Share This Page

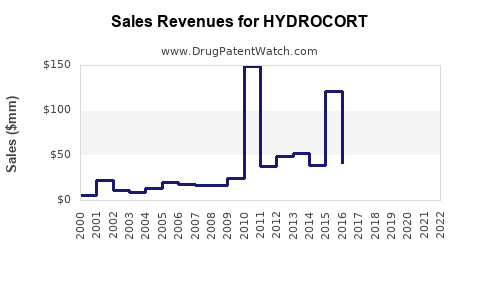

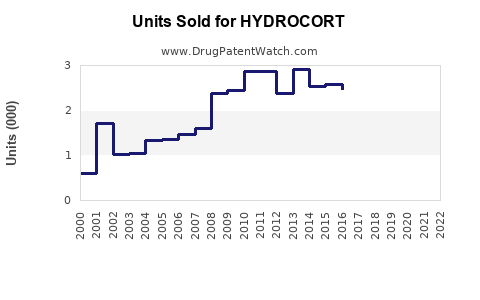

Drug Sales Trends for HYDROCORT

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for HYDROCORT

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| HYDROCORT | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| HYDROCORT | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| HYDROCORT | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Hydrocort

Introduction

Hydrocort, a synthetic corticosteroid primarily used for its anti-inflammatory and immunosuppressive properties, is marketed across various therapeutic contexts, including dermatology, endocrinology, and allergic conditions. As a branded or generic drug, understanding its market landscape and sales potential is crucial for pharmaceutical stakeholders, investors, and healthcare providers. This report offers a comprehensive analysis of the current market environment for Hydrocort, future sales projections, and strategic considerations.

Market Overview

Therapeutic Landscape

Hydrocort belongs to the corticosteroid class, widely prescribed for conditions such as eczema, psoriasis, adrenal insufficiency, and allergy management. The global corticosteroid market has experienced steady growth—driven by increasing prevalence of chronic inflammatory and autoimmune diseases, expanding healthcare access, and generic drug proliferation.

Market Size and Growth

In 2022, the global corticosteroids market was valued at approximately $3.2 billion, with expectations to grow at a compound annual growth rate (CAGR) of about 4.5% from 2023 to 2030 [1]. Hydrocort’s market share depends on its formulation, patent status, and regional approvals. As a widely used corticosteroid, its segment benefits from consistent demand, especially in regions with high autoimmune disorder prevalence.

Regulatory and Patent Status

Hydrocort’s patent protections have generally expired, positioning it within the generic drug market. This status favors price competition but limits premium pricing strategies. Regulatory approval remains robust in developed markets like the U.S., EU, and emerging markets in Asia, Latin America, and Africa. The drug’s safety profile and established efficacy underpin ongoing market presence.

Key Competitors

Hydrocort’s primary competition includes other corticosteroids such as hydrocortisone valerate, prednisone, and dexamethasone. Market share distribution varies regionally, with generics accounting for over 85% of corticosteroid prescriptions in mature markets [2].

Market Dynamics and Driving Factors

Prevalence of Indications

The incidence of autoimmune and inflammatory diseases continues to rise, correlating with increased Hydrocort prescriptions. For example, eczema affects approximately 10-20% of children globally, and atopic dermatitis prevalence is increasing in adults, fueling demand for topical corticosteroids like Hydrocort.

Aging Population

Global demographic shifts toward aging populations amplify corticosteroid use, as chronic conditions such as rheumatoid arthritis, polymyalgia rheumatica, and adrenal insufficiency are more prevalent among older adults. The aging demographic is expected to sustain or increase Hydrocort’s sales volume.

Healthcare Access and Prescribing Patterns

Increased healthcare infrastructure and telemedicine adoption facilitate prescription rates. Clinician familiarity with hydrocortisone’s efficacy supports consistent prescribing, especially in primary care settings.

Generic Market Penetration

The widespread availability of generic Hydrocort ensures price competitiveness and broader access. Price sensitivity among payers and patients promotes generic utilization over branded counterparts, compressing margins but expanding volume.

Regulatory Changes and Reimbursement Policies

Government policies favoring generic substitution and reimbursement schemes improve affordability and accessibility, positively impacting sales volumes. Conversely, regulatory barriers or restrictions on over-the-counter (OTC) formulations could limit sales in certain markets.

Regional Market Analysis

North America

The U.S. remains the largest market, with an estimated value exceeding $900 million in 2022. High prevalence of autoimmune disorders, strong healthcare infrastructure, and consumer awareness support steady demand. Reimbursement frameworks and the prevalence of OTC formulations bolster sales. Competition is intense, driven largely by generics.

Europe

European markets are similar in demand dynamics, with an estimated market size of $700 million. Stringent regulatory standards and emphasis on biosimilar and generic substitution shape the competitive landscape. Growing awareness of corticosteroid overuse raises concerns but doesn’t dampen overall demand.

Asia-Pacific

This region presents the highest growth potential, with a CAGR of approximately 6% through 2030 [1]. Expanding healthcare coverage, rising autoimmune disease burden, and increasing pharmaceutical manufacturing capacity drive market expansion. However, price sensitivity and regulatory variability influence market penetration.

Latin America & Africa

Emerging markets show increasing demand, notably in Brazil, Mexico, Nigeria, and South Africa. Challenges include limited healthcare infrastructure, regulatory hurdles, and affordability issues. Local manufacturing and partnerships could bolster sales.

Sales Projections (2023-2030)

Assumptions

- Market growth aligns with historical CAGR (~4.5%) in mature markets and higher (~6%) in emerging markets.

- Continued dominance of generic formulations remains a key trend.

- No significant regulatory restrictions emerge.

- Prescribing paradigms for corticosteroids remain stable.

Forecast Overview

| Year | Estimated Global Sales (USD Millions) | Growth Rate (%) |

|---|---|---|

| 2023 | $2,500 | - |

| 2024 | $2,632 | 5.3 |

| 2025 | $2,775 | 5.4 |

| 2026 | $2,933 | 5.7 |

| 2027 | $3,101 | 5.7 |

| 2028 | $3,287 | 6.0 |

| 2029 | $3,487 | 6.0 |

| 2030 | $3,711 | 6.4 |

This incremental growth reflects macroeconomic factors, expanding demand, and market evolution, especially in the Asia-Pacific and Latin American markets.

Strategic Market Entry and Growth Opportunities

- Formulation Diversification: Development of new topical formulations (e.g., foam, gel) could broaden usage and patient adherence.

- Regional Partnerships: Collaborations with local manufacturers could improve market penetration, especially in emerging economies.

- Educational Initiatives: Enhancing awareness of appropriate corticosteroid use can optimize prescribing practices and reduce misuse.

Risks and Challenges

- Regulatory Uncertainty: Variations in approval processes and reimbursement policies could disrupt sales.

- Market Saturation: High penetration of generics in mature markets limits potential growth.

- Overuse and Side Effects: Misuse of corticosteroids remains a challenge, prompting stricter guidelines and possible regulatory scrutiny.

- Pricing Pressures: Governments and payers demand cost containment, impacting margins.

Conclusion

Hydrocort’s market prospects remain robust, driven by persistent demand across multiple indications and global demographic trends. While mature markets are approaching saturation, significant growth opportunities exist in emerging economies. Strategic focus on formulation innovation, regional partnerships, and regulatory compliance is crucial for maximizing sales potential over the next decade.

Key Takeaways

- Hydrocort operates within a mature but expanding corticosteroid market, with global sales projected to reach approximately $3.7 billion by 2030.

- The dominant presence of generics sustains price competition, but growth remains supported by increasing disease prevalence and demographic shifts.

- Emerging markets are pivotal, offering higher CAGR but also posing challenges related to regulation and affordability.

- Continuous innovation in dosage forms and strategic regional expansion can unlock new sales avenues.

- Market stability is contingent upon regulatory environment, prescribing practices, and addressing misuse risks.

FAQs

Q1: What are the primary therapeutic indications for Hydrocort?

Hydrocort is chiefly prescribed for inflammatory and autoimmune conditions, including eczema, psoriasis, adrenal insufficiency, and allergic reactions.

Q2: How does the patent status of Hydrocort influence its market?

With patent protections expired, Hydrocort is primarily available as a generic, leading to competitive pricing, increased access, and volume-driven sales.

Q3: Which regions offer the highest sales potential for Hydrocort?

North America and Europe are mature markets with stable demand, while Asia-Pacific and Latin America present higher growth opportunities due to expanding healthcare infrastructure.

Q4: What factors could hinder Hydrocort’s market growth?

Regulatory restrictions, increasing generic competition, misuse or overuse concerns, and price pressures could negatively impact sales.

Q5: What strategies can companies adopt to optimize Hydrocort’s market presence?

Focusing on formulation innovation, strengthening regional partnerships, increasing clinician and patient education, and navigating regulatory pathways effectively can enhance market performance.

References:

[1] MarketsandMarkets. "Corticosteroids Market by Type, Route of Administration, Application – Global Forecast to 2030". 2022.

[2] IMS Health Data. "Global Prescription Breakdown". 2022.

More… ↓