Last updated: July 27, 2025

Introduction

Diphenhydramine, a first-generation antihistamine, has been a cornerstone in the treatment of allergic reactions, motion sickness, and sleep disorders for decades. Widely recognized for its efficacy and over-the-counter (OTC) availability, diphenhydramine remains a pivotal pharmaceutical agent amid evolving consumer health trends and regulatory landscapes. This article provides an in-depth market analysis and sales forecast for diphenhydramine, emphasizing current dynamics, emerging opportunities, and strategic considerations intrinsic to its commercial trajectory.

Market Dynamics and Industry Overview

Global Market Landscape

Diphenhydramine's market operates within the broader antihistamine segment, which is projected to grow at a compound annual growth rate (CAGR) of approximately 4.5% through 2028, according to industry reports [1]. As of 2022, the global antihistamine market was valued at around USD 5.3 billion, with diphenhydramine constituting a significant segment due to its longstanding OTC status.

Regulatory Environment

The widespread OTC classification in numerous jurisdictions amplifies its accessibility, promoting consistent demand. However, regulatory scrutiny concerning safety profiles, especially related to sedative effects and potential misuse among vulnerable populations, influences formulations and marketing strategies. Recent regulatory initiatives focusing on packaging reminders about sedation risks can impact sales volume growth.

Consumer Demographics and Usage Trends

Consumer preferences exhibit a preference for OTC medications that provide rapid relief with minimal side effects. Diphenhydramine's dual role as an antihistamine and sleep aid bolsters its appeal, particularly among older adults and allergy sufferers. Notably, the rise in self-medication and home health management drives demand, while awareness campaigns about the risks of sedative overuse could temper future consumption growth.

Market Segmentation

By Application

- Allergic Rhinitis and Conjunctivitis

- Motion Sickness and Nausea

- Sleep Aid

- Cough and Cold Remedies

- Other (Parkinson’s disease, insomnia management)

By Distribution Channel

- OTC Pharmacy Chains

- Supermarkets and Hypermarkets

- Online Pharmacies

- Drugstores and Distributors

By Region

- North America (leading market due to high OTC medication penetration)

- Europe

- Asia-Pacific (emerging growth owing to increasing healthcare awareness)

- Latin America

- Middle East & Africa

Competitive Landscape

Major players in the diphenhydramine market include Johnson & Johnson, Sanofi, and Bayer, among others. These companies focus on product differentiation through formulations, packaging, and marketing strategies targeting specific consumer segments. Generic formulations also dominate due to their affordability and widespread availability.

Emerging competitors leverage digital platforms for direct-to-consumer marketing, especially in the online pharmacy space, heightening competition. Patent expirations have allowed for increased generic entry, exerting pressure on pricing and margins.

Sales Projections and Forecast

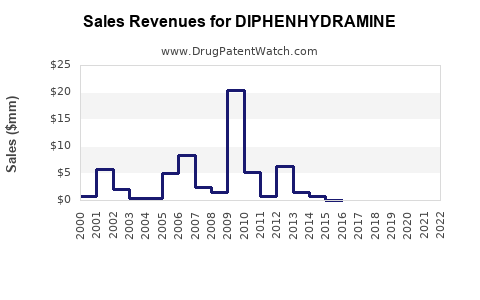

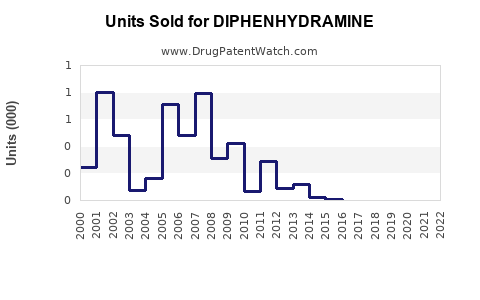

Historical Sales Data

From 2018 to 2022, global sales of diphenhydramine-containing products have experienced steady growth, driven by consistent demand for allergy relief and sleep aids. The global OTC antihistamine market, with diphenhydramine as a leading component, saw revenues approximate USD 1.8 billion in 2022, with diphenhydramine accounting for roughly 40-50% of OTC antihistamine sales [2].

Projected Sales Growth (2023-2030)

Base Scenario:

Assuming a CAGR of 4%, driven by sustained consumer demand and expanding markets in Asia-Pacific and Latin America, global sales of diphenhydramine products are forecasted to reach approximately USD 2.5 billion by 2030. The growth is contingent on regulatory stability, effective marketing, and innovation in formulations.

Optimistic Scenario:

If online sales channels and new formulation developments (e.g., non-sedating derivatives, combination products) improve adoption rates, CAGR could increase to 5-6%, boosting sales to over USD 3 billion by 2030.

Conservative Scenario:

Regulatory challenges, rising awareness of sedative side effects, or alternative therapies replacing diphenhydramine could cap growth at 2-3%, resulting in sales near USD 2 billion.

Regional Projections

North America is expected to sustain the largest market share, constituting nearly 45% of sales, fueled by high consumer purchasing power and OTC availability. Asia-Pacific is the fastest-growing region, with a CAGR of around 6%, driven by increased healthcare access, rising allergy prevalence, and expanding OTC distribution.

Key Market Drivers

- Prevalence of Allergic and Sleep Disorders: Rising incidence rates of allergies and sleep disturbances globally underpin consistent demand.

- Over-the-Counter Accessibility: Regulatory policies facilitating OTC sales sustain high-volume consumer access.

- Healthcare Self-Management Trend: Increasing adoption of self-medicating behaviors among consumers, especially in pandemic contexts, bolsters sales.

- Product Innovation: Formulation advancements, such as combination drugs and non-sedative derivatives, expand consumer appeal and market reach.

- Digital Market Expansion: Growth of online pharmacies and telemedicine services facilitates access to diphenhydramine products.

Market Challenges and Risks

- Safety and Side Effects: Sedation risk, potential for misuse, and contraindications may prompt regulatory restrictions or reformulations, impacting supply and sales.

- Regulatory Variability: Divergent classifications across regions pose challenges for global marketing strategies.

- Generic Competition: Price erosion from generics constrains profit margins.

- Consumer Preference Shifts: Preference for non-sedating antihistamines (second-generation) may decrease demand for diphenhydramine over time.

Strategic Opportunities

To capitalize on growth, pharmaceutical companies should focus on:

- Developing formulations with improved safety profiles.

- Expanding online and international distribution networks.

- Increasing consumer education about appropriate use and risks.

- Exploring combination therapies aligning with current medical guidelines.

- Conducting targeted marketing campaigns emphasizing efficacy and safety.

Key Takeaways

- Diphenhydramine continues to hold a dominant position within OTC antihistamines with projected global sales reaching USD 2-3 billion by 2030, assuming stable regulatory and consumer acceptance.

- Growing markets in Asia-Pacific and Latin America present lucrative expansion opportunities, especially through digital channels.

- Evolving safety concerns and regulatory policies necessitate innovation and strategic positioning to sustain market share.

- Diversification into non-sedating formulations or combination therapies could mitigate declining demand from safety-conscious consumers.

- Monitoring regulatory trends and consumer health awareness is critical for strategic planning.

FAQs

1. What factors have contributed to the sustained demand for diphenhydramine?

The drug’s proven efficacy, OTC availability, and versatility in treating allergies, motion sickness, and sleep issues drive continuous consumer demand.

2. How might regulatory changes impact diphenhydramine sales?

Regulations emphasizing safety, especially regarding sedative risks, may lead to formulation restrictions, age-specific dosing requirements, or shifts toward non-sedating alternatives, potentially limiting sales.

3. What are emerging consumer trends affecting the diphenhydramine market?

A preference for non-sedating antihistamines, increased health literacy, and digital shopping preferences influence product development and marketing strategies.

4. Which regions present the highest growth opportunities for diphenhydramine products?

Asia-Pacific and Latin America are expected to experience the fastest growth due to increasing healthcare access, allergy prevalence, and OTC product penetration.

5. How can stakeholders mitigate risks associated with diphenhydramine's sedative effects?

Investing in research for non-sedating derivatives, educating consumers about proper use, and complying with evolving safety regulations are critical strategies.

Sources

[1] MarketWatch, “Antihistamines Market Size, Share & Trends Analysis Report,” 2022.

[2] IQVIA, “Global Over-the-Counter Medicines Market Report,” 2022.