Last updated: July 27, 2025

Introduction

KEPPRA (Levetiracetam) is an antiepileptic drug (AED) developed by UCB Pharma, primarily used for the treatment of partial-onset seizures, myoclonic seizures, and primary generalized tonic-clonic seizures. Since its approval in the early 2000s, KEPPRA has become a prominent option within the epilepsy treatment landscape. This analysis evaluates the current market dynamics, competitive positioning, and future sales projections, providing insights crucial for stakeholders involved in pharmaceutical strategy, investment, and market planning.

Market Overview

Global Epilepsy Therapeutics Landscape

Epilepsy affects approximately 50 million people worldwide, representing a significant segment of the neurology pharmaceutical market [1]. The rising prevalence, coupled with increasing awareness and diagnostic capabilities, has driven robust growth in AED prescriptions. According to IQVIA, the global epilepsy drug market was valued at approximately $4.8 billion in 2022 and is forecasted to grow at a Compound Annual Growth Rate (CAGR) of around 4% from 2023 to 2030 [2].

Positioning of KEPPRA

Since its U.S. FDA approval in 2008, KEPPRA has carved out a substantial share within the AED segment. Its favorable pharmacokinetic profile, once-daily dosing, and broad spectrum efficacy have contributed to its widespread adoption. UCB Pharma's strong marketing, extensive clinician education, and the drug's favorable side effect profile further bolster its market position.

Therapeutic Prescription Trends

In 2022, KEPPRA maintained a leading position, with approximately 15% market share among AEDs globally, making it one of the top-prescribed brands in its category [3]. Its broad indications and safety profile appeal to neurologists, pediatricians, and primary care physicians, facilitating its consistent prescription across diverse patient populations.

Market Dynamics and Competitive Landscape

Key Competitors

KEPPRA faces competition from generics (e.g., Levetiracetam formulations), other branded AEDs such as Vimpat (lacosamide), Topamax (topiramate), Keppra XR (extended-release), and newer therapies like Fycompa (perampanel) and Banzel (rufinamide). The generic landscape exerts downward pressure on prices, impacting revenue potential in mature markets.

Generic Penetration and Impact

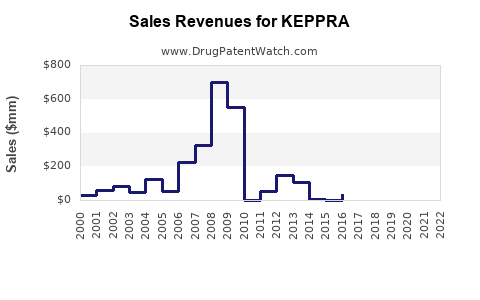

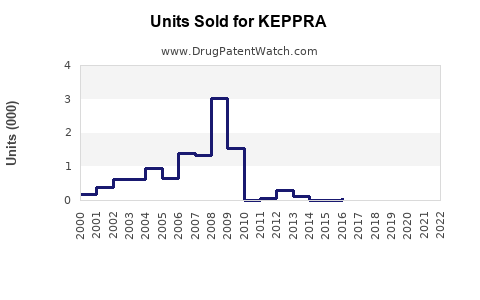

As patent protections for KEPPRA have expired or will expire soon (UCB's main patents expired around 2014-2019), generic Levetiracetam products have entered multiple markets, significantly reducing the brand-name drug's price premium. This commoditization in mature markets necessitates strategic focus on patient retention, formulation differentiations, and expanding indications to sustain sales.

Regulatory and Market Expansion Opportunities

Emerging markets like China, India, and parts of Southeast Asia present considerable growth potential due to rising epilepsy prevalence, limited existing treatment options, and expanding healthcare infrastructure. Additionally, off-label use and extended indications (e.g., for bipolar disorder or neuropathic pain) provide avenues for growth.

Sales Projections (2023–2030)

Factors Influencing Future Sales

- Patent Status and Generic Competition: As patents have expired, generic entries will intensify, pressuring prices and margins. However, branded KEPPRA often sustains premium pricing temporarily through physician preference and formulation advantages.

- Market Penetration and Patient Dynamics: Increasing epilepsy diagnosis rates and adherence to treatment contribute positively. Efforts to expand indications and formulations (such as extended-release or pediatric formulations) can drive incremental growth.

- Regulatory Approvals and Label Expansion: Approval for new indications—such as Lennox-Gastaut syndrome and other seizure types—can significantly augment sales.

- Emerging Markets: Rapid healthcare development and epilepsy prevalence in Asia and Latin America support high-growth projections.

Projected Revenue Trajectory

- 2023-2025: Given declining market share due to generics, sales in mature markets are expected to plateau or slightly decline, ranging between $550 million - $600 million annually. However, emerging markets could offset declines with double-digit growth rates, contributing an estimated $100 million-$150 million annually.

- 2026-2030: With potential expansion into new indications and increased market penetration in developing regions, revenues could stabilize or rebound slightly, reaching $700 million by 2030. Strategic innovation, such as sustained-release formulations or combining KEPPRA with novel agents, could further bolster sales.

Regional Analysis

| Region |

2023-2025 Projection |

2026-2030 Projection |

| North America |

~$380M, decline due to generics |

~$420M, stabilization, growth in niche indications |

| Europe |

~$150M, moderate decline |

~$180M, potential growth in pediatric formulations |

| Emerging Markets |

~$100M, rapid growth |

~$250M, driven by expansion and healthcare infrastructure improvements |

Strategic Recommendations

- Innovation in Formulations: Launching extended-release versions or combination therapies could command premium pricing and extend patent life.

- Market Expansion: Prioritizing regulatory approval and reimbursement strategies in emerging markets.

- Indication Expansion: Investing in clinical trials for broader seizure types or psychiatric comorbidities enhances market opportunity.

- Post-Patent Strategies: Developing biosimilars or competing generics with improved formulations to capture future market share.

Conclusion

KEPPRA remains a formidable player within the epilepsy treatment landscape despite the intensification of generic competition. Its ongoing growth hinges on market expansion, formulation innovation, and strategic positioning in emerging economies. While mature markets face revenue pressures, emerging regions and indication expansion present substantial opportunities. Stakeholders should adopt a multi-pronged approach emphasizing innovation, global expansion, and patient adherence to sustain and grow sales over the coming years.

Key Takeaways

- KEPPRA is a leading AED with sustained demand driven by its efficacy and safety profile, though patent expirations challenge premium pricing.

- The global epilepsy market is poised for steady growth, with emerging markets offering significant expansion opportunities.

- Sales are projected to stabilize around $600–$700 million annually over the next five years, with growth primarily driven by emerging markets and indication expansion.

- Strategic focus on formulation innovation and market expansion will be essential in counteracting generic-driven price erosion.

- Companies should prioritize regulatory and reimbursement strategies in high-growth regions to maximize long-term revenue potential.

FAQs

1. What factors are most likely to influence KEPPRA’s sales growth in the coming years?

Primarily, the expiration of patents leading to generic competition, regulatory approvals for new indications, expansion into emerging markets, and formulation innovations will dictate sales trajectories.

2. How does KEPPRA compare to newer antiepileptic drugs?

KEPPRA’s broad spectrum efficacy, favorable side effect profile, and once-daily dosing provide competitive advantages. However, newer agents with mechanisms targeting specific seizure types or comorbidities may capture niche markets, potentially impacting KEPPRA’s market share.

3. What strategies can UCB implement to sustain KEPPRA’s competitiveness?

Investing in formulation improvements, expanding geographic reach, pursuing new indications, and developing combination products can help extend product lifecycle and preserve revenue streams.

4. What is the outlook for KEPPRA’s market share amidst increasing generic competition?

While brand loyalty and clinical preference sustain initial brand sales, long-term share may decline unless innovative formulations or expanded indications are introduced.

5. Which markets present the highest growth potential for KEPPRA?

Emerging economies such as China, India, and Southeast Asian countries represent the most promising avenues due to rising epilepsy prevalence and expanding healthcare infrastructure.

Sources

[1] World Health Organization. Epilepsy Fact Sheet, 2022.

[2] IQVIA. Epilepsy Market Analysis Report, 2022.

[3] GlobalData. Neurology & Epilepsy Therapeutics Market Report, 2023.