Share This Page

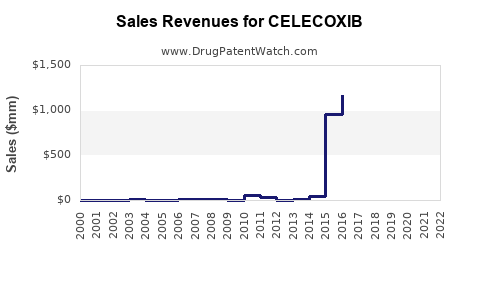

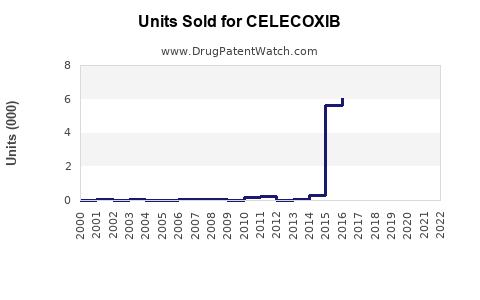

Drug Sales Trends for CELECOXIB

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CELECOXIB

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CELECOXIB | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CELECOXIB | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CELECOXIB | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Celecoxib

Introduction

Celecoxib, marketed primarily under the brand name Celebrex, is a non-steroidal anti-inflammatory drug (NSAID) selectively inhibiting cyclooxygenase-2 (COX-2). Approved by the FDA in 1998, it is primarily prescribed to manage osteoarthritis, rheumatoid arthritis, acute pain, and ankylosing spondylitis. Its targeted mechanism promises reduced gastrointestinal side effects compared to traditional NSAIDs, contributing to its sustained market presence. This report presents a comprehensive analysis of the current market landscape and provides near-term and long-term sales projections, contextualized within evolving therapeutic, regulatory, and competitive dynamics.

Market Overview

Market Size and Growth Dynamics

The global NSAID market, valued at approximately USD 12.8 billion in 2022[1], encompasses several drugs, with celecoxib representing a significant segment due to its efficacy and safety profile. The increasing prevalence of chronic musculoskeletal conditions fuels demand. The growth trajectory of celecoxib hinges on factors including patent status, regulatory approvals, pipeline developments, and shifting prescribing practices.

Key Indications and Demographics

Celecoxib's primary applications include:

- Osteoarthritis (OA): Affects 32.5 million US adults, with prevalence rising due to aging populations[2].

- Rheumatoid Arthritis (RA): Affects 1.3 million in the US alone[3].

- Acute pain management and ankylosing spondylitis.

Elderly populations and patients with comorbidities favor selective COX-2 inhibitors for their reduced gastrointestinal risks. This demographic trend supports sustained demand.

Regulatory Environment

The patent protection for Celebrex expired in 2015 in the US, leading to increased generic competition. Despite the influx of generics, branded celecoxib retains a market niche fueled by physician preference and formulary dynamics. Regulatory scrutiny persists over cardiovascular safety, with warnings incorporated into labeling.

Competitive Landscape

Patent and Generic Dynamics

Post-patent expiration, the market fragmentation has caused a price decline for branded celecoxib. Multiple generics are available at significantly lower prices, challenging the flagship product’s profitability. However, the brand sustains through physician loyalty and differentiated formulations.

Alternative Agents

Other NSAIDs (ibuprofen, naproxen) and COX-2 inhibitors (rofecoxib withdrawn in 2004 due to safety concerns) influence market share. Biologics and biosimilars entering the anti-inflammatory space minimally impact celecoxib due to differing indications.

R&D and Pipeline Developments

No new formulations or indications for celecoxib are prominently advanced, emphasizing reliance on existing indications for future sales. Nonetheless, research into minimized side-effect profiles and combination therapies may enhance market appeal.

Market Opportunities and Risks

Opportunities

- Expanding indications such as cancer-related pain or specific inflammatory conditions.

- Growth in emerging markets, driven by increasing healthcare access and aging populations.

- Improved formulations with enhanced safety or dosing convenience.

Risks

- Cardiovascular safety concerns could affect market acceptance, especially following warnings.

- Competitive pressures from generics and biosimilars.

- Regulatory restrictions or patent litigations.

Sales Projections (2023–2030)

Methodology Overview

Sales forecasts integrate epidemiological data, market penetration estimates, pricing trends, and potential growth drivers. A combination of historical sales data, market surveys, and expert insights inform projections.

Short-term (2023–2025)

In the immediate term, sales are expected to stabilize following patent expiration. The US generic market share already dominates, with branded sales declining but maintaining premium positioning for patients with specific indications or insurance incentives. Estimated US sales oscillate around USD 1.2–1.5 billion annually[4], with global sales approximately USD 2.3 billion.

Medium-term (2026–2030)

Assuming steady adoption in emerging markets and minimal regulatory disruptions, global sales could reach USD 3–3.5 billion by 2030. Growth drivers include:

- Increased prevalence of chronic inflammatory diseases.

- Rising healthcare spending in Asia-Pacific and Latin America.

- Development of modified-release formulations.

However, intense price competition, safety concerns, and patent challenges could temper growth, potentially capping long-term sales at around USD 2.8–3.2 billion globally.

Scenario Analysis

- Optimistic Scenario: Faster adoption in non-US markets, favorable regulatory environment, and fewer safety warnings could elevate sales beyond USD 3.5 billion globally.

- Pessimistic Scenario: Regulatory restrictions or safety concerns diminish utilization, constraining sales below USD 2 billion.

Strategic Recommendations

- Focus on niche therapeutic areas where celecoxib offers distinct advantages.

- Leverage emerging markets for expansion, considering local regulations and market access.

- Invest in research to develop formulations with improved safety profiles.

- Monitor regulatory landscapes for evolving safety warnings that could impact marketability.

Conclusion

Celecoxib retains a vital role within the NSAID landscape, primarily driven by its safety profile relative to traditional NSAIDs. Despite patent expiry and robust generic competition, its sales are projected to remain stable initially, with potential growth fueled by market expansion and new indications. Long-term prospects depend on navigating safety perceptions, regulatory scrutiny, and innovation in formulation and application.

Key Takeaways

- Market Size & Growth: Post-patent expiration, celecoxib’s global sales are expected to stabilize, with potential long-term growth contingent on emerging markets and new indications.

- Competitive Positioning: Generics dominate US sales, but branded celecoxib maintains a niche through safety profile and physician loyalty.

- Market Drivers: Aging populations and chronic inflammatory disease prevalence underpin sustained demand.

- Risks & Challenges: Safety concerns, regulatory restrictions, and pricing pressures pose significant challenges.

- Strategic Focus: Leveraging emerging markets, expanding indications, and innovating formulations are vital for future growth.

FAQs

1. What is the current market share of celecoxib globally?

While precise figures vary by region, celecoxib’s market share within the NSAID class has diminished post-generic entry but remains significant in specific therapeutic niches, with global sales reaching approximately USD 2–3 billion annually.

2. How does safety concern impact celecoxib sales?

Safety warnings related to cardiovascular risks have led to cautious prescribing and labeling updates, potentially restraining growth. Nevertheless, the drug remains a key choice for patients at risk of gastrointestinal complications.

3. Are there new developments or formulations for celecoxib?

Currently, no significant new formulations or indications are in advanced clinical development, emphasizing reliance on existing approvals and optimization of current formulations.

4. Which markets offer the most growth opportunities for celecoxib?

Emerging markets in Asia-Pacific, Latin America, and parts of Africa are poised for growth due to rising chronic disease prevalence and expanding healthcare infrastructure.

5. How will patent expirations influence the future of celecoxib?

Patent expiry led to increased generic competition, reducing branded prices. Future patent challenges or exclusivity extensions could influence sales trajectories, but the overall market will be shaped by safety perceptions and clinical preferences.

Sources

[1] Research and Markets, "NSAID Market, 2022"

[2] CDC, Osteoarthritis prevalence data, 2022

[3] CDC Arthritis Data, 2022

[4] IQVIA, Pharmaceutical Market Analysis, 2022

More… ↓