Share This Page

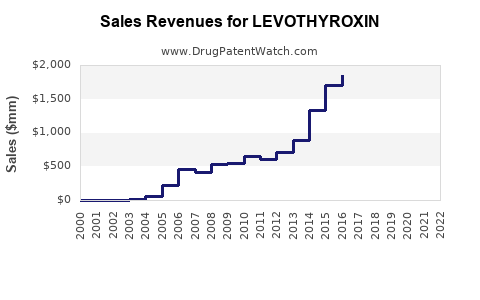

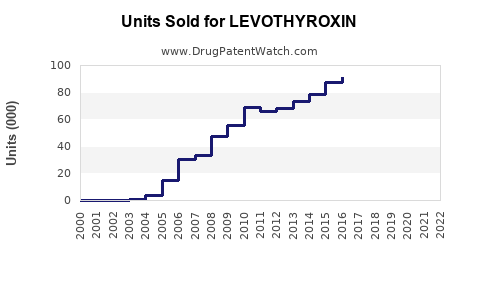

Drug Sales Trends for LEVOTHYROXIN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for LEVOTHYROXIN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| LEVOTHYROXIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| LEVOTHYROXIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| LEVOTHYROXIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| LEVOTHYROXIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| LEVOTHYROXIN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Levothyroxine

Introduction

Levothyroxine, a synthetic form of the thyroid hormone thyroxine (T4), remains the frontline treatment for hypothyroidism. As a globally prescribed medication, its market dynamics are influenced by factors such as increasing prevalence of thyroid disorders, aging populations, and expanding healthcare infrastructure. This analysis synthesizes current market trends, competitive landscape, and future sales projections to inform strategic decisions for stakeholders involved in the pharmaceutical sector.

Market Overview

Levothyroxine's global market is driven by its established position as the standard therapy for hypothyroidism, a condition affecting approximately 4.6% of the population in the United States alone, according to the American Thyroid Association (ATA) [1]. The drug's patent status varies by region, with many formulations now available as generics, facilitating widespread accessibility.

Key Drivers

-

Rising Prevalence of Thyroid Disorders: The incidence of hypothyroidism is increasing, influenced by autoimmune diseases like Hashimoto's thyroiditis, iodine deficiency, and environmental factors [2].

-

Aging Population: Older demographics are more susceptible to thyroid disorders, expanding the potential patient base.

-

Diagnostic Advancements: Improved screening and diagnostic procedures have led to higher detection rates.

-

Healthcare Access and Awareness: Growing awareness and expanding healthcare infrastructure in emerging markets improve prescription rates.

Market Limiters

-

Generic Competition: Numerous manufacturers produce generic levothyroxine, intensifying price competition.

-

Formulation Variability: Concerns over bioequivalence among different generics can affect prescribing patterns.

-

Market Saturation in Developed Countries: Mature markets such as North America and Europe show slower growth rates due to high penetration levels.

Regional Dynamics

-

North America: Dominates due to high hypothyroidism prevalence and robust healthcare systems. The U.S. accounts for over 50% of the global market share [3].

-

Europe: Exhibits steady growth driven by aging demographics and healthcare upgrades.

-

Asia-Pacific: Represents the fastest-growing market, attributed to increasing healthcare spending, iodine deficiency correction programs, and expanding pharmaceutical manufacturing capabilities.

-

Latin America and Middle East: Moderate growth prospects, with markets opening up due to increased healthcare access.

Competitive Landscape

The levothyroxine market comprises brand-name drugs and a vast array of generics. Key players include Merck, Pfizer, and Teva Pharmaceuticals, among others. While brand-name formulations like Synthroid (by AbbVie, formerly Pfizer) maintain significant market share—especially in the U.S.—generics dominate in volume due to cost advantages.

Notably, the market faces quality assurance challenges, with some generic formulations facing scrutiny over bioequivalence. Regulatory bodies like the FDA and EMA enforce strict standards to address these concerns.

Sales Projections (2023-2030)

Forecasts predict a compounded annual growth rate (CAGR) of approximately 3-5% over the next seven years, reaching an estimated $1.8 billion to $2.2 billion globally by 2030 [4].

Factors Supporting Growth

-

Disease Prevalence: Continued increase in hypothyroidism cases, especially among aging populations.

-

Market Expansion: Emerging markets’ expanding healthcare infrastructure and improved diagnostic capacity.

-

Generic Market Penetration: Lower prices and increased manufacturing encourage broader access.

Potential Market Challenges

-

Market Saturation: Mature regions may experience plateauing sales.

-

Regulatory Risks: Any new regulations or reformulations addressing bioequivalence or bioavailability could impact sales.

-

Emerging Alternatives: Novel therapies or formulations could disrupt existing preferences.

Segment-Specific Projections

-

Generic Levothyroxine: Expected to retain dominant market share due to price competitiveness, with sales growing at a CAGR of approximately 4%.

-

Branded Formulations: Will see slower growth, limited primarily to premium or specialized markets, at roughly 2-3% CAGR.

-

Emerging Markets: Projected to exhibit higher CAGR (~6-8%) owing to expanding healthcare coverage.

Strategic Implications

Stakeholders should focus on maintaining quality standards, optimizing manufacturing efficiencies, and penetrating emerging markets to capitalize on growth trends. Investment in regulatory compliance and supply chain robustness will mitigate risks associated with reformulation mandates and bioequivalence concerns.

Conclusion

Levothyroxine’s market remains resilient, fueled by increasing thyroid disorder prevalence, demographic shifts, and expanding healthcare access in emerging regions. While mature markets may face saturation, emerging economies present significant opportunities. Strategic positioning—especially emphasizing quality and cost-effectiveness—enables companies to harness projected growth effectively.

Key Takeaways

-

The global levothyroxine market is projected to reach over $2 billion by 2030, with a CAGR of 3-5%.

-

Development in emerging markets offers substantial opportunities, with regional CAGRs exceeding 6%.

-

Generic formulations dominate the market, necessitating a focus on quality assurance to maintain competitive advantage.

-

Increasing thyroid disorder prevalence and improved diagnostics underpin ongoing demand; however, market saturation in developed regions requires diversification strategies.

-

Regulatory environments and bioequivalence standards remain critical factors influencing market stability and growth.

FAQs

1. How does the rise in autoimmune diseases influence levothyroxine sales?

Autoimmune conditions like Hashimoto's thyroiditis are leading causes of hypothyroidism, boosting the demand for levothyroxine therapy worldwide.

2. What impact do generic drugs have on levothyroxine market sales?

Generics drive volume sales through lower prices, expanding accessibility, though they heighten competition and potentially pressure profit margins.

3. Are there upcoming regulatory changes that could affect the levothyroxine market?

Regulatory scrutiny over bioequivalence and formulation consistency could influence manufacturing standards, impacting availability and pricing.

4. Which regions are poised for the highest growth in levothyroxine sales?

Asia-Pacific and Latin America are expected to see the most significant growth owing to expanding healthcare infrastructure and rising disease recognition.

5. How might emerging therapies disrupt the current market?

Innovative treatments, such as alternative thyroid hormone formulations or combination therapies, could challenge traditional levothyroxine use if proven superior or cost-effective.

Sources

[1] American Thyroid Association. (2022). Hypothyroidism Factsheet.

[2] Pearce, S. H., & Korevaar, T. I. (2017). The Epidemiology of Thyroid Disease. Journal of Endocrinology.

[3] GlobalData. (2022). Levothyroxine Market Report.

[4] MarketWatch. (2023). Levothyroxine Market Forecast and Trends.

More… ↓