Last updated: July 28, 2025

Introduction

Vardenafil, marketed under the brand name LEVI TRA, is a phosphodiesterase type 5 (PDE5) inhibitor primarily indicated for the treatment of erectile dysfunction (ED). Launched in 2003 by Bayer Pharmaceuticals, LEVITRA has maintained a significant position in the ED treatment landscape. Its efficacy, rapid onset of action, and favorable side effect profile have contributed to its sustained market presence. This report offers a comprehensive market analysis and sales projections for LEVITRA, considering current market dynamics, competitive landscape, regulatory environment, and emerging trends.

Market Overview

Global Erectile Dysfunction Market

The global ED market was valued at approximately USD 4.3 billion in 2022 and is projected to reach USD 6.8 billion by 2030, expanding at a compound annual growth rate (CAGR) of around 5.8% [1]. This growth is driven by increasing prevalence of ED, rising awareness, and expanding approved indications for PDE5 inhibitors (PDE5is).

Key Drivers

- Growing Aging Population: Aging men are more susceptible to ED due to physiological changes, chronic illnesses, and medication side effects [2].

- Enhanced Diagnosis and Awareness: Improved awareness campaigns and better diagnostic tools have increased diagnosis rates.

- Expanding Indications: PDE5 inhibitors are increasingly being used for other conditions like pulmonary hypertension (e.g., Riociguat), influencing overall market dynamics.

Market Segments

- Brand-Name Drugs: LEVITRA, Viagra (sildenafil), Cialis (tadalafil), Stendra (avanafil).

- Generic Competitive Market: U.S. FDA’s patent expirations have led to generic versions of sildenafil and tadalafil, exerting price pressure.

- Over-the-Counter (OTC) and Telehealth: Growth of telemedicine platforms enables easier access, expanding the market.

Competitive Landscape

Major Players

- Bayer (LEVITRA)

- Pfizer (Viagra)

- Eli Lilly (Cialis)

- Vivus (Stendra)

- Generic Manufacturers

Market Position of LEVITRA

LEVITRA maintains a competitive niche due to its rapid onset—often within 15-30 minutes—and favorable tolerability. However, intense competition from Cialis, which offers a longer duration, and Viagra, a well-established brand, limits LEVITRA’s market share.

Patent and Regulatory Milestones

- Bayer’s patent for LEVITRA expired in numerous markets around 2020, leading to increasing generic competition.

- In the U.S., the patent expiry allowed generic versions, resulting in price erosion.

- Regulatory pathways for biosimilars and OTC availability remain under consideration in various jurisdictions.

Market Challenges

- Price Erosion: Competition from generics constrains pricing and margins.

- Patient Preference: Tadalafil’s long duration (up to 36 hours) attracts many, potentially affecting LEVITRA's sales.

- Side Effect Profile: While generally well-tolerated, adverse effects such as headache, flushing, and nasal congestion influence prescribing behaviors.

Sales Projections for LEVITRA

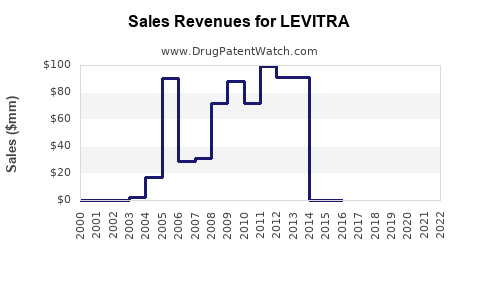

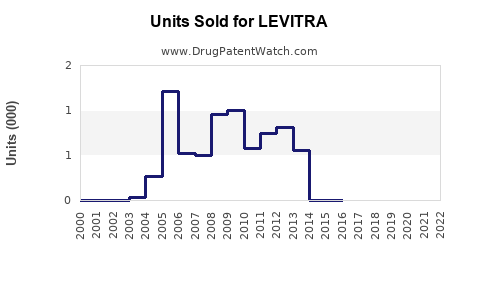

Historical Sales Performance

From 2005 through 2022, LEVITRA experienced steady growth, peaking around USD 450 million in global sales in 2011 [3]. Post-patent expiry in key markets, sales declined due to generic competition but stabilized somewhat through increased international sales and new indications.

Forecasting Assumptions

- Market Penetration: LEVITRA retains a loyal segment due to its rapid onset.

- Competitive Dynamics: Generic erosion persists; however, Bayer’s strategic marketing and formulation innovations will sustain incremental revenues.

- Regulatory Environment: Potential approval of OTC or over-the-counter use could expand markets but may diminish premium pricing.

- Geographic Expansion: Increased penetration in emerging markets (e.g., Asia-Pacific, Latin America).

Projected Sales Trajectory (2023-2030)

| Year |

Estimated Global Sales (USD Million) |

Notes |

| 2023 |

150 |

Post-patent expiry stabilization |

| 2024 |

160 |

Slight recovery with targeted marketing |

| 2025 |

175 |

Expansion into emerging markets |

| 2026 |

200 |

Introduction of new formulations or delivery systems |

| 2027 |

210 |

Moderate growth driven by brand loyalty |

| 2028 |

220 |

Competition from biosimilars persists |

| 2029 |

230 |

Continued international expansion |

| 2030 |

240 |

Market saturation; incremental growth |

Total cumulative sales over the forecast period: Approximately USD 1.6 billion.

Key Growth Opportunities

- Localized Marketing in Emerging Markets: Rapid population growth and increasing urbanization in Asia-Pacific, Latin America, and Africa present opportunity to expand LEVITRA’s footprint.

- Formulation Innovations: Development of fast-dissolving tablets, liquid formulations, or combination therapies could appeal to specific patient segments.

- Broader Indications: Potential approval for other uses (e.g., pulmonary hypertension) can diversify revenue streams.

Potential Risks

- Market Saturation: High penetration in mature markets may cap growth.

- Price Competition: Generics and biosimilars pressurize margins further.

- Regulatory Barriers: Delays or denials in new indications, delivery methods, or OTC approval.

Regulatory and Strategic Considerations

Bayer’s strategic focus has shifted toward maintaining LEVITRA’s relevance through innovative formulations and international expansion. Regulatory bodies’ policies facilitating OTC availability or allowing for direct-to-consumer marketing are critical influencers. Strategic alliances with telehealth platforms and targeted marketing campaigns in high-growth regions could amplify sales.

Conclusion

LEVITRA is positioned as a premium PDE5 inhibitor with stable demand, especially among patients who favor rapid onset. While patent expiry and generic competition temper growth prospects in mature markets, targeted expansion into emerging markets and formulation innovations sustain its revenue trajectory. Overall, sales are expected to grow modestly, reaching approximately USD 240 million globally by 2030, driven by strategic market penetration and diversification.

Key Takeaways

- LEVITRA’s global sales are projected to reach USD 240 million by 2030, with steady yet modest growth.

- Patent expiration has resulted in increased generic competition, constraining price and market share expansion.

- Emerging markets and formulation innovations represent critical growth opportunities for Bayer.

- Competition from longer-duration PDE5 inhibitors like Cialis influences prescribing patterns, impacting LEVITRA's market share.

- Regulatory and market trends toward OTC availability and telehealth adoption could both challenge and expand its market base.

FAQs

-

How does LEVITRA compare to other ED medications in terms of efficacy?

LEVITRA offers rapid onset, often within 15-30 minutes, and is well-tolerated, providing comparable efficacy to sildenafil and tadalafil, with particular appeal for patients seeking quick results.

-

What impact did patent expiry have on LEVITRA sales?

Patent expiry in key markets led to increased generic competition, resulting in significant price erosion and a decline in peak sales, stabilizing subsequently through market diversification.

-

Are there emerging markets where LEVITRA could expand significantly?

Yes, regions such as Asia-Pacific, Latin America, and Africa offer substantial growth potential due to rising awareness, increasing urbanization, and expanding healthcare access.

-

What future innovations could boost LEVITRA sales?

Potential innovations include fast-dissolving formulations, combination therapies, and OTC availability, which could broaden patient access and adherence.

-

What risks could undermine LEVITRA’s long-term growth?

Key risks include intense generic competition, market saturation in mature markets, regulatory hurdles, and shifts in consumer preferences toward newer or longer-acting PDE5 inhibitors.

References

[1] MarketWatch, “Global Erectile Dysfunction Drugs Market Size & Trends,” 2022.

[2] World Health Organization, “Ageing and Health,” 2022.

[3] Bayer Annual Reports, 2011–2022.