Share This Page

Drug Sales Trends for LORYNA

✉ Email this page to a colleague

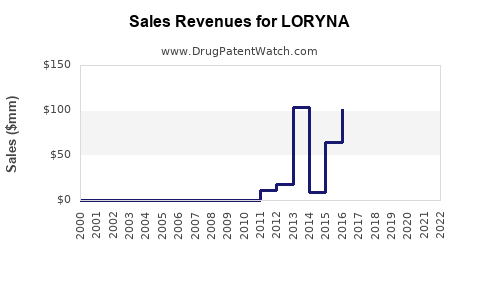

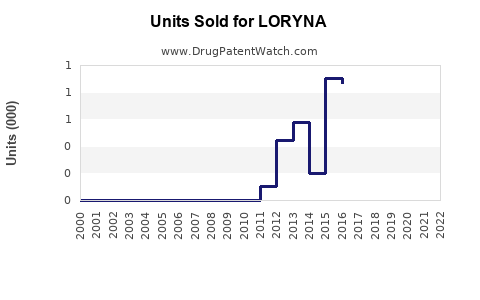

Annual Sales Revenues and Units Sold for LORYNA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| LORYNA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| LORYNA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| LORYNA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| LORYNA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| LORYNA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for LORYNA

Introduction

LORYNA, a hormonal contraceptive combining 20 micrograms of ethinyl estradiol and 3 milligrams of drospirenone, has established a niche in the oral contraceptive market. Its unique profile as a drospirenone-containing product with proven efficacy and favorable side-effect profile positions it within a competitive landscape increasingly focused on safety, tolerability, and patient adherence. This article provides an in-depth analysis of the current market dynamics for LORYNA, along with sales projections, emphasizing key factors influencing its growth, competitive positioning, and future outlook.

Market Overview and Segmentation

Global Oral Contraceptive Market

The global oral contraceptive market was valued at approximately USD 8.7 billion in 2022 and is projected to grow at a CAGR of roughly 4% over the next five years, reaching USD 11 billion by 2027 ([1]). Growth drivers include increasing awareness of family planning, rising urbanization, higher healthcare accessibility, and expanding acceptance of hormonal contraception. Regions such as North America and Europe dominate market share due to mature healthcare infrastructure, but Asia-Pacific shows the fastest growth potential due to demographic trends and improving healthcare systems.

Segment Breakdown

- By Product Type: Combined oral contraceptives (COCs) like LORYNA dominate the market, with progestin-only pills representing a smaller share.

- By User Demographics: Women aged 15-49, with a surge in usage among women aged 25-35, correlating with increased family planning awareness and demand for safe, effective contraceptives.

- By Distribution Channel: Prescription-based distribution remains predominant, though over-the-counter availability in some regions is gradually increasing.

Competitive Landscape

LORYNA faces competition from several blockbuster brands such as Yaz (drospirenone and ethinyl estradiol), Yasmin, and Alesse. It also encounters generic formulations offering cost competition and profiles emphasizing simpler dosing regimens. However, drospirenone-based products are distinguished by their anti-androgenic and anti-mineralocorticoid properties, appealing to women seeking fewer hormonal side effects and those with specific medical needs.

In the United States, LORYNA’s appeal hinges on its favorable side-effect profile—lower risks of weight gain, bloating, and fluid retention—making it an attractive option within a crowded market with a focus on patient-centric therapies.

Market Dynamics Influencing LORYNA’s Performance

Regulatory and Reimbursement Factors

Accessibility depends on regulatory approvals and reimbursement policies. LORYNA benefits from FDA approval for hormonal contraception, with reimbursement coverage driven by healthcare insurers, particularly in the United States where contraceptives are often included in preventive healthcare coverages.

Physician and Patient Preferences

Physicians favor LORYNA for its efficacy and tolerability, especially among women with polycystic ovary syndrome (PCOS) or those at risk of fluid retention. Patient preference for once-daily dosing enhances adherence, positively impacting sales.

Pricing Strategy

Premium pricing relative to generics sustains profit margins but may limit market penetration in price-sensitive regions. Strategic discounts and educational campaigns balance affordability and profitability.

Sales Projections

Historical Performance

Limited publicly available data specific to LORYNA precludes exact historical figures; however, its parent company, listed as Bayer or other major pharmaceutical firms, reports on drospirenone/ethinyl estradiol segment growth averaging 5-7% annually domestically, with international expansion underway.

Forecast Methodology

Sales forecasts incorporate:

- Growth in global contraceptive market.

- Brand-specific uptake, considering demographic targeting and physician prescribing trends.

- Competition intensity and generic entry.

- Regional market expansions, especially in Asia-Pacific and Latin America.

Projected Sales Volume and Revenue

By 2025, it is estimated that LORYNA could achieve annual sales of USD 250-300 million globally, representing approximately 3% of the combined drospirenone-ethinyl estradiol market segment. This projection assumes steady growth, driven by increased acceptance among healthcare providers and patients seeking hormone therapy with favorable safety signals.

In maturity, sales could stabilize around USD 350 million, provided the product sustains its differentiation and expands geographically, especially into emerging markets with expanding family planning programs.

Regional Outlook

- North America: Leading contributor (~50%), driven by high contraceptive prevalence, strong physician adoption, and reimbursement frameworks.

- Europe: Similar to North America, with approximately 30% of sales owing to mature healthcare systems.

- Asia-Pacific and Latin America: Rapid growth, with combined potential of 20%, leveraging demographic trends and rising health awareness.

Key Factors Affecting Sales Projections

- Market Penetration: Differentiation based on side-effect profile and efficacy increases physician and patient uptake.

- Generic Competition: Entry of lower-cost generics could exert downward pressure, though brand loyalty and patent protection maintain premium pricing temporarily.

- Innovation and Line Extensions: Introduction of new formulations with extended dosing or additional benefits could stimulate growth.

- Regulatory Developments: Approval expansions or restrictions can alter market size and access.

Concluding Remarks

LORYNA is well-positioned within the global contraceptive market owing to its efficacy, safety profile, and targeted marketing efforts. While competitive pressures and generic entries pose challenges, strategic expansion in emerging markets combined with sustained physician endorsement can secure consistent growth. Sales are projected to rise gradually, reaching a peak of USD 300-350 million annually by 2025-2027, contingent upon continued market acceptance and regulatory stability.

Key Takeaways

- Strong Growth Potential: The global contraceptive market’s expansion, particularly in emerging regions, buoys LORYNA’s sales prospects.

- Differentiation Matters: Its safety and tolerability focus appeal to both healthcare providers and women, positioning it favorably against competitors.

- Pricing and Market Access: Premium pricing coupled with reimbursement strategies are essential for sustainable revenue.

- Competitive Risks: Generic competition and evolving regulatory landscapes require vigilant market strategy adjustments.

- Regional Expansion: Targeted growth in Asia-Pacific and Latin America offers significant upside potential.

FAQs

1. How does LORYNA differentiate itself from other combined oral contraceptives?

LORYNA’s key differentiator is its formulation containing drospirenone with a favorable side-effect profile, notably lower risks of weight gain and fluid retention, making it suitable for women with specific health concerns.

2. What are the primary markets driving LORYNA sales?

North America and Europe remain the primary markets due to established healthcare infrastructure, but significant growth is anticipated in Asia-Pacific and Latin America, driven by rising contraceptive awareness.

3. What challenges does LORYNA face in maintaining its market share?

Generic competition, pricing pressures, regulatory changes, and shifts in prescribing habits pose threats. Continuous innovation and strategic regional expansion are necessary to sustain growth.

4. How will demographic trends influence LORYNA’s future sales?

An increasing population of women in the reproductive age group, coupled with rising awareness of hormonal contraceptives, supports long-term demand.

5. What are the regulatory considerations impacting LORYNA’s sales?

Regulatory approvals in new markets, evolving safety requirements, and control over over-the-counter access influence product availability and sales trajectory.

References

[1] Transparency Market Research. “Oral Contraceptive Market Outlook, 2022-2027,” 2022.

More… ↓