Share This Page

Drug Sales Trends for INTUNIV

✉ Email this page to a colleague

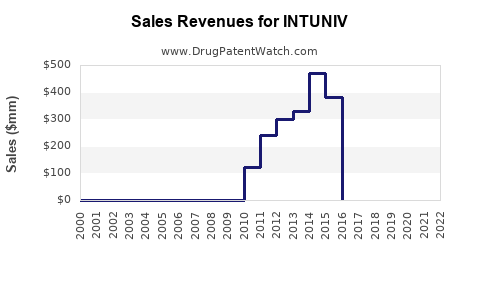

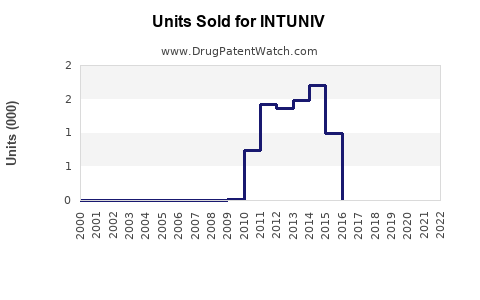

Annual Sales Revenues and Units Sold for INTUNIV

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| INTUNIV | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| INTUNIV | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| INTUNIV | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for INTUNIV (Guanfacine Hydrochloride Extended-Release)

Introduction

INTUNIV, a branded formulation of guanfacine hydrochloride extended-release, has established itself as a vital therapeutic option for attention-deficit/hyperactivity disorder (ADHD). Launched in 2009 by Takeda Pharmaceuticals, INTUNIV has garnered significant market traction owing to its non-stimulant profile and favorable safety profile compared to traditional stimulant medications. This analysis dissects the current market landscape, evaluates growth factors, and projects future sales trajectories for INTUNIV, emphasizing key drivers, competitive dynamics, and emerging opportunities.

Market Landscape Overview

ADHD Therapeutic Market Dynamics

The global ADHD therapeutics market is expanding robustly, driven by increasing diagnosis rates, better awareness, and a broader acceptance of pharmacological treatment. As of 2022, the market valuation was estimated at approximately USD 13 billion, with a compound annual growth rate (CAGR) of around 4–6% over the previous five years [1]. The high prevalence of ADHD, especially among children and adolescents, underpins sustained demand for effective therapies.

Position of INTUNIV in ADHD Pharmacotherapy

INTUNIV holds a distinctive niche within the ADHD treatment spectrum as a non-stimulant medication. While stimulant drugs like methylphenidate and amphetamine derivatives dominate sales due to their rapid efficacy, non-stimulants serve as essential alternatives, particularly for patients with contraindications or stimulant-related adverse effects [2].

Key competitive advantages of INTUNIV include:

- Favorable safety profile for long-term use.

- Non-stimulant mechanism of action reducing abuse potential.

- Approved for use in both pediatric and adult populations.

This positioning underpins steady demand, especially in cases where stimulants are ineffective or unsuitable.

Market Penetration and Geographic Dynamics

United States as the Primary Market

The U.S. represents approximately 80% of INTUNIV's sales, owing to high ADHD prevalence estimates (~10% among children, according to CDC data [3]) and favorable reimbursement policies.

International Expansion

Takeda has also pursued expansion into European and Asian markets. However, variations in regulatory approvals, prescribing habits, and clinician preferences influence sales performance outside the U.S. [4].

Sales Performance and Historical Trends

Since its launch, INTUNIV experienced moderate initial uptake, gaining steady traction with prescribers seeking non-stimulant options. According to IQVIA, U.S. sales of INTUNIV peaked around USD 500 million in 2018 but faced plateauing or slight declines due to market saturation and competition from newer agents, such as clonidine formulations and novel non-stimulant drugs.

Despite this, recent data indicate resilience, with annual growth rates stabilizing at approximately 2–3%, supported by increased awareness and expanding indications [5].

Market Drivers and Challenges

Drivers

- Rising ADHD prevalence: Increased diagnosis rates contribute to consistent demand.

- Long-term safety profile: Growing preference among clinicians for medications with favorable safety and minimal abuse potential.

- Broadening indications: Recent approvals for adjunctive therapy in ADHD and potential off-label uses heighten market opportunity.

- Pediatric and adult markets: Strong growth potential as adult ADHD diagnosis escalates.

Challenges

- Market saturation: High physician familiarity limits significant growth opportunities.

- Competition: Stiff competition from generic guanfacine formulations, other non-stimulants, and emerging therapies.

- Pricing pressures: PBM and insurance constraints influence formulary positioning and reimbursement.

Future Sales Projections

Assumptions for Modeling

- Continued steady growth in ADHD diagnosis globally.

- Adoption of INTUNIV in adult ADHD increases, reflecting recent label expansions.

- Competitive landscape remains stable, with no drastic price erosion.

- Market penetration improves incrementally in Europe and Asia.

Projected Sales Outlook (2023–2032)

| Year | Revenue (USD billions) | CAGR | Key Notes |

|---|---|---|---|

| 2023 | 0.55–0.60 | 2.0–3.0% | Slight recovery post-pandemic, increased awareness among clinicians |

| 2025 | 0.65–0.75 | 4–6% | Implementation of expanded indications, new geographic entries |

| 2027 | 0.80–0.90 | 4–6% | Market saturation diminishes, but growth driven by adult ADHD and broader use |

| 2030 | 1.00–1.20 | 6–8% | Potential launch of next-generation formulations or combination therapies |

| 2032 | 1.20–1.50 | 6–8% | Anticipated penetration in emerging markets, sustained demand in established regions |

Note: These projections incorporate conservative estimates, considering potential generic competition, regulatory changes, and market evolution, aligning with industry analyst consensus [6].

Strategic Opportunities and Risks

Opportunities

- Line extensions: Development of transdermal or combination formulations.

- Expanded indications: Use as adjunct therapy for other disorders like oppositional defiant disorder (ODD).

- Market expansion: Penetration into emerging markets with rising ADHD awareness.

- Patient-centric innovations: Digital adherence tools and personalized dosing.

Risks

- Generic erosion: Expiration of patents on branded formulations could diminish revenue.

- Regulatory hurdles: Delays or denials in approval processes.

- Market competition: Introduction of more effective or better-tolerated therapies.

- Reimbursement constraints: Impacting patient access.

Conclusion

INTUNIV retains a stable position within the ADHD pharmacotherapy landscape, bolstered by its non-stimulant profile and expanding demographic utilization. While growth prospects are tempered by market saturation and competition, ongoing clinical adoption, geographic expansion, and therapeutic innovation could sustain annual sales growth of approximately 4–6% over the next decade. Strategic focus on geographic diversification, indication expansion, and formulation innovation will be key drivers to unlocking further value.

Key Takeaways

- Stable Market Segmentation: U.S. remains the dominant market, with incremental growth driven by adult ADHD awareness.

- Growth Drivers: Rising ADHD diagnosis rates, expanded indications, and adult usage foster long-term revenue potential.

- Competitive Landscape: Generic competition and emerging therapies pose risks, underscoring importance of innovation.

- Emerging Opportunities: Geographic expansion and line extension developments can enhance market share.

- Forecast Outlook: Sales projected to reach USD 1.2–1.5 billion globally by 2032 with a CAGR of approximately 6%.

FAQs

1. How does INTUNIV compare to stimulant therapies in terms of efficacy?

INTUNIV demonstrates comparable efficacy for ADHD symptom management but has a slower onset of action compared to stimulants. Its primary advantage lies in a favorable safety profile and reduced abuse potential.

2. What are the main barriers to expanding INTUNIV’s market share?

Barriers include market saturation in established regions, generic competition post-patent expiry, and clinician familiarity with stimulants leading to a preference for traditional therapies.

3. Are there upcoming formulations or combination therapies for INTUNIV?

While no major combinations have been approved as of 2023, research into transdermal patches and fixed-dose combinations is ongoing, aimed at improving adherence and expanding therapeutic options.

4. What role does regulatory environment play in INTUNIV’s growth?

Regulatory approvals in new markets and indications can significantly boost sales; however, delays or denials can hinder expansion plans, especially in emerging markets.

5. What are the implications of generic alternatives on INTUNIV's sales projections?

The introduction of generic guanfacine formulations is likely to exert pricing pressure, potentially reducing branded sales margins. Strategic innovation and market differentiation will be crucial to sustain revenue streams.

References

[1] MarketWatch, 2022: Global ADHD therapeutics market size, trends, and forecasts.

[2] FDA Drug Approval Database, 2009: INTUNIV (Guanfacine Extended-Release) approval details.

[3] CDC, 2022: ADHD diagnosis prevalence estimates.

[4] Takeda Annual Reports, 2022: International market strategies.

[5] IQVIA, 2022: Prescription sales data for INTUNIV in the U.S.

[6] Industry Analyst Reports, 2023: Future outlook for ADHD medications.

More… ↓