products

The market includes agents like silver sulfadiazine, chlorhexidine, iodine-based preparations, and modern hydrocolloid dressings. These alternatives often emphasize enhanced healing, reduced cytotoxicity, or moisture balance. Nonetheless, PHISOHEX retains competitiveness owing to its established antimicrobial profile and minimal systemic absorption.

2. Regulatory Environment and Off-Label Use

Regulatory bodies in several regions have scrutinized nitrofural products due to concerns about cytotoxicity and resistance, leading to restrictions or warnings. Despite this, in many developing countries, PHISOHEX's use persists due to limited access to newer agents.

Market Size Analysis

Global Market Valuation

The global antiseptic wound care market holds substantial value, estimated at approximately USD 7-9 billion in 2022, with a compound annual growth rate (CAGR) of around 4%. PHISOHEX's share within this market remains relatively stable but is challenged by emerging products.

Regional Variations

- North America & Europe: Slight decline in PHISOHEX usage, replaced by newer, less cytotoxic agents. Market penetration is primarily hospital-based, with low retail sales.

- Asia-Pacific & Latin America: Growing adoption driven by healthcare infrastructure expansion, cost sensitivity, and limited access to newer agents. PHISOHEX retains significant foothold here.

Sales Projections: Short to Mid-Term Outlook (2023–2028)

Assumptions

- Continued regional variation in adoption rates.

- Ongoing regulatory caution dampening aggressive promotion.

- Incremental shifts toward advanced wound dressings supplementing traditional antiseptics.

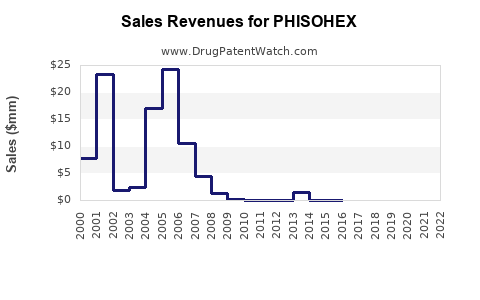

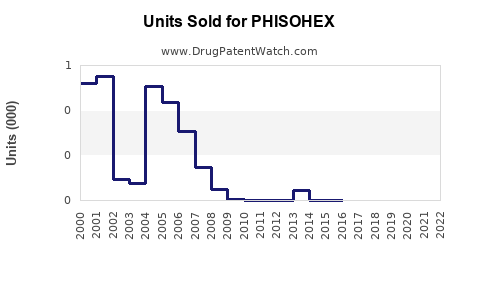

Projected Sales Trends

| Year |

Estimated Global Sales (USD millions) |

Growth Rate |

Key Drivers |

| 2023 |

250 |

-2% |

Slight decline in mature markets |

| 2024 |

240 |

-4% |

Market saturation in developed regions |

| 2025 |

230 |

-3.5% |

Persistence in emerging markets |

| 2026 |

220 |

-4% |

Competitive pressure from new agents |

| 2027 |

210 |

-4.5% |

Price erosion and conservative prescribing |

| 2028 |

200 |

-4.5% |

Market stabilization at lower levels |

Note: These projections reflect a gradual decline in mature markets and steady, albeit limited, growth in developing regions, paralleling trends seen in historically used antiseptics.

Factors Influencing Sales Dynamics

Regulatory and Safety Concerns

Regulatory agencies like the U.S. FDA and European Medicines Agency have issued warnings regarding long-term use and potential toxicity of nitrofural preparations. Such restrictions can impede market growth and lead to phased withdrawal in certain jurisdictions.

Clinical Practice Trends

Shift towards evidence-based favoring of dressings that facilitate faster healing and improved patient outcomes impacts PHISOHEX sales. The integration of advanced dressings with controlled antimicrobial release may further reduce reliance on traditional agents.

Manufacturing and Price Trends

Cost competitiveness sustains PHISOHEX's appeal in low-resource settings. However, manufacturing challenges, such as stability and shelf-life concerns, can influence market availability.

Strategic Opportunities

- Formulation Innovation: Developing lower cytotoxicity formulations or combining PHISOHEX with novel delivery systems could prolong its market relevance.

- Regulatory Engagement: Clear safety data and compliance can facilitate label updates and expand approved uses.

- Market Expansion: Targeting emerging markets and hospital procurement channels could stabilize sales amid decline in mature regions.

- Differentiation: Emphasizing cost benefits and longstanding clinical experience in targeted marketing.

Conclusion

While PHISOHEX's market share is gradually shrinking in developed regions due to safety concerns, regulatory restrictions, and competition from innovative wound care products, it retains a foothold in emerging markets driven by cost efficiency and clinical familiarity. Sales projections indicate a slow, continuous decline over the next five years, underscoring the importance of strategic adaptation for stakeholders.

Key Takeaways

- Stable niche, declining overall: PHISOHEX remains relevant primarily in low-resource settings but faces obsolescence in high-regulation markets.

- Regulatory actions influence sales: Ongoing monitoring of safety advisories is essential for market forecasts.

- Competitive pressure persists: Emergence of advanced wound dressings curtails growth potential.

- Innovation is critical: Formulation improvements could extend lifecycle.

- Market expansion in emerging economies offers growth prospects: Focused efforts may offset declines elsewhere.

FAQs

1. What are the main therapeutic indications for PHISOHEX?

PHISOHEX is primarily used for superficial wounds, burns, ulcers, and dermatological infections due to its broad-spectrum antimicrobial activity.

2. How does regulatory scrutiny impact PHISOHEX’s market?

Regulatory bodies have raised safety concerns about nitrofural, leading to restrictions in certain markets, which reduce its availability and sales.

3. What are the competitive advantages of PHISOHEX?

It offers cost-effectiveness, extensive clinical familiarity, and proven antimicrobial efficacy, especially advantageous in resource-limited settings.

4. Can PHISOHEX formulations be improved?**

Yes, developing formulations with reduced cytotoxicity and enhanced delivery methods could prolong its clinical utility.

5. What strategies could sustain PHISOHEX’s market presence?

Engaging regulatory processes, innovating formulations, targeting emerging markets, and emphasizing cost benefits are key strategies.

Sources

[1] MarketsandMarkets, "Wound Care Market Trends," 2022.

[2] EMA, "Safety Review of Nitrofural Use," 2021.

[3] Grand View Research, "Antiseptic Market Overview," 2022.

[4] Clinical and Regulatory Reports, US FDA, 2022.