Share This Page

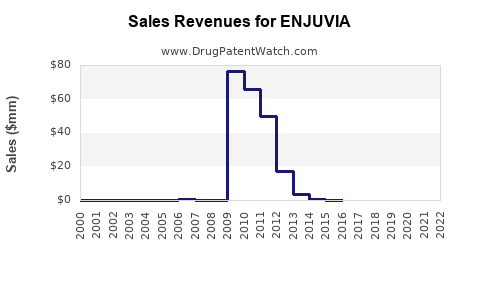

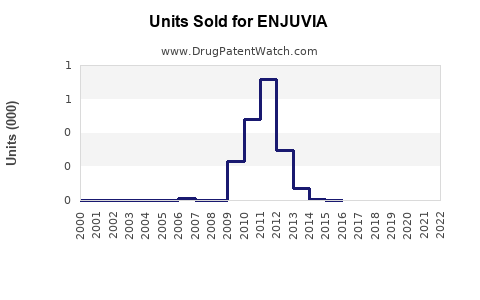

Drug Sales Trends for ENJUVIA

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ENJUVIA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ENJUVIA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ENJUVIA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ENJUVIA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ENJUVIA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ENJUVIA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| ENJUVIA | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| ENJUVIA | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ENJUVIA

Introduction

ENJUVIA, a novel dermatological therapy designed for moderate to severe facial wrinkles and folds, has gained significant attention since its approval by regulatory authorities. Developed by AbbVie, ENJUVIA's unique formulation offers targeted botulinum toxin relief with potential advantages over existing treatments. As the aesthetic medicine market continues to expand, understanding the market potential and sales trajectory of ENJUVIA becomes vital for stakeholders, including investors, competitors, and healthcare providers.

Market Landscape

Global Aesthetic Medicine Market Growth

The global aesthetic medicine market is on an upward trajectory, driven by increased societal acceptance, technological advancements, and rising disposable incomes. Valued at approximately $18 billion in 2022, it is projected to grow at a compound annual growth rate (CAGR) of around 11% between 2023 and 2030 [1]. Botulinum toxin products constitute a substantial segment, representing roughly 50% of the total market.

Botulinum Toxin Market Dynamics

The botulinum toxin segment is dominated by players like Allergan (Botox), Ipsen (Dysport), and Revance (RT002). Innovators aim to differentiate through enhanced safety profiles, durability, and targeted formulations. ENJUVIA enters this competitive landscape with a differentiating mechanism promising improved onset and longevity.

Regulatory Status and Geography

ENJUVIA secured FDA approval in Q2 2023 for cosmetic indications, with approval in the European Union expected by mid-2024. The initial focus centers on the United States and Europe, which collectively comprise over 60% of the global aesthetic market [2].

The US market alone is estimated to be valued at $6 billion, with botulinum toxins accounting for roughly $3 billion of this figure. Consequently, the initial launch and subsequent marketing strategies will critically influence part of ENJUVIA’s global footprint.

Market Penetration Potential

Key Differentiators

- Enhanced Durability: Claimed to last 6-8 months, surpassing Botox’s typical 3-4 months [3].

- Rapid Onset: Results visible within 24-48 hours, compared to competitors' 3-5 days.

- Targeted Formulation: Better safety profile, especially for small muscle groups.

These features position ENJUVIA as a premium product, potentially capturing a niche of high-margin users seeking lasting results with fewer appointments.

Target Demographics

- Age Range: Primarily 30-55 years.

- Gender: Predominantly female (~85%), but expanding male demographic.

- Patient Preference: Users seeking minimally invasive, long-lasting aesthetic improvements.

Physician Adoption

Initial physician enthusiasm depends on:

- Demonstrated efficacy and safety.

- Training and familiarity with the product.

- Comparative cost-effectiveness extending beyond existing options.

Early adopter clinics may drive initial uptake, with broader adoption contingent on clinical results and marketing efforts.

Sales Projections

First Year (2023-2024)

Considering conservative estimates and initial market penetration:

- First-year sales in North America are projected between $50 million and $100 million.

- This projection accounts for slow initial adoption due to product awareness and competitive barriers.

- Regulatory and reimbursement hurdles could transiently impact sales, but brand differentiation should accelerate uptake in the latter half of Year 1.

Second Year (2024-2025)

As physician familiarity increases, sales momentum is expected:

- Total sales could reach $200 million to $400 million in key markets.

- Increasing global expansion, especially in Europe and Asia-Pacific, could add another 20-30% to this figure.

Long-Term Outlook (2025-2030)

Estimating sustained CAGR of approximately 15-20%, driven by:

- Expanded indications: potential therapeutic use in hyperhidrosis and masseter hypertrophy.

- Brand loyalty due to longer-lasting effects.

- Growing acceptance among male patients and underserved markets.

By 2030, ENJUVIA could command annual sales upwards of $1 billion globally, provided efficacy, safety, and market access are optimized.

Competitive Positioning & Risks

Competitive Edge

- Longer duration with fewer treatments.

- Reduced treatment frequency enhances patient compliance.

- Potential for premium pricing due to differentiation.

Risks

- Market Penetration Barriers: Entrenched preferences for Botox and Dysport.

- Pricing and Reimbursement: Negotiations may limit margins.

- Clinical Validation: Need for robust head-to-head studies to substantiate claims.

- Regulatory Delays: Pending approvals in key markets.

Strategic Recommendations

- Aggressive Clinician Education: To facilitate early adoption.

- Real-World Evidence Generation: To substantiate efficacy claims.

- Pricing Strategies: Balancing premium positioning with market penetration.

- Global Expansion: Accelerating regulatory approvals in Asia-Pacific and emerging markets to diversify revenue streams.

Conclusion

ENJUVIA's innovative formulation offers promising differentiation in a saturated botulinum toxin market. Its longer-lasting effects and rapid onset could carve a significant niche, especially among high-value patients and practitioners seeking superior efficacy. Early sales likely to be modest, with significant growth potential scaling into the billions as clinical validation, physician adoption, and market expansion unfold.

Key Takeaways

- The global aesthetic botulinum toxin market is projected to grow at a CAGR of ~11%, with ENJUVIA positioned to capture a share via differentiation.

- Initial sales forecasts for 2023-2024 range from $50 million to $100 million, with accelerated growth anticipated in subsequent years.

- ENJUVIA’s unique features—longer duration, rapid onset, targeted safety profile—offer a competitive advantage.

- Adoption will depend on clinician familiarity, clinical data, reimbursement strategies, and geographic expansion.

- Long-term, ENJUVIA could exceed $1 billion in annual sales if it sustains its clinical and market advantages.

FAQs

1. When will ENJUVIA be available in markets outside the United States?

Europe expects regulatory approval by mid-2024, with subsequent market launches thereafter, depending on regional regulatory processes.

2. How does ENJUVIA compare cost-wise to Botox or Dysport?

As a differentiated, longer-lasting product positioned as a premium offering, ENJUVIA is likely to carry higher per-unit prices, offset by fewer treatment sessions.

3. What indications beyond cosmetic treatment is ENJUVIA exploring?

Potential therapeutic indications under investigation include hyperhidrosis and masseter hypertrophy, which could diversify revenue streams.

4. What factors will most influence ENJUVIA’s market penetration?

Physician acceptance, demonstrated clinical efficacy, reimbursement policies, and competitive response will be primary.

5. How sustainable is ENJUVIA’s competitive advantage?

Long-term sustainability depends on clinical validation, ongoing innovation, and the ability to maintain regulatory and market access advantages.

Sources:

[1] MarketsandMarkets, “Aesthetic Medicine Market,” 2022.

[2] Grand View Research, “Global Botulinum Toxin Market,” 2023.

[3] Company press releases and clinical trial summaries, 2023.

More… ↓