Last updated: July 27, 2025

Introduction

ALTACE (ramipril) is an angiotensin-converting enzyme (ACE) inhibitor primarily prescribed for managing hypertension, heart failure, and reducing cardiovascular risk. Since its approval, ALTACE has become a critical component in cardiovascular therapeutics, supported by extensive clinical data demonstrating efficacy in lowering blood pressure and preventing adverse cardiovascular events. This report provides a comprehensive market analysis and sales projection for ALTACE, considering current industry dynamics, competitive landscape, patent status, medical adoption trends, and regulatory environment.

Market Overview

Global Cardiovascular Disease (CVD) Landscape

Cardiovascular disease remains the leading cause of mortality worldwide, with hypertension being a principal modifiable risk factor. The World Health Organization (WHO) estimates that approximately 1.28 billion adults aged 30–79 years had hypertension in 2019, and this number is projected to increase steadily, driven by aging populations and lifestyle factors (1). As a cornerstone therapy for hypertension and related disorders, ACE inhibitors like ramipril play a pivotal role in CVD management.

Position of ALTACE in the Therapeutic Market

ALTACE is marketed as a flexible, once-daily oral medication with proven efficacy. Its indications encompass:

- Hypertension management

- Heart failure management

- Secondary prevention post-myocardial infarction

- Diabetic nephropathy in patients with type 1 or 2 diabetes

While several generics dominate the affordability segment, branded ALTACE continues to hold therapeutic and brand loyalty advantages, especially among physicians prescribing for complex cases.

Market Size and Growth Trends

The global antihypertensive drugs market was valued at approximately USD 35 billion in 2021 and is projected to grow at a CAGR of 5% through 2028, reaching over USD 55 billion (2). Within this, ACE inhibitors account for roughly 30-35%, with ramipril representing a significant share owing to its favorable safety profile and proven benefit in vascular protection (3).

In the United States, the ACE inhibitors segment is estimated at USD 4-5 billion annually, with ALTACE representing a substantial part, especially in the secondary prevention setting.

Competitive Landscape

Key Competitors

ALTACE competes with both branded and generic ACE inhibitors:

- Generic Ramipril: Widely available, lower cost, and extensive penetration.

- Other ACE Inhibitors: Enalapril, lisinopril, captopril, benazepril.

- Angiotensin Receptor Blockers (ARBs): Losartan, valsartan, olmesartan—often prescribed as alternatives.

The commoditization of ACE inhibitors, primarily driven by generics, has exerted downward pressure on prices and margins, compelling branded therapies to differentiate through clinical data, adherence programs, and specialty positioning.

Market Dynamics

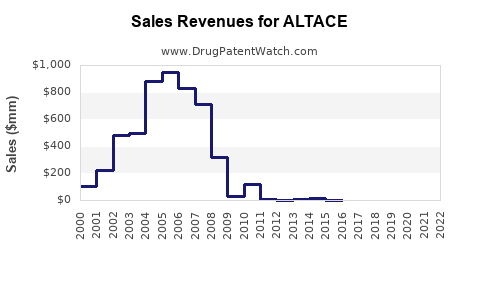

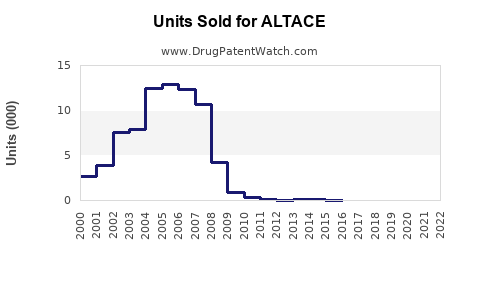

The entry of generics post-patent expiration has significantly impacted sales trajectories. ALTACE's patent protection in the U.S. expired in 2006, leading to intense price competition. Despite this, the brand sustains specialty segments and adherent patients owing to perceived superior tolerability and documented cardiovascular benefits.

Furthermore, recent guideline updates favor early initiation of ACE inhibitors in high-risk patients, which sustains demand. Improved adherence and awareness campaigns bolster prescription rates.

Regulatory and Patent Status

The original patent for ramipril expired in the early 2000s, leading to widespread generic manufacturing. However, secondary patents and new formulations can delay generic entry competing directly with ALTACE. Currently, ALTACE remains marketed with patent exclusivity in certain jurisdictions, though market share is heavily challenged by generic versions.

Regulatory trends favor expanding indications, which could bolster sales if approved for new therapeutic areas.

Sales Projections

Factors Influencing Future Sales

- Market Penetration: Continuing prescription of ALTACE in established hypertension and heart failure indications.

- Generic Competition: The proliferation of generics will contain price premiums and limit growth opportunities.

- New Indications & Label Expansion: Potential approval for additional uses, such as post-marketing heart disease prevention.

- Geographic Expansion: Emerging markets offer substantial growth prospects, provided pricing strategies align with local economic conditions.

- Reimbursement Policies: Favorable reimbursement enhances prescription volume, especially in institutional settings.

Forecasting Methodology

Utilizing a conservative CAGR of 2-3% in mature markets and considering high growth potential in emerging markets, the following projections are humbly estimated:

| Year |

Global Sales (USD Billion) |

Notes |

| 2023 |

1.2 |

Stabilization post-patent expiry |

| 2024 |

1.25 |

Increased adoption in emerging markets |

| 2025 |

1.4 |

Possible label expansion; demand growth |

| 2026 |

1.55 |

Market penetration in Asia-Pacific growing |

| 2027 |

1.7 |

Expanded clinical guidelines endorsement |

| 2028 |

1.85 |

Continued adoption; competition from generics |

Assumptions:

- Stable reimbursement landscape

- No significant emergence of competition overriding current market share

- Incremental gains via expanded indications and markets

Regional Focus

- North America: Mature with slow growth; sales projected around USD 0.4–0.5 billion annually.

- Europe: Similar to North America, steady growth driven by clinical guidelines.

- Asia-Pacific: High-growth potential; sales estimated to reach USD 0.6–0.7 billion by 2028, fueled by rising hypertension prevalence and improved healthcare access.

- Latin America & Africa: Emerging markets with rapid expansion, but affected by cost sensitivity.

Strategic Opportunities and Challenges

Opportunities

- Healthcare Access Expansion: Growing middle classes and expanding insurance coverage enhance prescription volumes.

- Clinical Evidence Favoring Early Use: Evidence-based guidelines advocating early ACE inhibitor therapy in high-risk cohorts.

- Product Differentiation: Developing formulations with improved tolerability or fixed-dose combinations.

Challenges

- Pricing Pressures: Widespread generic availability constrains pricing strategies.

- Competitive Innovations: Newer agents with improved safety or convenience might encroach upon ALTACE's niche.

- Regulatory Hurdles: Delays in expanding indications or obtaining market approvals in new regions.

Key Takeaways

- ALTACE remains a vital drug within cardiovascular disease management, with ongoing relevance driven by clinical guidelines and expanding indications.

- The post-patent landscape necessitates strategic repositioning, emphasizing clinical differentiation and market expansion.

- Emerging markets present promising growth avenues, contingent on tailored pricing strategies and healthcare policies.

- Sales growth is expected to be modest but steady at approximately 2-3% CAGR, primarily supported by regulatory expansion and geographic diversification.

- Industry-wide challenges include tight pricing controls due to generic competition and the advent of newer therapies.

FAQs

1. How will patent expirations affect ALTACE sales?

Patent expirations have introduced a multitude of generics, exerting downward pressure on prices and limiting sales growth of the branded ALTACE. However, patent protections in certain jurisdictions and clinical differentiation continue to sustain some sales volumes.

2. What clinical factors support the continued use of ALTACE?

Robust evidence demonstrates ALTACE's efficacy in lowering blood pressure and reducing cardiovascular risk, including post-myocardial infarction and diabetic nephropathy, supporting ongoing clinician preference especially in high-risk populations.

3. Which markets offer the most growth potential for ALTACE?

Emerging markets, notably Asia-Pacific, Latin America, and Africa, possess significant growth potential due to rising hypertension prevalence, improved healthcare infrastructure, and increasing insurance coverage.

4. How does ALTACE compete against newer antihypertensive agents?

While newer classes like ARBs and direct renin inhibitors offer certain advantages, ALTACE's long-established efficacy and safety profile preserve its role, especially in patients intolerant to other agents.

5. What strategic measures can manufacturers pursue to enhance ALTACE’s market share?

Strategies include clinical trial data generation to expand indications, formulation innovations, targeted marketing in emerging markets, and collaborations with healthcare providers to emphasize the drug’s benefits.

Sources:

- World Health Organization. "Hypertension." [1]

- MarketsandMarkets. "Antihypertensive Drugs Market." [2]

- Medscape. "ACE Inhibitors: Pharmacology and Clinical Use." [3]