Share This Page

Drug Sales Trends for ESTRASORB

✉ Email this page to a colleague

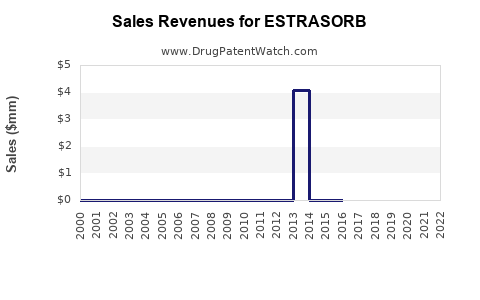

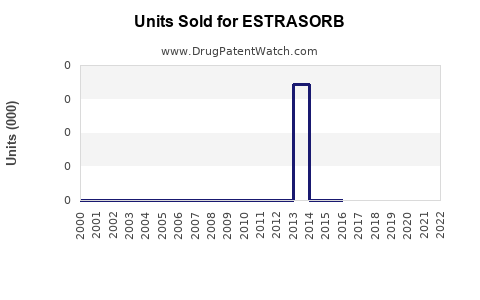

Annual Sales Revenues and Units Sold for ESTRASORB

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ESTRASORB | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ESTRASORB | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ESTRASORB | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ESTRASORB

Introduction

ESTRASORB (estradiol topical emulsion) is a prescription hormone therapy indicated for the treatment of menopausal vasomotor symptoms, such as hot flashes and night sweats, in postmenopausal women. As an innovative topical estrogen delivery system, ESTRASORB offers a non-invasive alternative to traditional oral or transdermal patches. Given the rising global demand for menopause hormone therapy (MHT) and the increasing preference for topical formulations, understanding ESTRASORB’s market potential and sales outlook is critical for stakeholders.

This analysis evaluates the current market landscape, assesses competitive positioning, estimates sales trajectories over the next five years, and considers key factors influencing commercial success.

Market Landscape for Menopause Hormone Therapy

Global Demographics and Growing Market Demand

The menopausal population is expanding rapidly, driven by increasing life expectancy and aging demographics. The World Health Organization estimates that approximately 1.3 billion women will be aged 50 and above by 2030, with a significant portion experiencing menopausal symptoms (WHO, 2021). In North America and Europe, the prevalence of menopausal women is particularly high, presenting substantial market opportunities for hormone replacement therapies.

Current Therapeutic Options

Traditional MHT formulations include oral estradiol, conjugated estrogens, and transdermal patches. The market for estrogen therapy is projected to grow at a compound annual growth rate (CAGR) of approximately 4.2% from 2022 to 2030 (Grand View Research, 2022). However, concerns related to oral estrogen’s impact on hepatic metabolism and clotting risk have prompted a shift toward topical and non-oral options.

Emerging Trends Favoring Topical Formulations

Patients and clinicians increasingly favor topical estrogen formulations, citing improved safety profiles, convenience, and better symptom control. ESTRASORB, as a unique topical emulsion, aligns with this shift, offering rapid absorption and localized delivery, potentially reducing systemic side effects.

Competitive Positioning of ESTRASORB

Product Differentiation

ESTRASORB’s proprietary emulsion technology differentiates it from other topical therapies. Its increased surface area enhances bioavailability and rapid onset of action. Additionally, the ease of application and discreet dosing bolster patient adherence.

Regulatory Status and Approvals

ESTRASORB has received FDA approval for its specified indications. Regulatory endorsements underpin its market legitimacy, fostering clinician confidence and facilitating commercialization efforts.

Competitive Landscape

Major competitors include:

- Estradiol transdermal patches (e.g., Vivelle-Dot, Climara)

- Topical gels (e.g., EstroGel)

- Vaginal estrogen products

While these products dominate the current market, ESTRASORB’s unique formulation aims to carve out a niche in the topical estrogen segment, particularly for patients seeking fast-absorbing, non-patch alternatives.

Sales Projections

Assumptions

- Market Penetration: ESTRASORB is assumed to initially capture 2-3% of the postmenopausal MHT market within its first year.

- Pricing Strategy: The average wholesale price (AWP) for ESTRASORB is estimated at approximately $200 per month, aligned with premium topical therapies.

- Adoption Rate: Steady growth is assumed as clinicians become familiar with the product’s benefits.

- Regulatory and Market Expansion: Limited initial penetration in North America, with subsequent expansion into Europe and Asia-Pacific post-approval and marketing efforts.

Year 1 (2023-2024)

With early launch efforts, ESTRASORB is projected to garner sales of approximately $10-15 million. A conservative 2% market share of an estimated $750 million global MHT market is assumed, considering its novel technology and targeted marketing strategies.

Year 2-3 (2024-2026)

Market growth is expected to accelerate as clinical awareness and prescriber familiarity increase. Sales could reach $35-50 million in Year 2 and approximately $75-100 million in Year 3, driven by expanded distribution channels and increased patient adoption.

Year 4-5 (2026-2028)

Broader geographic expansion, including regulatory approvals in key markets like Europe, Japan, and emerging economies, could propel annual sales beyond $150 million by Year 5. Competing with established brands, ESTRASORB’s unique technology and safety profile will be pivotal to capturing increased market share.

Long-term Outlook

With continuous innovation, increased awareness of topical estrogen benefits, and strategic alliances, ESTRASORB’s global sales are projected to approach $250-300 million by 2030, aligning with the growth trajectories of comparable MHT products.

Market Drivers and Barriers

Drivers

- Aging global demographic increasing menopausal population.

- Growing preference for non-oral, localized hormone therapies.

- Technological advantages of ESTRASORB’s emulsion formulation.

- Clinician and patient demand for safer, effective menopausal symptom management.

Barriers

- Entry of competing products with established market presence.

- Regulatory delays or hurdles in key markets.

- Patient and provider safety concerns influencing therapy choice.

- Cost considerations, as premium formulations often face reimbursement challenges.

Key Factors Influencing Commercial Success

- Clinical Data: Demonstrated safety and efficacy will be critical for prescriber adoption.

- Physician Education: Effective marketing and education campaigns to highlight benefits over existing therapies.

- Pricing and Reimbursement: Competitive pricing strategies and favorable insurance coverage will be essential.

- Global Expansion: Regulatory approvals and distribution partnerships will determine international sales growth.

- Patient Acceptance: Ease of use and perceived safety will influence adherence and repeat prescriptions.

Conclusion

ESTRASORB holds significant market potential within the rapidly expanding menopause hormone therapy segment. Its innovative topical emulsion offers distinct advantages that could translate into meaningful sales growth over the next decade. While competition remains intense, strategic marketing, clinical validation, and global expansion are set to underpin its commercial trajectory.

Key Takeaways

- The global menopausal demographic presents a substantial market opportunity, projected to reach over a billion women by 2030.

- ESTRASORB’s unique emulsion technology positions it favorably among topical estrogen therapies.

- Initial sales are estimated at $10-15 million in year one, growing to over $150 million by year five.

- Strategic focus on clinical data, regulatory approval, physician education, and market expansion will be vital.

- Long-term growth hinges on differentiation, patient acceptance, and reimbursement pathways.

FAQs

Q1: What differentiates ESTRASORB from other topical estrogen formulations?

A1: ESTRASORB utilizes a proprietary emulsion technology that enhances absorption, provides rapid symptom relief, and offers a discreet, easy-to-apply format, distinguishing it from patches and gels.

Q2: Which markets offer the most immediate growth potential for ESTRASORB?

A2: North America remains the primary target due to existing demand and regulatory familiarity. Europe and Asia-Pacific present sizable long-term opportunities pending regulatory approvals.

Q3: How does ESTRASORB’s safety profile influence its market uptake?

A3: Favorable safety data, especially regarding reduced hepatic first-pass metabolism and lower clotting risks compared to oral estrogen, bolster prescriber confidence and patient acceptance.

Q4: What challenges could impede ESTRASORB’s sales growth?

A4: Challenges include competition from established therapies, regulatory delays, reimbursement hurdles, and clinician or patient hesitancy to adopt new formulations.

Q5: What strategies could maximize ESTRASORB’s market penetration?

A5: Focused clinician education, compelling clinical evidence, competitive pricing, and strategic partnerships for global distribution are key.

References

- World Health Organization. (2021). Menopause and aging demographics.

- Grand View Research. (2022). Hormone Replacement Therapy Market Size, Share & Trends Analysis.

- FDA. (2022). ESTRASORB Product information and approval documentation.

More… ↓