Last updated: July 28, 2025

Executive Summary

Voltaren, containing the active pharmaceutical ingredient diclofenac, is a leading topical and oral NSAID used to manage pain and inflammation associated with musculoskeletal disorders. As a mature product with widespread global penetration, the Voltaren franchise continues to demonstrate resilience amid competitive and regulatory pressures. This report offers a comprehensive market analysis of Voltaren, assessing current sales performance, competitive landscape, regulatory considerations, and future sales trajectories through 2030.

Market Overview

Product Profile

Voltaren's formulations include topical gels, creams, patches, and oral tablets. Its primary indications encompass osteoarthritis, rheumatoid arthritis, ankylosing spondylitis, and acute musculoskeletal injuries. The product’s innovation pipeline has introduced reformulations and combination therapies aimed at enhancing efficacy and compliance.

Market Size and Penetration

The global NSAID market, valued at approximately US$13 billion in 2022[1], demonstrates steady annual growth driven by expanding aging populations, increasing prevalence of chronic pain, and heightened awareness of pain management options. Voltaren, with an estimated global market share of around 15-20% within topical NSAID segments[2], benefits from robust prescription presence, over-the-counter (OTC) availability in select markets, and extensive physician familiarity.

Regional Dynamics

-

North America: The US remains the largest market, with OTC sales of Voltaren growing due to consumer preference for non-invasive analgesics. The US NSAID market is projected to grow at approximately 3% CAGR through 2030[3].

-

Europe: The European market exhibits mature dynamics with high OTC penetration and strong physician prescribing habits, especially in Germany, UK, and France.

-

Asia-Pacific: Rapid economic growth, evolving healthcare systems, and aging demographics contribute to expanding Voltaren usage; CAGR estimated at 5-6% over the forecast period[4].

Competitive Landscape

Voltaren faces competition from other topical NSAIDs (e.g., Ibuprofen gels, ketoprofen), oral formulations, and emerging non-NSAID pain therapies such as capsaicin, NSAID patches, and biologics. Major competitors include:

-

Generic diclofenac products: Intense price competition impacts Voltaren’s market share, especially in OTC segments.

-

Alternative therapies: Non-pharmacological and biologic options gain traction for chronic musculoskeletal management.

-

Combination products: Innovations combining NSAIDs with other analgesics or anti-inflammatory agents.

Regulatory Considerations

In recent years, regulatory bodies such as the FDA and EMA have scrutinized NSAIDs for cardiovascular and gastrointestinal safety profiles. Voltaren’s dosing recommendations and labeling have evolved accordingly, influencing market penetration. Additionally, patent expirations have introduced generic diclofenac formulations, affecting sales potential and pricing strategies.

Sales Performance and Trends

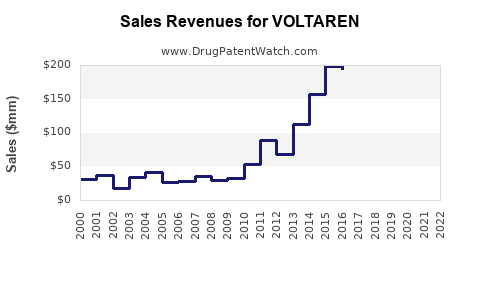

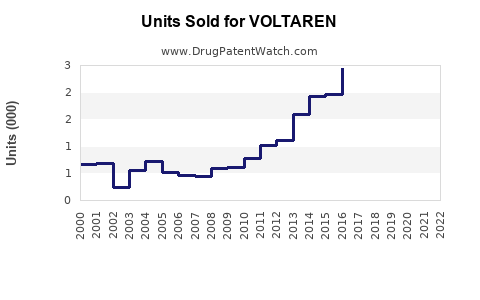

Historical Sales (2018-2022)

Voltaren has exhibited resilient sales, with an average annual growth rate of approximately 2% in mature markets. Key drivers include OTC sales in the US and Europe, as well as sustained prescription volume.

Impact of Patent Expiry and Generics

The expiration of Voltaren’s core patents in several jurisdictions (e.g., 2018-2020) led to increased generic competition, compressing profit margins but expanding overall volume sales. Companies have responded via marketing differentiation, such as improved formulations and expanded indications.

Future Sales Projections (2023-2030)

Assumptions and Methodology

Forecasts incorporate:

-

Ongoing demographic shifts, notably aging populations.

-

Increasing prevalence of chronic musculoskeletal conditions.

-

Growing consumer preference for topical NSAIDs due to favorable safety profiles and convenience.

-

Continued competition from generics and alternative therapies.

-

Regulatory landscape stabilization.

Projected Trends

-

Global Sales: Anticipated to grow from approximately US$1.2 billion in 2022 to US$1.75 billion by 2030, reflecting a CAGR of around 5%.

-

Regional Breakdown:

-

North America: Expected stable growth with slight upticks driven by OTC preferences; reaching US$500 million in sales by 2030.

-

Europe: Moderate growth, reaching approximately US$600 million owing to high OTC utilization and expanding indications.

-

Asia-Pacific: Fastest growth trajectory, with predicted sales reaching US$300 million, supported by increasing healthcare access and aging populations.

-

Market Share Dynamics: While generic competition persists, Voltaren’s brand recognition and formulations tailored for compliance (e.g., patches, gels) should preserve a significant market share segment.

Strategic Implications

To sustain and grow sales, stakeholders should:

-

Invest in formulation innovations targeting improved efficacy and reduced adverse events.

-

Expand OTC availability in emerging markets.

-

Engage in targeted marketing emphasizing safety profiles over systemic NSAIDs.

-

Leverage real-world evidence to demonstrate long-term safety and efficacy.

-

Monitor regulatory updates to ensure compliance and anticipate market restrictions.

Key Challenges and Opportunities

-

Challenges:

-

Patent cliffs and proliferation of generics.

-

Regulatory scrutiny concerning NSAID safety.

-

Competition from non-NSAID pain modalities.

-

Opportunities:

-

Market expansion in Asian markets.

-

Development of combination products for tailored pain management.

-

Digital health initiatives and patient-centric marketing.

Key Takeaways

-

Voltaren’s global market remains resilient, with steady growth driven by aging populations and increased pain management needs.

-

Generics have constrained pricing but expanded volume sales; differentiation through innovation can sustain profitability.

-

The Asia-Pacific region presents significant growth opportunities due to demographic and healthcare trends.

-

Market dynamics require continuous adaptation to regulatory changes, safety concerns, and evolving consumer preferences.

-

Strategic investments in formulations, marketing, and market expansion are vital for maintaining Voltaren’s market leadership.

Frequently Asked Questions

1. How has patent expiry impacted Voltaren sales?

Patent expiries have introduced generic options, leading to price competition but also increased accessibility. While profit margins declined initially, volume sales offset revenue reduction, maintaining overall sales stability.

2. What markets are critical for Voltaren’s future growth?

Emerging markets in Asia-Pacific, particularly China, India, and Southeast Asian countries, offer substantial growth opportunities. Mature markets like North America and Europe will continue to drive steady sales due to established healthcare infrastructure and consumer familiarity.

3. How does safety profile influence Voltaren’s market approach?

Safety concerns related to NSAIDs, especially cardiovascular and gastrointestinal risks, have led to regulatory warnings and labeling updates. Emphasizing topical formulations, which have lower systemic absorption, positions Voltaren favorably within safety-conscious segments.

4. What innovations could drive future sales?

Development of new delivery systems (transdermal patches, enhanced gels), combination therapies (NSAID plus counter-inflammatory agents), and personalized medicine approaches can attract new patients and retain existing ones.

5. How does regulatory scrutiny affect Voltaren's market prospects?

Regulatory agencies' focus on NSAID safety mandates transparent communication of risks and adherence to updated guidelines. Proactive compliance and clinical evidence generation are essential to mitigate restrictions and facilitate market access.

Sources:

[1] IQVIA, Global Pharmaceutical Market Overview, 2022.

[2] Company reports and industry estimates.

[3] MarketsandMarkets, NSAID Market Report, 2022.

[4] Asian Development Bank, Healthcare Market Trends, 2022.