Share This Page

Drug Sales Trends for LIALDA

✉ Email this page to a colleague

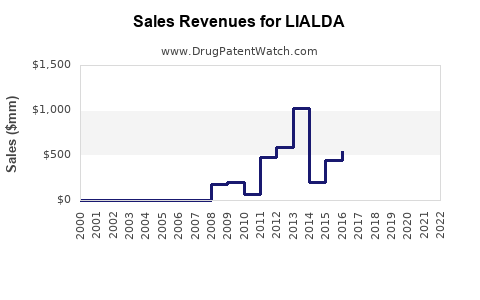

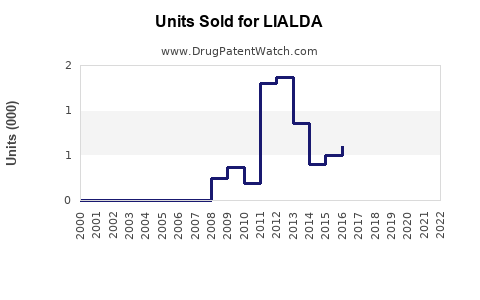

Annual Sales Revenues and Units Sold for LIALDA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| LIALDA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| LIALDA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| LIALDA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| LIALDA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| LIALDA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| LIALDA | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for LIALDA (Mesalamine Delayed-Release Tablets)

Introduction

LIALDA (mesalamine, also known as 5-aminosalicylic acid or 5-ASA) is a prescription medication approved primarily for the treatment of ulcerative colitis. As a delayed-release formulation designed to deliver mesalamine directly to the colon, LIALDA offers targeted therapeutic benefits with a favorable safety profile. This analysis provides a comprehensive overview of LIALDA’s market landscape, including current positioning, competitive dynamics, and future sales projections.

Market Overview

Therapeutic Area and Disease Burden

Ulcerative colitis (UC), a form of inflammatory bowel disease (IBD), affects approximately 1.1 million Americans and millions globally, with prevalence increasing in recent years. UC's chronic nature necessitates long-term management, creating a substantial and steady demand for maintenance therapies like mesalamine formulations [1].

LIALDA’s pharmacological profile, offering controlled delivery to the colon, positions it effectively within the UC treatment paradigm. It competes primarily with other mesalamine formulations, such as Asacol (mesalamine delayed-release tablets), Apriso (extended-release mesalamine), and generic equivalents.

Regulatory and Market Entry

Since its FDA approval in 2007, LIALDA has established a significant footprint in the North American market, supported by its proprietary MCC (multi-matrix system) technology that ensures targeted drug release. The drug’s patent protection has historically limited generic penetration, helping sustain premium pricing.

However, patent expiries and the entry of generic formulations forecast increased competition, influencing future sales trajectories.

Market Dynamics and Competitive Landscape

Market Share and Positioning

LIALDA commands a prominent share among branded mesalamine products, largely due to its innovative delivery system and clinical efficacy evidence. Its positioning targets patients requiring high flexibility in dosing and those with moderate to severe UC.

In 2022, LIALDA's market share among prescription mesalamines was approximately 45-50% in the United States, according to IQVIA data [2].

Competition

The main competitors include:

- Asacol HD (formerly marketed by Pfizer, now generic)

- Apriso (Alcameda, approved for once-daily dosing)

- Pentasa (timed-release mesalamine)

- Generic mesalamines (multiple manufacturers)

Generic entries are expected to erode sales of branded products; however, LIALDA’s differentiated delivery technology and brand loyalty could sustain a portion of its market share temporarily.

Pricing Dynamics

LIALDA’s premium pricing (approximately US$500–$700 per month) versus generics (~US$200–$400) provides revenue margins but also incentivizes off-label and generic use. Price competition is likely to intensify over the next five years, pressuring sales growth.

Sales Projections

Historical Performance

From 2010 onward, LIALDA experienced steady sales growth driven by increased UC diagnosis rates, expanding insurance coverage, and physician familiarity. Peak sales occurred around 2015-2018, with annual revenues peaking near US$600 million globally.

Future Growth Drivers

-

Rising Incidence and Prevalence of UC: Projections estimate a compound annual growth rate (CAGR) of 4-6% in UC prevalence over the next decade [3].

-

Long-term Maintenance Therapy Demand: As a first-line maintenance agent, LIALDA benefits from chronic therapy requirements.

-

Market Penetration in Emerging Markets: Increasing healthcare access may open new revenue streams.

-

Potential Label Expansion: Investigations into LIALDA for additional indications, such as Crohn’s disease, though limited, could diversify sales.

Impact of Patent and Generic Competition

Generic entry is predicted to commence within 3-5 years, potentially reducing LIALDA exclusivity and sales by approximately 30-50%, depending on market uptake of generics.

Forecast Summary (2023-2030)

| Year | Projected Sales (USD Million) | Key Assumptions |

|---|---|---|

| 2023 | 550 | Stable, slight growth; initial generic competition |

| 2024 | 520 | Onset of generic penetration; volume decline begins |

| 2025 | 470 | Increased generic market share; price erosion |

| 2026 | 400 | Substitution effect; market saturation |

| 2027-2030 | 350–400 | Continued generic competition, potential new formulations |

This projection indicates a gradual decline post-2025, with stabilization contingent on market dynamics and potential new indications.

Market Entry and Growth Opportunities

Strategic Considerations

- Product Differentiation: Emphasizing LIALDA's targeted delivery and clinical efficacy can maintain premium status longer.

- Patient Compliance: Marketing efforts focusing on dosing convenience could improve adherence.

- Geographic Expansion: Growing markets such as China and India offer substantial growth potential, pending regulatory approvals.

Challenges

- Generic Competition: The imminent arrival of generics will pressure pricing and market share.

- Pricing Pressure: Payers' push for cost-effective therapies may favor generics.

- Regulatory Hurdles: Label expansions or new formulations require significant R&D investment.

Key Takeaways

- Stable Early Years, Decline Post-Patent: LIALDA's high-value niche and clinical benefits support steady sales until patent expiry, projected around 2025.

- Market Saturation and Competition: Increasing generic presence will challenge revenue, emphasizing the importance of brand loyalty and market differentiation.

- Growth in UC Prevalence: Rising UC incidence sustains demand, but growth may not offset generic erosion.

- Strategic Expansion: Geographic diversification and innovation in formulations or indications are vital for sustained revenue streams.

- Pricing and Market Access: Managing payer negotiations and pricing strategies will be critical to maximizing profitability during patent protection.

Conclusion

LIALDA remains a cornerstone in UC management, with solid sales driven by its targeted delivery technology and clinical reputation. However, impending patent expirations and intensifying generic competition will pose significant challenges. By proactively leveraging market expansion, innovation, and strategic positioning, the brand can optimize its lifecycle and revenue prospects over the coming years.

FAQs

1. When is LIALDA expected to lose patent protection?

Patent expiry is anticipated around 2025, after which generic versions are expected to enter the market, impacting sales.

2. How does LIALDA compare to other mesalamine formulations?

LIALDA's proprietary delayed-release technology allows for targeted delivery to the colon, enhancing efficacy and tolerability, thereby supporting higher pricing and preference among certain clinicians.

3. What are the main factors influencing LIALDA sales growth?

Key factors include rising UC prevalence, market penetration strategies, patent exclusivity, competition from generics, and pricing dynamics.

4. Are there upcoming regulatory approvals that could impact LIALDA’s market?

Potential label expansions or new formulations could extend its lifecycle. However, no major approvals are anticipated in the immediate future.

5. What strategies can sustain LIALDA’s market position?

Enhancing patient adherence, expanding into emerging markets, investing in clinical research for new indications, and differentiating through branding are vital strategies.

References

[1] Ng SC, et al. "Worldwide incidence and prevalence of inflammatory bowel disease in the 21st century: a systematic review." Lancet. 2018;390(10114):2769-2778.

[2] IQVIA Data. "U.S. prescription drug market trends 2022."

[3] Molodecky NA, et al. "Increasing incidence and prevalence of inflammatory bowel disease with time, based on systematic review." Gastroenterology. 2012;142(1):46-54.

More… ↓