Last updated: July 29, 2025

Introduction

Verapamil, a calcium channel blocker primarily indicated for hypertension, angina pectoris, and certain cardiac arrhythmias, remains a cornerstone in cardiovascular therapeutics. With its established efficacy and generic availability, the drug’s market dynamics are influenced by regulatory, competitive, and technological factors. This analysis delineates current market conditions and offers sales projections grounded in epidemiological trends, patent landscapes, and emerging therapeutic applications.

Market Overview

Global Market Context

The global calcium channel blocker market was valued at approximately USD 2.8 billion in 2021 and is projected to reach USD 3.6 billion by 2028, expanding at a compound annual growth rate (CAGR) of around 4.2% (2022-2028) [1]. Verapamil, representing a substantial segment within this category, benefits from its long-standing clinical efficacy but faces commercialization challenges due to patent expirations and generic competition.

Key Indications and Patient Populations

Verapamil’s primary indications—hypertension, angina, and arrhythmias—cover a vast patient demographic. The global prevalence of hypertension alone exceeds 1.3 billion individuals, with approximately 30% receiving pharmacological treatment [2]. The angina pectoris population is estimated at 9 million globally, with significant overlaps with hypertensive cohorts [3]. The large patient base supports a resilient demand outlook.

Market Drivers

- Increasing Hypertension Prevalence: Elevated incidence rates in aging populations drive consistent demand.

- Shift Towards Oral, Low-Cost Medications: As a well-established generic drug, verapamil remains a cost-effective therapy.

- Expanding Use in Arrhythmia Management: Emerging evidence supports its adjunctive role, expanding utilization.

Market Challenges

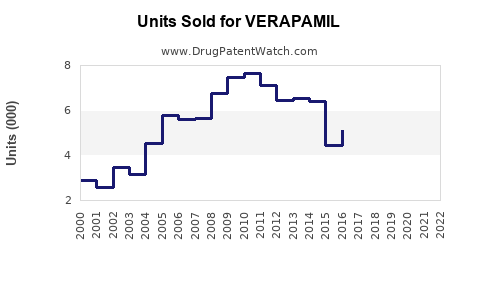

- Generic Competition: Patent expiration of several formulations has led to intense price competition.

- Preference for Newer Agents: Angiotensin receptor blockers (ARBs) and novel antihypertensives are capturing market share.

- Limited Innovation: Minimal pipeline for verapamil-based derivatives constrains product differentiation.

Market Segmentation

- Geographical Distribution: North America dominates accounting for roughly 40% of sales, driven by high hypertension awareness and healthcare access, followed by Europe and Asia-Pacific.

- Formulation Types: Immediate-release verapamil remains dominant; sustained-release formulations are gaining popularity for improved adherence.

- End-User Segments: Hospitals, outpatient clinics, and pharmacies constitute primary sales channels, with increasing OTC availability in some regions.

Competitive Landscape

Major players include Mylan, Teva, Sandoz, and local generic manufacturers. While brand-name formulations exist, generics capture over 85% of the market in mature regions [4]. Patent cliffs in various formulations necessitate strategic pricing and marketing efforts to sustain revenues.

Emerging Trends

- Combination Therapies: Verapamil inclusion in fixed-dose combinations with other antihypertensives to improve compliance.

- Regulatory Approvals for New Indications: Limited expansion potential but possible for niche uses such as cluster headaches, benefiting niche markets.

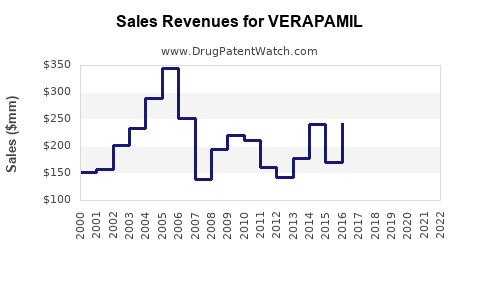

Sales Projections (2023-2030)

Baseline Scenario

Assuming steady growth driven by existing indications and modest expansion into new indications, global verapamil sales are projected to grow at a CAGR of 2.5%, reaching approximately USD 1.2 billion by 2030. This projection factors in the sustained demand for established therapies, offset by generic pricing pressures.

Best-Case Scenario

If a significant pipeline innovation or regulatory approval facilitates new indications or formulations, sales could exceed USD 1.4 billion by 2030, with a CAGR of roughly 4%.

Worst-Case Scenario

Increased market saturation and aggressive competition may depress growth to below 1%, stagnating sales near USD 1 billion by 2030.

Regional Outlook

- North America: Expected to hold over 45% of sales, benefiting from high disease prevalence and well-established distribution networks.

- Asia-Pacific: Fast-growing markets (CAGR ~4%), driven by increasing hypertension awareness and healthcare infrastructure development.

- Europe: Moderate growth, influenced by healthcare reforms and patent expiries.

Regulatory and Patent Landscape Implications

Patent expiries across various verapamil formulations have catalyzed generic proliferation, pressuring prices but expanding volume. Regulatory bodies may facilitate entry of biosimilars or new formulations, influencing future sales trajectories [5].

Conclusion

Verapamil's market sustains robust demand rooted in its proven clinical profile and broad patient base. The landscape presents moderate growth opportunities, primarily in emerging markets and through formulation innovations. Companies investing in marketing strategies, cost-effective manufacturing, and niche indications can capitalize on stable revenue streams.

Key Takeaways

- Verapamil remains a vital component in cardiovascular drug therapy, with a resilient market supported by global hypertension and angina prevalence.

- Generics dominate sales, but price competition and patent expiries necessitate differentiation strategies.

- Asia-Pacific and emerging markets represent lucrative expansion opportunities due to rising disease burden and healthcare access improvements.

- Innovative formulations and niche indications could offset commoditization pressures, boosting sales.

- Market growth is expected to modestly accelerate, reaching approximately USD 1.2 billion globally by 2030 under current trends.

FAQs

-

How do patent expirations affect verapamil's market share?

Patent expiries have led to a surge in generic competitors, reducing pricing power and profit margins, but increasing overall volume sales.

-

What are the main therapeutic areas driving verapamil demand?

Hypertension, angina pectoris, and cardiac arrhythmias are the primary drivers, supported by its effectiveness and low cost.

-

Are there emerging indications for verapamil?

Yes. Off-label uses like cluster headaches are gaining recognition, and research into new indications may open additional markets.

-

How is the competitive landscape evolving?

The market is highly commoditized with intense price competition; innovation in formulations and combination therapies remains limited but necessary for differentiation.

-

What are the key markets for verapamil growth?

North America and Europe are mature but saturated; Asia-Pacific and Latin America present high-growth potential owing to increasing cardiovascular disease burden.

References

[1] MarketsandMarkets, "Calcium Channel Blockers Market," 2022.

[2] World Health Organization, "Global Hypertension Prevalence," 2021.

[3] American Heart Association, "Angina Pectoris Epidemiology," 2020.

[4] IQVIA, "Generic Drug Market Trends," 2022.

[5] U.S. Food and Drug Administration, "Patent Cliff Reports," 2021.