Last updated: July 28, 2025

Introduction

CLARITIN, the antihistamine marketed by Schering-Plough (now part of Merck & Co.), is a leading OTC medication used to treat allergic rhinitis, chronic hives, and other allergic conditions. As a first-generation antihistamine that gained wide consumer acceptance, CLARITIN's market performance hinges on evolving regulatory landscapes, competitive dynamics, consumer preferences, and global healthcare trends. An in-depth market analysis coupled with sales projections offers valuable insights into CLARITIN's current status and future trajectory.

Market Overview

Global Allergic Rhinitis and Hives Treatment Market

The global allergic rhinitis market was valued at approximately USD 10 billion in 2022, with an expected compound annual growth rate (CAGR) of around 4-6% through 2030[1]. This growth is driven by increasing prevalence of allergies attributable to environmental pollution, urbanization, and climate change. The antihistamines segment, which includes CLARITIN, maintains a significant share—over 60%—of allergy medication sales.

The chronic urticaria market, including treatments for hives, is projected to grow at a CAGR of around 5% over the next decade[2]. A combination of durable efficacy profiles, over-the-counter (OTC) accessibility, and consumer shifting preferences bolsters CLARITIN's market relevance.

Regulatory and Consumer Trends

In many countries, CLARITIN is available OTC, significantly broadening its accessibility. Regulatory shifts favoring OTC status have facilitated consumer self-medication, bolstering sales. However, patent expirations and emergence of generic equivalents have intensified price competition.

Competitive Landscape

CLARITIN's primary competitors include other second-generation antihistamines such as Allegra (fexofenadine), Zyrtec (cetirizine), and infants' formulations like Benadryl (diphenhydramine). Generics and regional brands also fill significant market share, pressuring unit prices and margins.

Market Penetration and Consumer Segments

Demographics

CLARITIN primarily appeals to adult and adolescent populations. Its safety profile, non-sedating properties, and OTC availability benefit consumers with active lifestyles. Pediatric formulations expand its reach but face stringent regulations in some markets.

Regional Markets

- North America: The largest share, owing to high allergy prevalence, OTC access, and mature OTC markets.

- Europe: Growing demand driven by environmental factors and aging populations.

- Asia-Pacific: Rapid expansion due to rising allergy incidence, urbanization, and improving healthcare infrastructure.

Distribution Channels

Pharmacies, supermarkets, online retail platforms, and healthcare providers constitute primary sales channels. Digital channels, in particular, are experiencing accelerated growth, especially post-pandemic.

Sales Performance and Historical Trends

Historical Sales Data

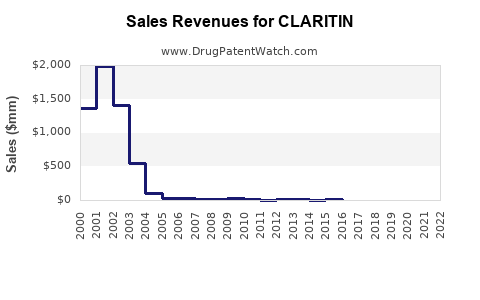

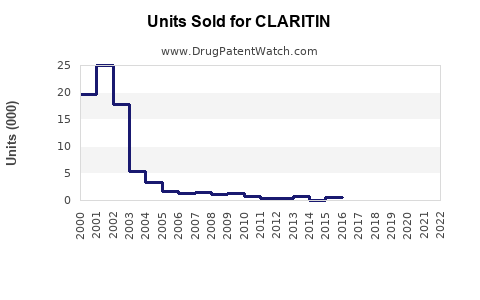

From 2018 to 2022, CLARITIN's annual global sales have fluctuated around USD 1.8 billion to USD 2.2 billion[3]. The slight decline during 2020-2021 can be tied to supply chain disruptions and shifts in consumer behavior during COVID-19, but recovery is observable.

Impact of Patent Expiry

While CLARITIN's original patent expired in many markets by 2017, its established brand presence, consumer trust, and OTC status sustained its sales. Generic versions entered the market, leading to competitive pricing but also increasing market penetration.

Sales Projections (2023-2030)

Assumptions

- Continued regulatory favorability for OTC access.

- Moderate price competition owing to generics.

- Growing allergy prevalence globally.

- Increased online sales channel utilization.

- No significant adverse regulatory or safety concerns.

Forecast

- 2023-2025: Sales are projected to stabilize around USD 2 billion annually, supported by expanding consumer awareness and urbanization. Slight growth from increased allergy prevalence and OTC accessibility will offset competition pressures.

- 2026-2030: A CAGR of approximately 3-4% could elevate annual sales to USD 2.4 billion by 2030, driven by emerging markets’ expansion, aging populations, and innovations in formulations (e.g., long-acting, pediatric-friendly options).

Market Share Considerations

Despite intensifying competition, CLARITIN's dominant brand presence and strong OTC positioning could preserve at least 35-40% of the antihistamine market, with potential upward shifts depending on marketing strategies and regional growth initiatives.

Strategic Factors Impacting Future Sales

- Product Line Expansion: Introducing new formulations like fast-dissolving tablets or nasal sprays could capture additional consumer segments.

- Regional Market Penetration: In Asia-Pacific, expanding distribution and local manufacturing can propel sales.

- Digital Marketing: Leveraging e-commerce and telehealth can further boost consumer reach.

- Regulatory Adaptations: Navigating region-specific approval pathways will be crucial in maintaining OTC status and launching new variants.

Key Challenges

- Generic Competition: Price competition from generics erodes margins but may boost overall market volume.

- Regulatory Hurdles: Variations in approval processes may hinder rapid geographic expansion.

- Consumer Preferences: Rising demand for natural or alternative therapies may shift market share.

Conclusion

CLARITIN remains a cornerstone antihistamine with resilient sales supported by strong brand equity, OTC accessibility, and global allergy prevalence. Its sales are poised for modest but steady growth over the next decade, influenced by demographic shifts, regional expansion, and digital innovation. Strategic product diversification, regional market focus, and adaptive marketing could further safeguard and enhance its market position.

Key Takeaways

- CLARITIN's global sales are expected to grow approximately 3-4% annually until 2030, reaching around USD 2.4 billion.

- The drug's OTC status and established brand strength are significant competitive advantages.

- Growth opportunities abound in emerging markets, notably Asia-Pacific, with increased urbanization and allergy awareness.

- Competition from generics necessitates strategic branding and diversification efforts.

- Digital channels and formulation innovations will be critical drivers for sustained sales expansion.

FAQs

1. How has patent expiration affected CLARITIN's sales?

Patent expiration introduced generic competitors, leading to price competition. However, CLARITIN's strong brand recognition and OTC status have mitigated major sales declines, maintaining robust revenue streams through generics and consumer loyalty.

2. In which regions is CLARITIN expected to see the most growth?

Emerging markets in Asia-Pacific and expanding OTC agreements in Europe are anticipated to drive future growth, supported by rising allergy prevalence and increasing healthcare infrastructure.

3. What competitive strategies are vital for CLARITIN to sustain its market share?

Investing in formulation innovation, expanding pediatric and long-acting options, enhancing online sales channels, and strengthening regional distribution will be crucial.

4. How do regulatory changes impact CLARITIN's market projections?

Regulatory approvals for OTC status and new formulations can positively influence sales, while unfavorable regulations or restrictions on OTC availability can pose challenges.

5. What role will digital and e-commerce channels play in CLARITIN’s future sales?

Digital channels will become increasingly vital, facilitating direct-to-consumer sales, personalized marketing, and telehealth integrations, thereby expanding market reach and consumer engagement.

References

[1] Market Research Future, "Allergic Rhinitis Market," 2022.

[2] Grand View Research, "Chronic Urticaria Treatment Market," 2021.

[3] IQVIA, "Global Pharmaceutical Sales Data," 2022.